- Milk Road Crypto

- Posts

- MR PRO | Ethereum vs. The World

MR PRO | Ethereum vs. The World

Who's Winning The L1 War?

GM PRO DOers! 😎

The competition among blockchain ecosystems is fierce.

Fast and cheap blockchains are all the rage.

Is Ethereum losing its edge? Are other blockchains soon going to dethrone the King? 👑 Or are Ethereum L2s succeeding and fulfilling the plan for Ethereum all along? 👀

Twitter would tell you that Ethereum is losing, but looking onchain suggests otherwise…

1 year ago today, we wrote a PRO report called “Is Ethereum Scaling?”

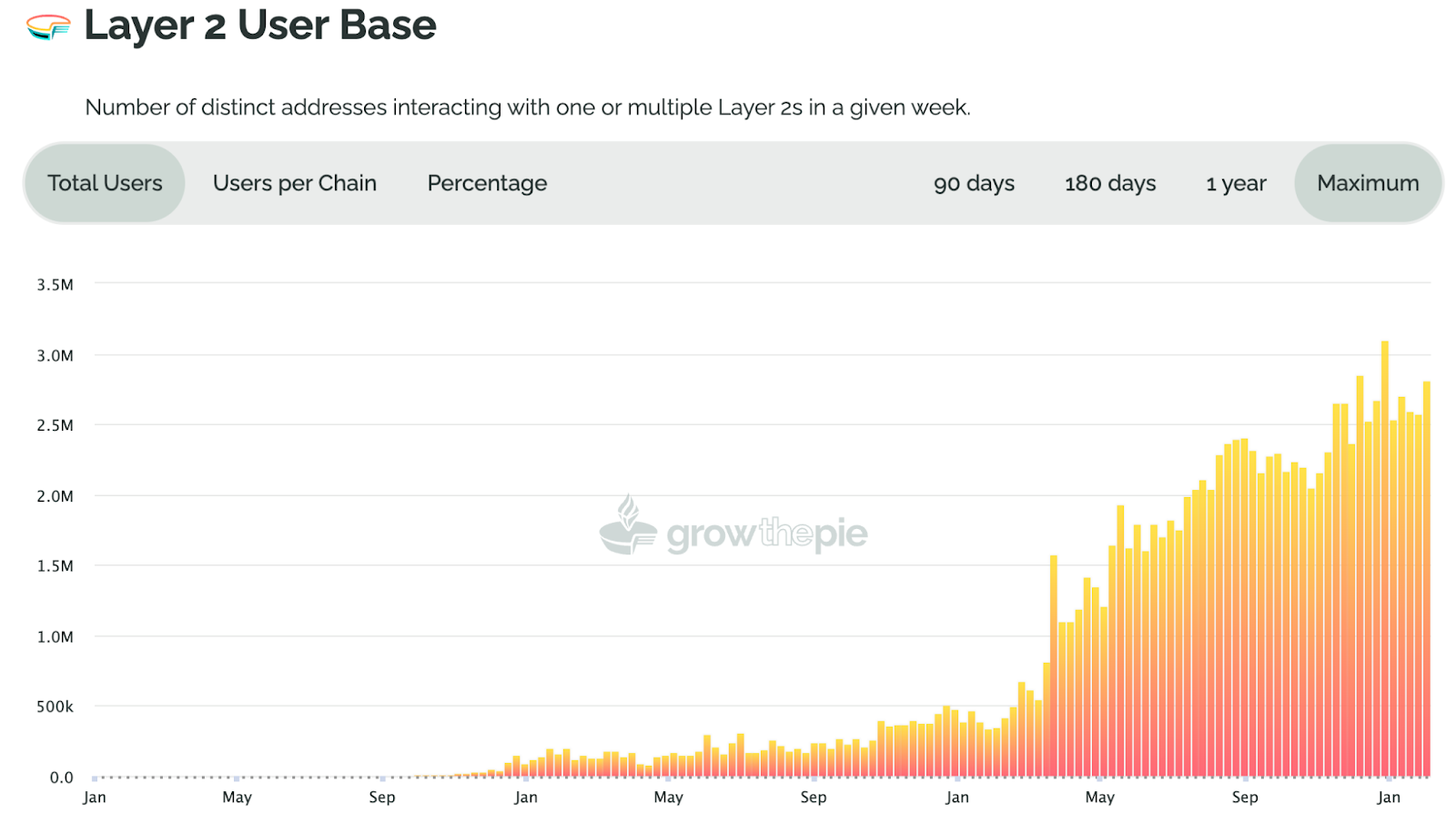

At the time, L2s were still very new and their numbers were limited. Here were the numbers across the entire L2 ecosystem in February 2023:

< 500k weekly active wallets

< 900,000 transactions daily

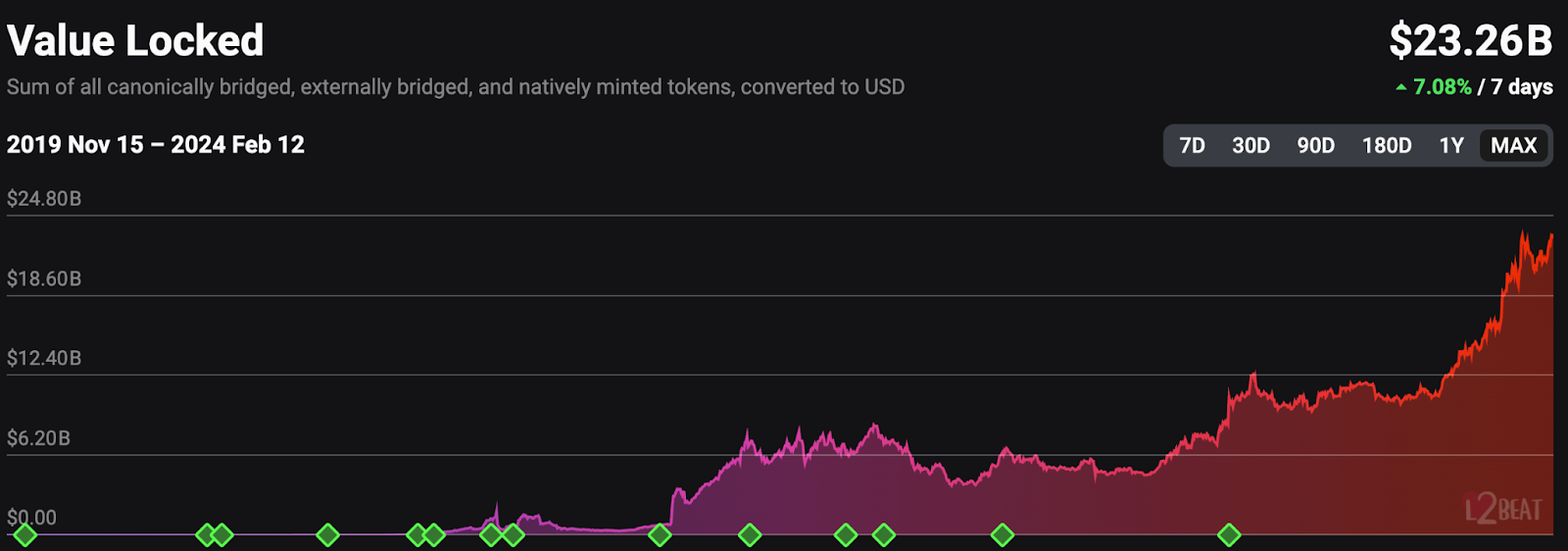

$5.6 billion in total value locked

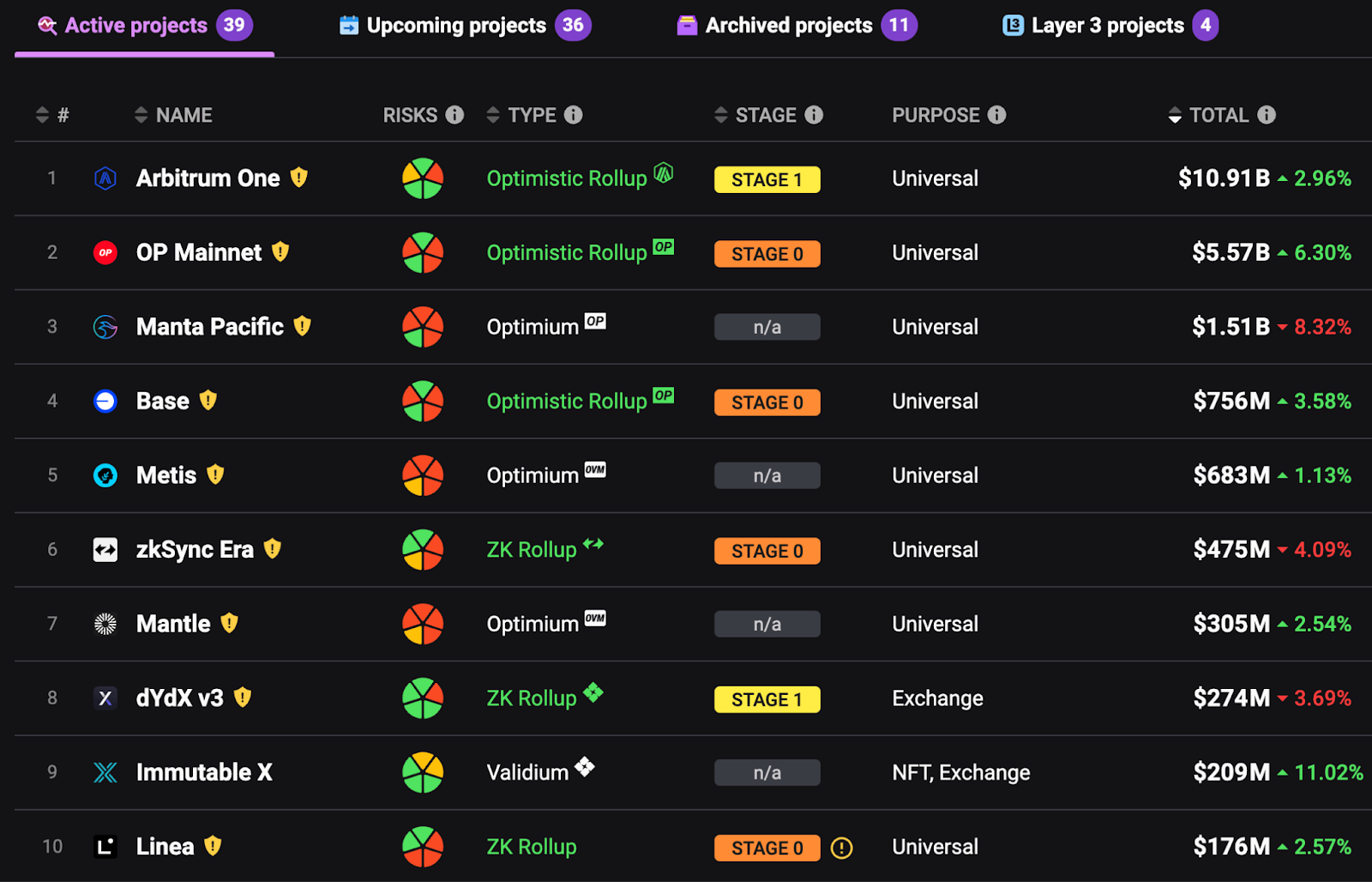

~7 active and relevant L2s listed on L2Beat

Today, the numbers across the L2 ecosystem look very different.

We’ve since surpassed 3 million weekly active wallets (6x from last year)…

6 million Daily Transactions (6.67x from last year)…

$23.26 billion total value locked (4x from last year)…

And a highly competitive, innovative and thriving L2 ecosystem, with more than 39 active L2s, 36 recorded upcoming L2s (soon to be launched), 4 Layer 3s already live and plenty more that hasn’t been announced yet.

Also, on March 13th, 2024, we’ll have an important upgrade to Ethereum (EIP-4844) which will reduce the expenses of Ethereum L2s by approximately 10x.

This will surely ignite the innovation and competition amongst L2s even further.

The L2 landscape on Ethereum is one of the most exciting areas in crypto currently and it brings with it plenty of opportunity.

But of course, it comes with many challenges too, like broken UX and fragmented liquidity. However, these are all technical issues that are solvable and likely won’t be an issue in a couple of years from now.

What is a pressing issue for Ethereum and its L2 ecosystem is its competition with faster and cheaper L1s. – Solana, Avalanche, BNB, TRON, Cosmos and a long tail of many others have made a lot of noise over the last year, gaining a fair share of attention, users, developers and capital across the crypto ecosystem.

In today’s PRO report we are looking onchain to understand how well these alternative L1s stack up against Ethereum and its L2 ecosystem.

When we published the “Is Ethereum Scaling” report in early 2023, we were one of the first to combine the data of Ethereum + its Layer 2s.

When comparing blockchains, it no longer makes sense to compare something like Solana or Avalanche to only Ethereum.

Instead, you must compare Ethereum + all of its L2s to other chains.

While the data isn’t perfect, it’s come a long way since our last report, so we’ll be diving into:

Transactions

Active wallets

Transactions Per Second (TPS)

Total Value Locked (TVL)

Fees and Profitability

Active Developers

Monthly Commits

Number of Applications

One final note before we get into the numbers, for the purpose of this report, we’ve included Polygon POS as an L2 on Ethereum.

In its current state, Polygon is technically its own blockchain, however in the coming months it will be migrated into a proper L2 on Ethereum, so we feel including its numbers within the Ethereum ecosystem makes sense.

Also, reliable data is not yet readily available for many of the newer chains like Aptos, SUI and others, so we’re using the more established chains with the highest real numbers to date (Solana, BNB, Avalanche, TRON & Near).

Ok, let’s get into it!

What Chains Have All the Activity? 📈

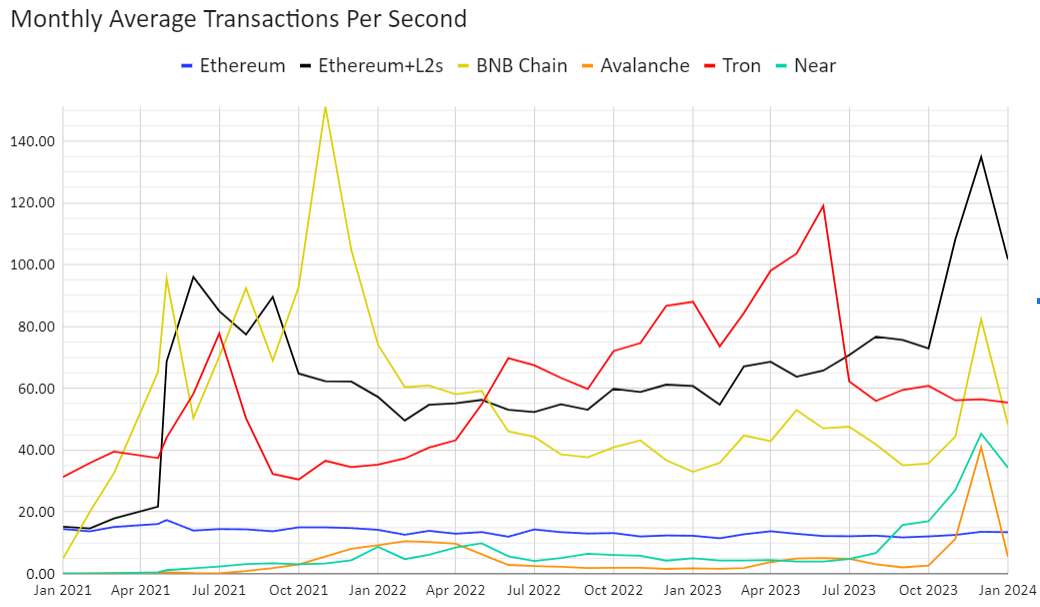

In terms of scale, transactions per second (TPS) is a great metric to understand the scale of a blockchain.

While every chain has a “theoretical TPS”, like Solana’s potential 60,000 TPS, what we need to look at are the actual transactions per second it’s executing.

Amongst various blockchains, Solana is the clear winner here, achieving more than 700 TPS (excluding voting transactions)...

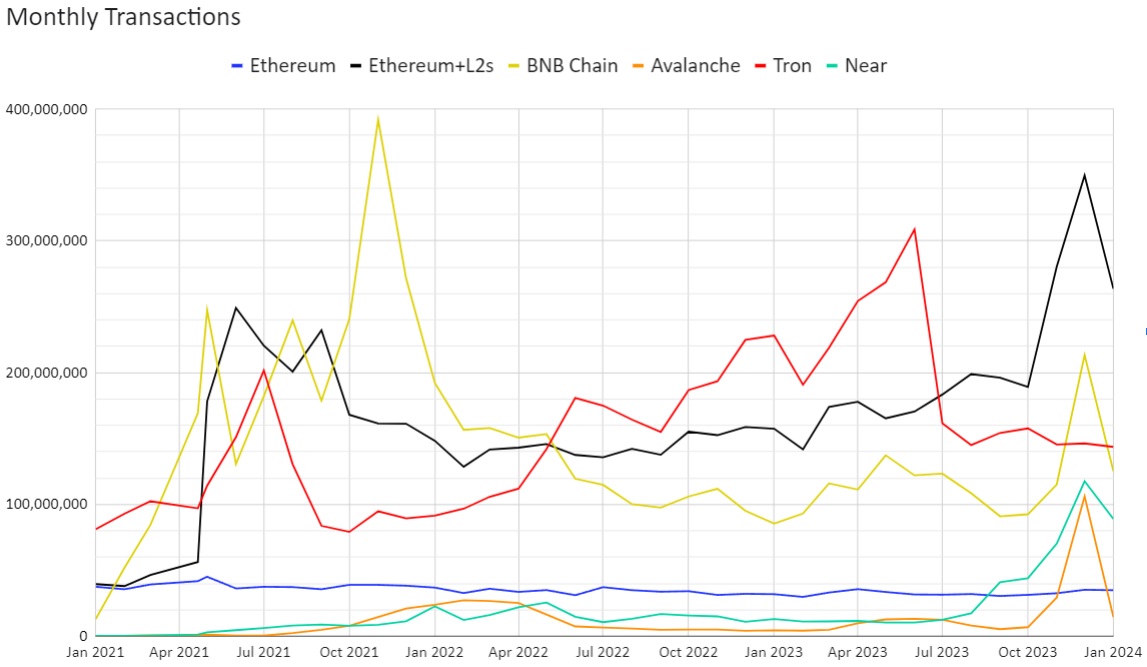

If we remove Solana to get a better look at the rest, we can see that Ethereum has been maxed out at 16 TPS for years.

In the last year, it has been surpassed by every other L1. However, when we combine Ethereum + Layer 2s, we can see exactly how well Ethereum is scaling.

With L2s, Ethereum is now processing more than 100 TPS, 2nd amongst any other blockchain.

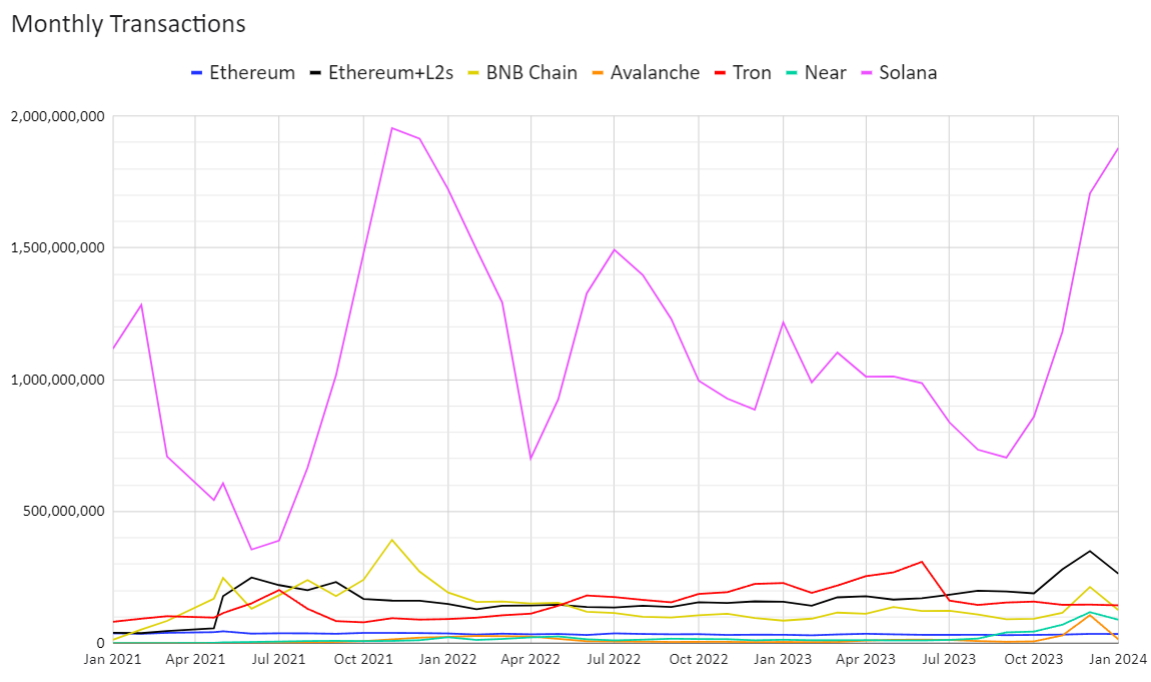

In terms of overall monthly transactions, no blockchain compares to Solana right now. Solana is nearing 2 billion monthly transactions whereas no other chain has surpassed even 400 million monthly transactions to date.

If we once again remove Solana from the chart, we can get a better picture of the rest of the chains’ monthly transactions.

Ethereum, which has been maxed out on its number of transactions, is now second to Solana when you combine its L2 ecosystem.

One thing to note about transactions is that most chains saw a spike in November and December due to crypto prices increasing during those months (speculation/activity increases with price).

This also explains why TRON saw no increase in activity as its transactions are predominantly for stablecoins.

Solana saw sustained activity through January, which can likely be attributed to airdrop farmers transacting to farm the various Solana applications soon to be launching tokens.

It’s difficult to determine what is organic activity and what is not at the moment, but this will be something to continue to watch over the years to come. 👀

To wrap up the activity section, Solana is the clear leader. However as we’ll see in the coming sections, it lacks in many other areas.

Outside of Solana, it appears that Ethereum + L2s are beginning to break away from the rest of the pack.

Let’s move on to users and liquidity. ⏬

Where Are The Users and Liquidity? 💰️

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full access to the Milk Road Portfolio & weekly updates to see what we’re actively investing in

- • NEW: Unlimited access to the Milk Road PRO Token Center with token ratings and insights. 🔓

- • Weekly “Where Are We In The Cycle?” indicators to help you spot the bull market top before it’s too late 📈

- • Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

- • Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. Don’t miss the monthly live events! 🫂

- • 50% OFF the Crypto Investing Masterclass 📚️