- Milk Road Crypto

- Posts

- MR PRO | Is Ethereum Scaling?

MR PRO | Is Ethereum Scaling?

Breaking down Ethereum's current on-chain bull run during this bear market

For web3 to succeed, blockchains must scale.

Plain and simple. 🤷

We can’t go mainstream without faster and cheaper transactions.

Not only for the UX experience of users but also to make this a viable technology for businesses to build on top of.

It’s likely that in the future web3 users won’t have to pay or think about gas fees (the fee required to transact on a blockchain). Not because gas fees won’t exist, but because the application layer will subsidize this cost for their users.

Transaction fees will likely become a common expense for applications, similar to the current fees around hosting and servers today. 💭

We can see this trend already taking place with the likes of Reddit, Starbucks, and Immutable (a gaming/NFT Ethereum L2) already covering fees for their users.

However, for this to work, the costs of transacting on a blockchain must come down. This is why we’ve seen so many new fast and cheap blockchains launch in the last few years. ✅

The issue in most of these blockchains is that it’s not just important to have fast and cheap transactions, they must also occur on a secure, permissionless, and censorship-resistant blockchain (aka a decentralized blockchain).

Without the decentralization property, fast and cheap is irrelevant. We already have fast and cheap centralized technologies which power our internet today, there is no use in recreating that on a centralized blockchain.

At the moment, Ethereum is our best option to reach all 3 of these properties. But is Ethereum actually scaling?

We’ve been hearing that Ethereum will scale for many years, yet Ethereum was nowhere near “scalable” during the 2020-21 bull run.

Even today, in the depths of the bear market, it costs a few dollars to make a transaction on Ethereum. There’s no way that a business could cover these costs for its users while still remaining profitable. ❌

But what if I told you that in the last 6 months, Ethereum was actually pushing all-time highs in transactions, higher than during the bull market of 2020-21? And this is without gas fees significantly increasing!

Not only that, but depending on where you transact, you could settle your transaction on the decentralized blockchain of Ethereum, for pennies.

Well, friends, that’s the world we’ve just entered. Take a look at the chart below for proof (I will explain what this means below).

In this report, I’m going to show you how during this “bear market”, Ethereum has actually been having an on-chain bull run, in terms of users, transactions, deployments, and more. And during this bull run, Ethereum has managed to lower its fees by orders of magnitude.

Why is no one else talking about this “on-chain” bull run? Because the industry is still behind in regards to how it analyzes Ethereum.

You see, Ethereum is now a modular blockchain rather than a monolithic blockchain.

What this means is that Ethereum now executes transactions across multiple blockchains (layer 2 blockchains) within its ecosystem, while still settling those transactions on Ethereum.

This is Ethereum's roadmap to scaling to the masses. 📈

What this means is that we now have to track Ethereum's numbers differently. We need to start viewing Ethereum's numbers collectively across the consensus layer (Ethereum) and its execution layers (Layer 2s), rather than as a stand-alone blockchain like Solana or Binance Smart Chain.

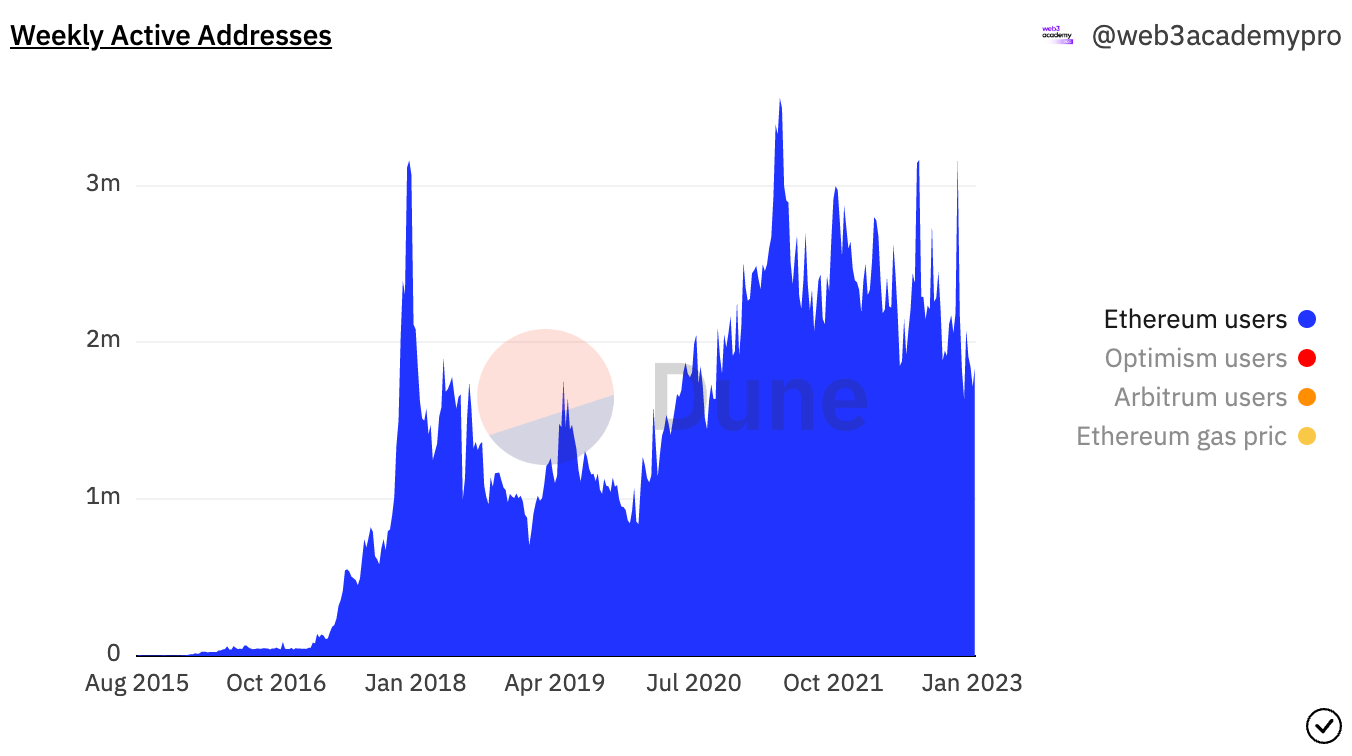

It means that when we look at weekly active wallet addresses on Ethereum we go from < 2 million:

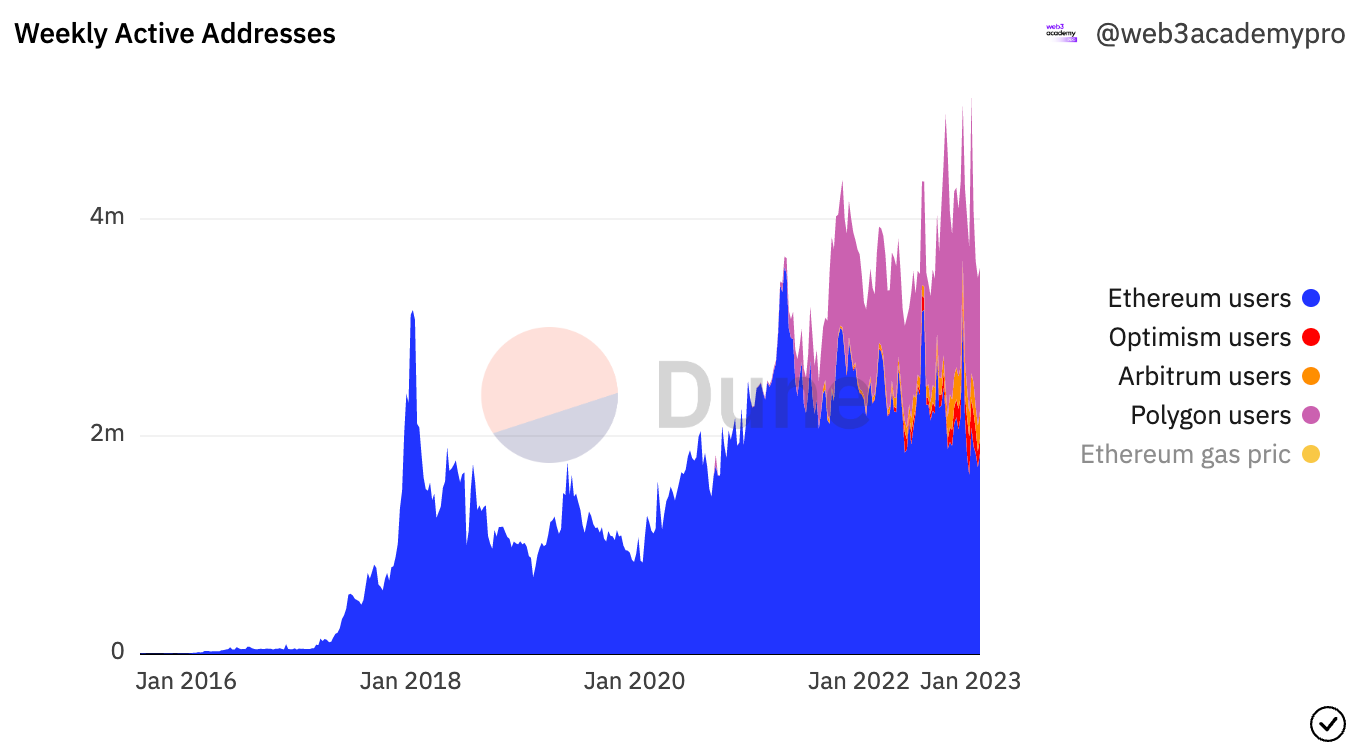

To a more accurate number of weekly active addresses in the Ethereum ecosystem of > 4 million.

This is an exciting and new paradigm for tracking the Ethereum ecosystem. When we do it this way (the right way), we uncover just how much Ethereum has been growing and scaling, even throughout the 2022-23 bear market.

Let’s 👀🔛⛓️ to determine how the Ethereum ecosystem is scaling. 👇

The Ethereum Ecosystem Is Scaling

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full access to the Milk Road Portfolio & weekly updates to see what we’re actively investing in

- • NEW: Unlimited access to the Milk Road PRO Token Center with token ratings and insights. 🔓

- • Weekly “Where Are We In The Cycle?” indicators to help you spot the bull market top before it’s too late 📈

- • Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

- • Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. Don’t miss the monthly live events! 🫂

- • 50% OFF the Crypto Investing Masterclass 📚️