- Milk Road Crypto

- Posts

- MR PRO | Where Are We In The Market Cycle?

MR PRO | Where Are We In The Market Cycle?

Learnings From Retail Investors...

GM PRO DOers! 😎

Earlier this month, we wrote about why market cycles exist (if you missed it, read on here).

Today, we’re diving into understanding the hype part of the cycle (the top) and looking at various indicators that can help us understand when we are nearing the top.

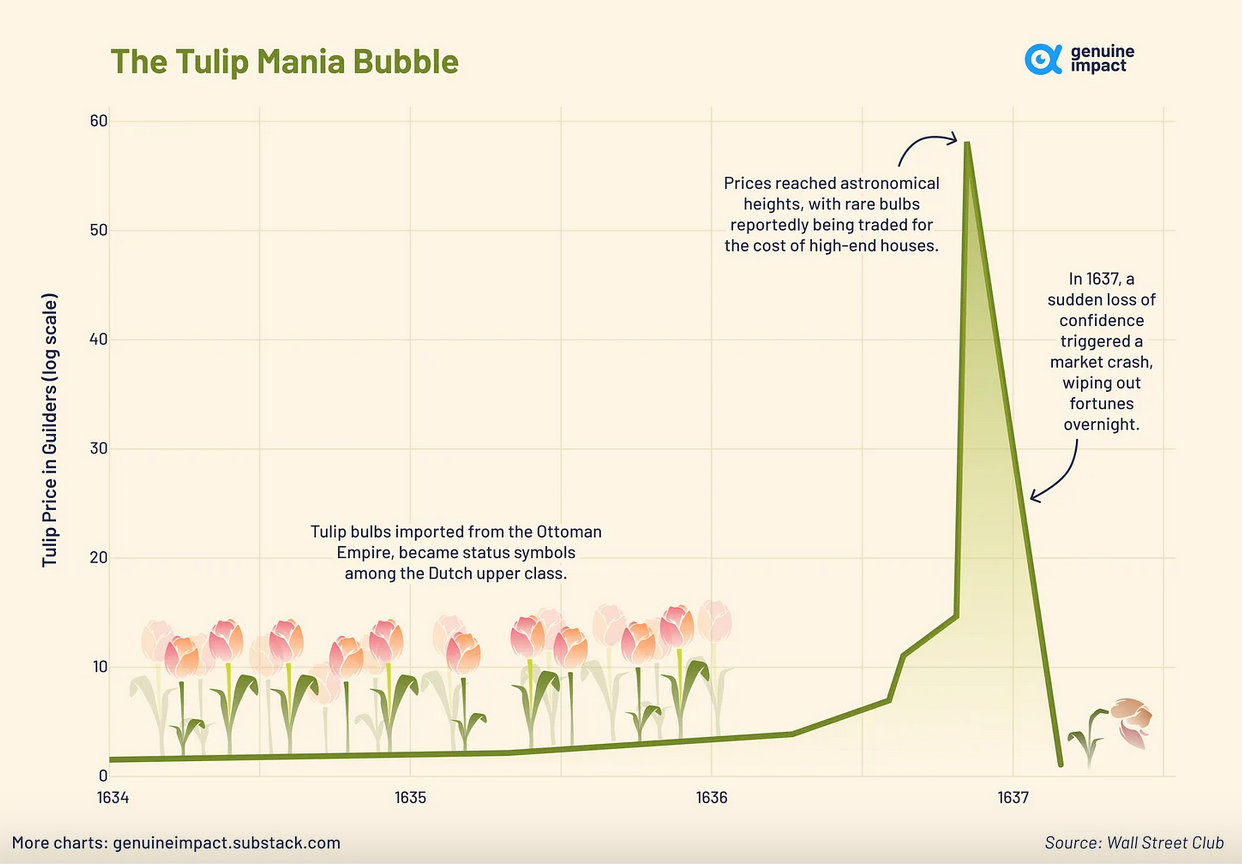

Hype cycles across any asset class almost always work the same. You can match chart patterns across crypto, tech, real estate and even tulip bubbles from the 1600’s.

This happens because of human psychology. Humans are innately greedy and always want more. Thus, whenever we see others making money, we want to make some too… even if it’s a tulip. 🤷

There’s a very popular chart on Wall Street that outlines the psychology of a market cycle…

The gist of it is that we become the most confident and invested during the riskiest of times (the top) and the most scared and least invested during the least riskiest times (the bottom).

These psychological attributes of markets are what drive new investors, mainly retail, into markets near the top of every market cycle.

The interesting thing about the crypto asset class however is that because it’s so easily accessible to anyone in the world, it attracts retail more than any other asset class.

This isn’t true for real estate or other more expensive / globally restricted assets, whereas crypto is global and can be bought in tiny pieces (even for $1 or less).

While institutions and professionals struggle with the psychology of markets too, it's more consistent with retail investors.

With each crypto cycle that passes, we witness the same thing with retail investors… Once mainstream retail investors realize that people are making money in crypto, they flood into the market with ease, just like what happened in 2017 and 2021.

After the music stops and the prices head back down, they leave with their heads low and their investing accounts even lower. 😢

And that brings us to the opportunity of today. For the last 1.5 years, retail investors have completely left the crypto market. During bear markets and early stages of bull markets, mainstream retail investors are nowhere to be seen. They don’t invest in crypto, they don’t care about it and rarely think about it.

Just think about your non-crypto friends and family members. Do they care about crypto right now? No. Did they buy it in 2021 though? Probably, yes!

And just like every cycle previously, they will come back with vengeance this time too.

As educated investors in crypto that are here well before the masses, one simple thing we can do to understand these cycles is to watch for when mainstream retail enters the market.

At that point, it’s time for us to start trying to identify the top and think about taking profits. Our goal is to be allocated way before the mainstream gets here (if you’ve been following PRO reports then you should already have achieved this) and then dollar cost average out as they pile in (if you want to take profits).

So how do we know when retail investors are here? Well, that’s what we are going to cover in today's PRO report.

We’re going to look at various indicators that you can track to understand who is entering the market. Most of these numbers are not onchain, but instead looking at more unique indicators like:

Social media views and subscribers for crypto channels

Active users on centralized exchanges and onchain

Crypto app downloads on Apple and Google

Short term vs. long term holders

Google search trends

Social cues

Let’s dive in. ⏬

The first thing to understand about retail investors is that they get their investing information from social media, not institutional reports.

This means we can gain a lot of information from social platforms.

As you’ll see from the charts below, retail tends to enter the market late in the cycle and then leave the bear market late too. They buy the top and sell the bottom. Exactly what you don’t want to do! 😅

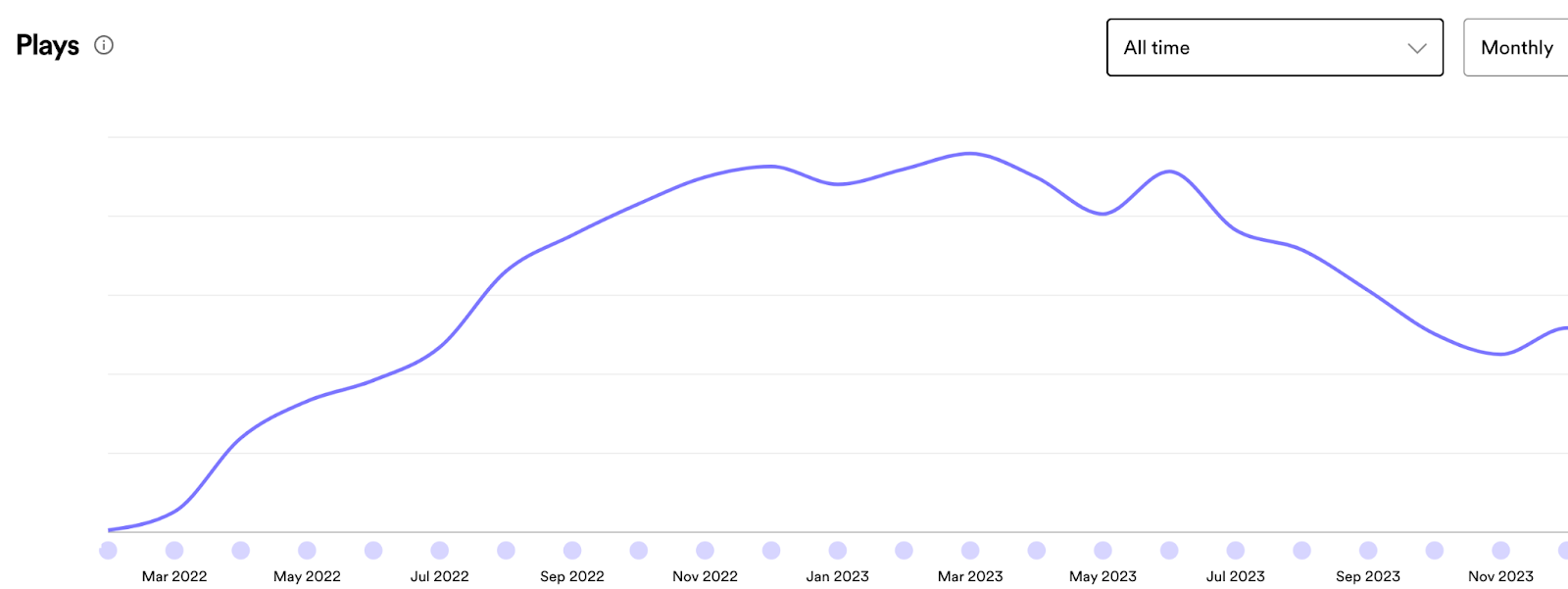

Below is the growth in our podcast downloads throughout the bear market. We launched in March 2022 (tail end of the bull market) and managed to grow significantly, even though prices topped out back in November 2021.

But look at where our growth stopped – November 2022, the exact bottom of the crypto bear market.

Even though Bitcoin went up more than 150% in 2023, we continued to see a decline until November 2023, when Bitcoin was back above $40k.

Our marketing agency Impact3 works with various crypto media companies and the numbers are the same across the board.

Here are the YouTube channel views of one of the largest crypto influencers in the space. It just started to see views pick up in November 2023 as well.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full access to the Milk Road Portfolio & weekly updates to see what we’re actively investing in

- • NEW: Unlimited access to the Milk Road PRO Token Center with token ratings and insights. 🔓

- • Weekly “Where Are We In The Cycle?” indicators to help you spot the bull market top before it’s too late 📈

- • Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

- • Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. Don’t miss the monthly live events! 🫂

- • 50% OFF the Crypto Investing Masterclass 📚️