- Milk Road

- Posts

- 🥛 Last chance before lift off? ✈️

🥛 Last chance before lift off? ✈️

PLUS: What to look out for this week 👀

GM. This is Milk Road, your own personal crypto jukebox (we keep the hits coming, no quarters required).

Here’s what we got for you today:

✍️ What to look out for this week

✍️ Last chance before lift off?

🎙️ The Milk Road Show: Why $ETH Is Becoming the World’s Most Important Asset | Joe Lubin Ethereum Co-Founder & SBET Chairman

🍪 “We are The Ether Machine”

BlockFills is the all-encompassing digital assets trading platform, designed for institutions. Sign up with BlockFills today.

WHAT TO LOOK OUT FOR THIS WEEK 📆

“Hey Siri, add the following to my calendar…

No, don’t call my mom, I said add these to my calendar—urrrgh, fine. I’ll do it myself.”

1/ Macro 🌎

Here’s what we’re looking at:

Powell Speaks – Tuesday – will he announce his retirement? ¯\_(ツ)_/¯

June Existing Home Sales data – Wednesday – are people buying old homes?

June New Home Sales data – Thursday – are people buying new homes?

July S&P Global Manufacturing PMI data – Thursday – are purchasing managers buying new stock in preparation for economic growth? The S&P PMI will give us a better idea.

PLUS: roughly 15% of S&P 500 companies report earnings this week.

Speaking of which…

2/ Earnings 💰

Aka: the 7 stocks that make up ~35% of the S&P 500’s total value (which is a proxy for the US stock market). 👇

3/ Government 🏛️

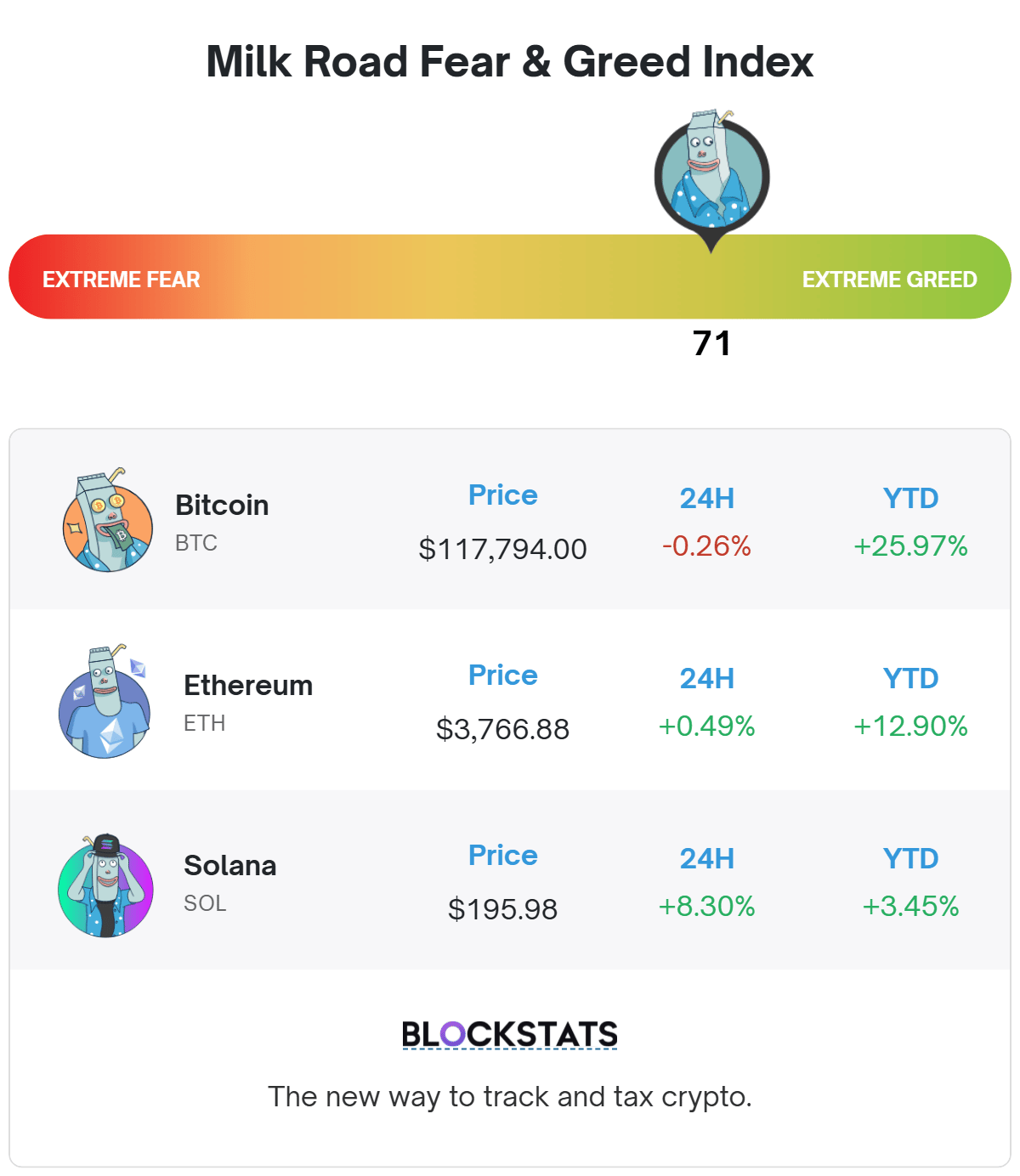

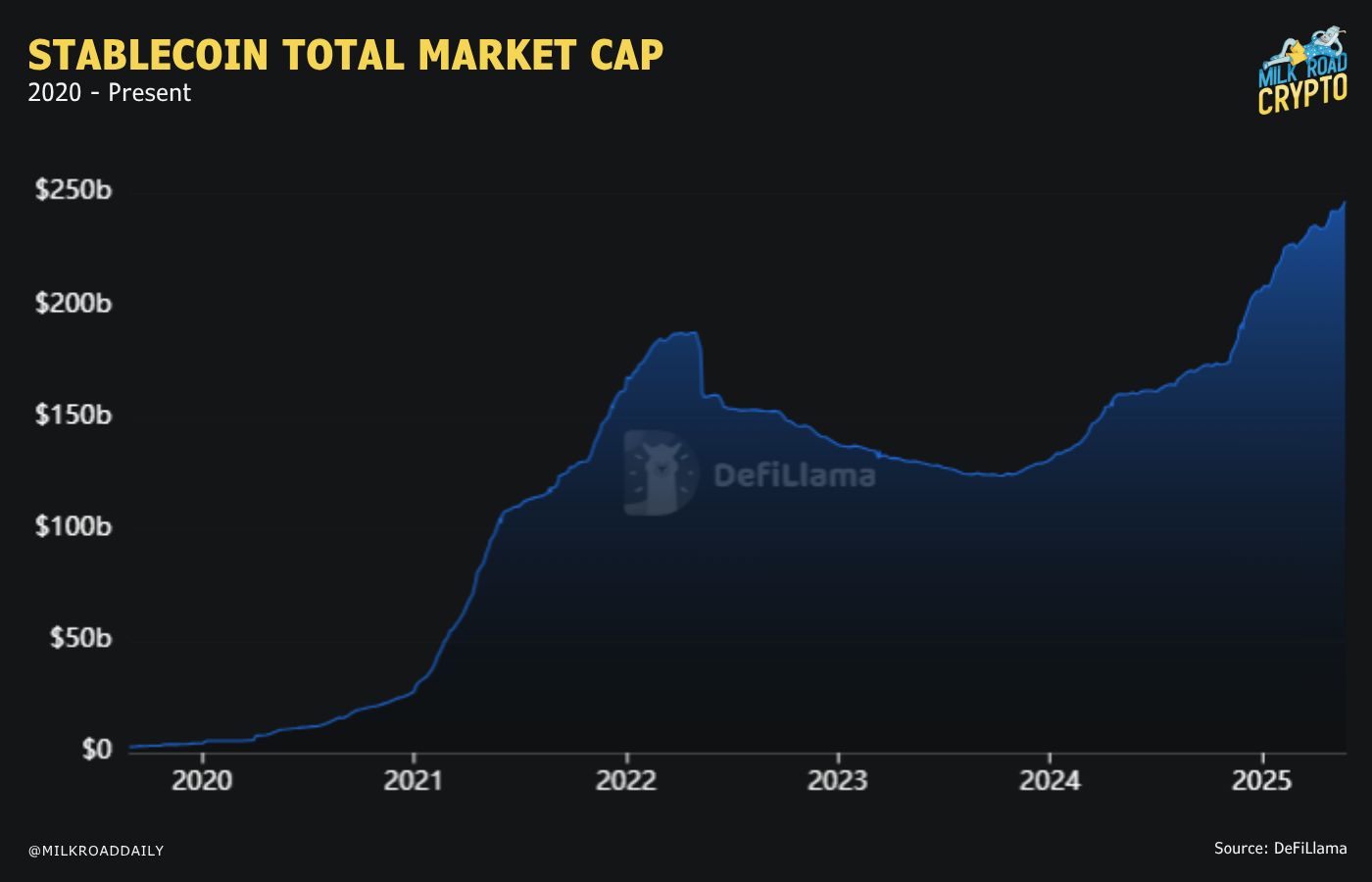

The stablecoin market cap has continued to rip harder than a divorced dad’s velcro wallet, adding ~$3B just over the last 7 days, bringing its total to $261.25B. 👇

And last Friday, President Trump signed the GENIUS Act into law – a piece of legislation that gives clear regulatory guidelines to US-based entities looking to launch their own stablecoin.

i.e. US banks n’ builders now have the green light to enter the stablecoin space – so keep an eye on this chart for further movements up-and-to-the-right.

4/ Podcasts/AMAs 🎙️

Our First-Ever Degen PRO AMA is happening this Tuesday.

Want to know what LG’s buying? What he regrets aping into? What's on his radar next? Now's your shot.

Drop your questions here.

Not in Degen PRO yet? This is your last chance to get access at a 20% discount!

As for podcasts — on today’s episode of The Milk Road Show, we have Joe Lubin!

Chairman of SharpLink Gaming ($SBET), founder of ConsenSys (creators of MetaMask), and co-founder of – wait for it – ETHEREUM.

Stop what you’re doing and click below. 👇

…oh, and that’s of top of Scott Melker (The Wolf Of All Streets) on Tuesday, and Ryan Watkins (Co-Founder of Syncracy Capital) on Thursday!

5/ Everything else 📋

The total crypto market is hovering around all time highs – can it climb higher Well, funding rates (which help us tell if the market is overheated) are still neutral at 0.01% (0.05% = overheated) – so things are looking up!

ETF flows ripped last week ($2.38B for $BTC & $2.18B for $ETH) – we’re watching to see if $ETH can flip $BTC’s flows

All while the altcoin market, as a whole, continues to rip

…speaking of Altcoins – last Wednesday we wrote an article titled “Are We On The Verge Of Alt Season?”

And not even a week later, we feel like we need to update you on it.

Keep scrolling to the next article for an important/expedited update. 👇

This probably isn’t for you, unless—oh, you’re an institutional investor?

Well then. Right this way ser. Please, take a seat and allow me to introduce you to:

BlockFills - the crypto trading platform built specifically for institutions. They’ve got the trust, volume, and geographical spread you’re looking for.

We’re talking:

1700+ institutional clients

$100B+ in trading volume

Operating in 70+ countries

And 5 global offices

BlockFills provides an all-encompassing digital assets trading platform and unmatched liquidity to digital asset market participants worldwide.

(The perfect bouquet for your palate.)

*Derivatives products available to qualified counterparties only.

LAST CHANCE BEFORE LIFT OFF? ✈️

Is…is this it?

Is this our last chance to allocate before risk-on behavior takes over the market and pushes alts through to new all-time highs (stealing the spotlight from Bitcoin)?

It’s starting to feel like it is. Here’s what we’re seeing:

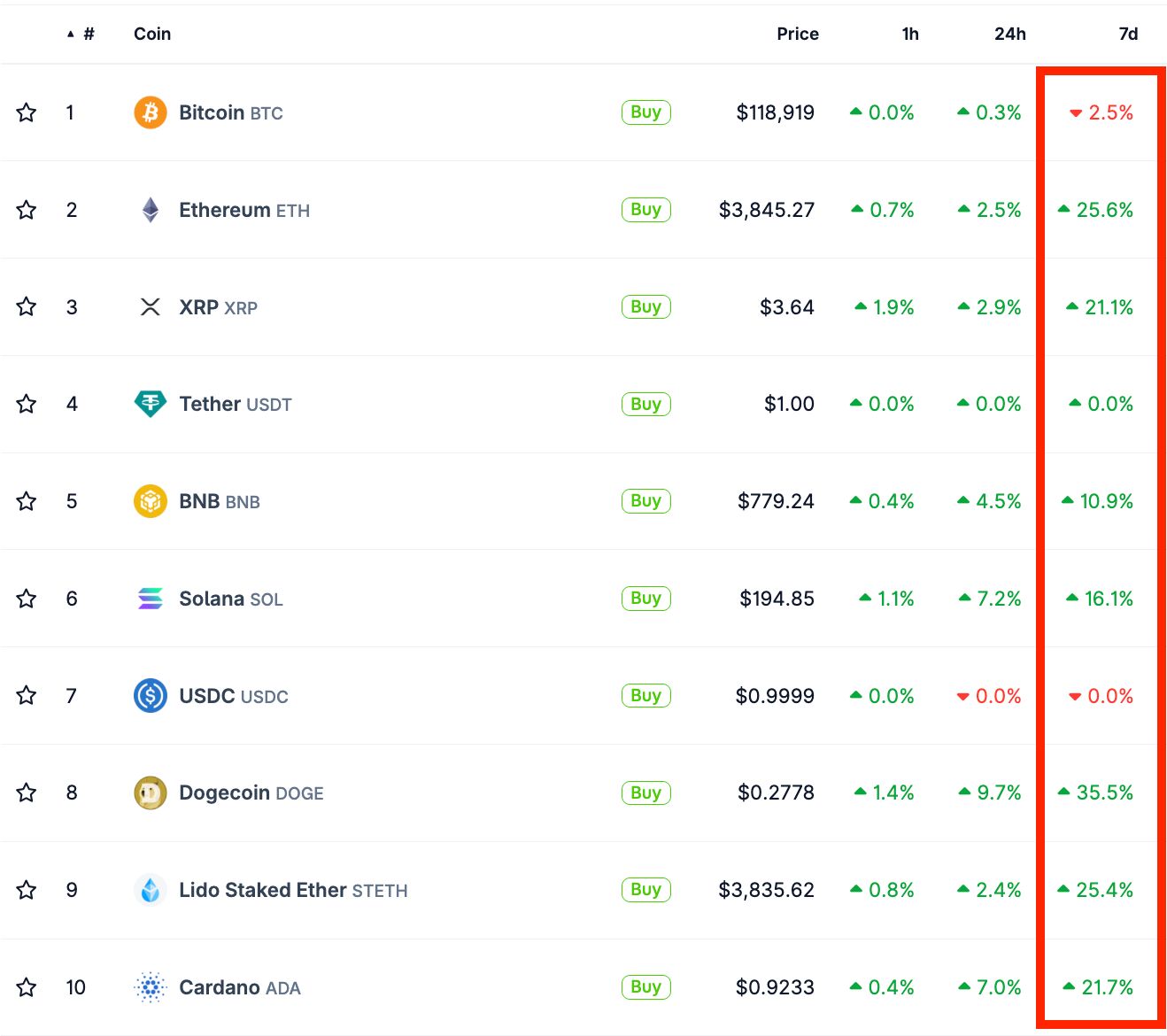

1/ Altcoin performance is dominating the top 10 🥊

Last Wednesday, this section listed four altcoins in the top 10 cryptocurrencies by market cap that were outperforming $BTC over the trailing 7 days.

Today, there’s only one coin that’s down over the same time period, and it’s Bitcoin. 👇

2/ How risk-on are we right now? Just look at the NFT market… 😧

NFTs – remember them? Yuh. Well, they’re up 17% over the last 24hrs, thanks in large part to a single buyer gobbling up 48 Crypto Punks (do they know something we don’t?).

But it’s not just Crypto Punks that are having a moment – the sector is showing renewed signs of life across the board!

And NFTs = alt season asset.

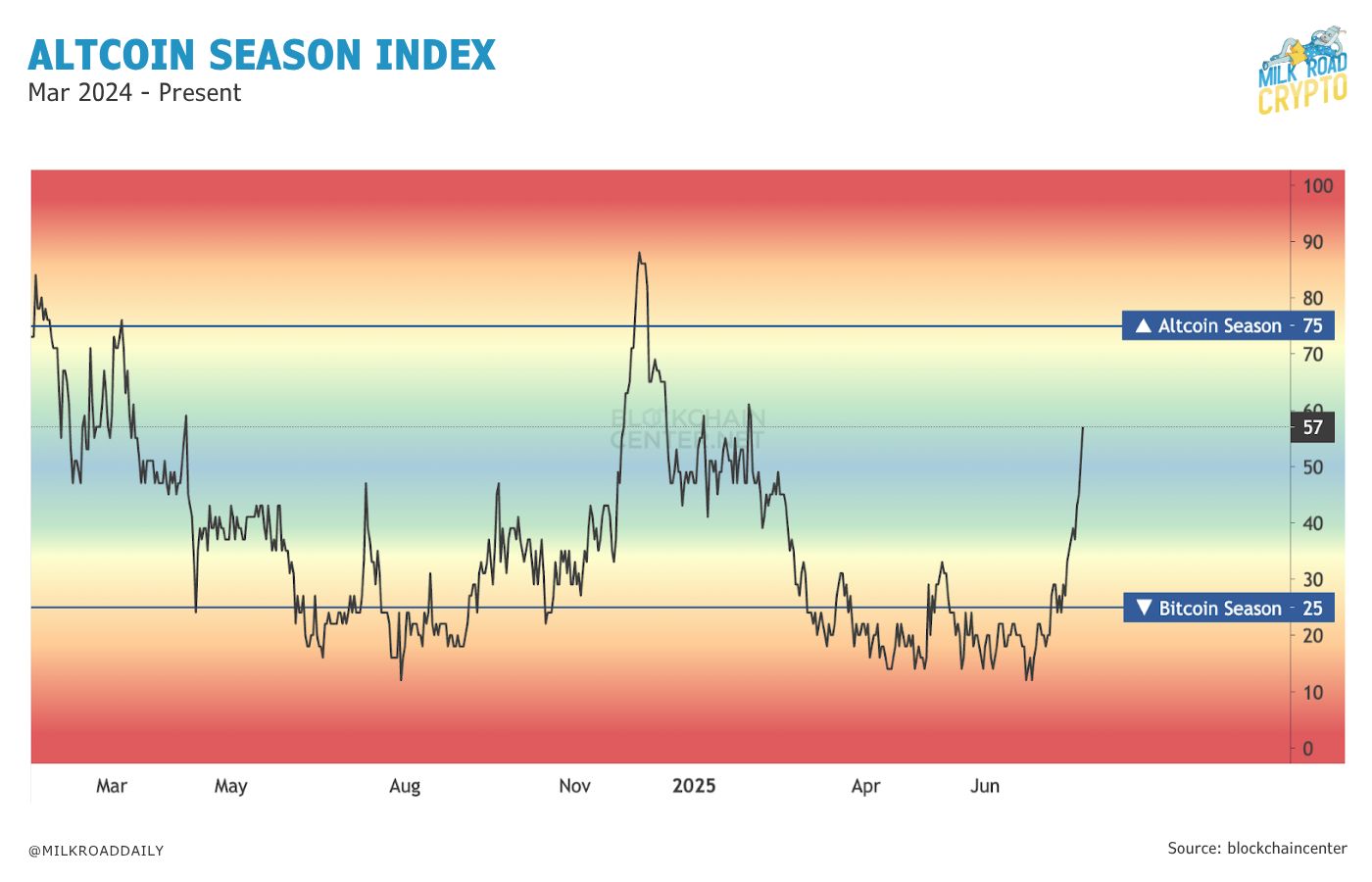

3/ The altcoin index is sprinting towards alt season ☀️

Quick refresher:

Altcoin season = 75% or more of the top 50 tokens outperforming Bitcoin over 90 days – while Bitcoin season = 25% or less.

Last Wednesday, we were at 39%. Today, we’re at 57%.

4/ Meanwhile, TradFi continues to mirror similar risk-on behavior 🏦

How risk-on? Unprofitable tech stocks are up 66% (and climbing) since April’s tariff-driven economic growth scare. 👇

PLUS:

At last count, global liquidity (the amount of money sloshing around global markets) is hovering around all-time highs. Growth in liquidity typically = growth in risk assets.

Our macro team expects ISM’s PMI data to break 50 in Aug/Sep (which is similar, but different from S&P’s PMI data). A 50+ ISM PMI typically correlates with alt season.

$BTC.D (a measure of how much of crypto’s total market cap is made up of $BTC) is currently sitting at 60.50%, in its 5th straight week of falling.

If $BTC.D finishes the week at or below ~59%, it will mark the break of a three-year uptrend. 👇

…add this all together and it feels safe to say:

This is probably your last chance to allocate before the altcoin market breaks through to new all-time highs.

Don’t want to pay capital gains tax on your crypto gains? IRA Financial lets you invest in Bitcoin & over 40 other tokens tax-free within a Roth IRA.*

“We are The Ether Machine.” A brand new public entity is looking to invest over $1.5B in yet another $ETH treasury play.

Crypto is filled with treasury companies at the moment. StablecoinX has announced that they will invest $360M into Ethena’s token $ENA.

Following Coinbase, Block will also be joining the S&P 500. Their shares rallied 10% on this news. - DL News

The comeback is on. Here are three memecoins that are gearing up for a rebound. Spoiler: One of them is $BONK.

Crypto cashback, baaaby! The Gemini Credit Card gives you 4% back on gas, 3% on dining, 2% on groceries and 1% on everything else.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY