- Milk Road Crypto

- Posts

- 🥛 Are we on the verge of alt season? ☀️

🥛 Are we on the verge of alt season? ☀️

PLUS: Is Jerome Powell about to be fired? 😰

GM. This is Milk Road – the crypto newsletter with a single mandate: make ‘em laugh, make ‘em learn.

Here’s what we got for you today:

✍️ Are we on the verge of alt season?

✍️ Is Jerome Powell about to be fired?

🎙️ The Milk Road Show: Why This New Macro Cycle Will Break the Fed's Playbook w/ Jim Bianco

🍪 PumpFun has already started token buybacks

REX-Osprey are the creators of the first US-based Solana staking ETF, giving 100% of its staking yield back to shareholders. Learn more here!

ARE WE ON THE VERGE OF ALT SEASON? ☀️

She’s taking hours to send a one-word response.

Your memes are sitting lonely & un-hearted in her DMs.

And your plans to rent that cabin together in the fall have dried up.

You haven’t been dumped yet… but you can feel it coming.

That’s kinda how we’re seeing the potential for a risk-on economic environment.

(A time where riskier assets thrive, altcoins outperform Bitcoin, and everyone thinks they’re an investing genius – even though they’re just riding a trend.)

We’re not ready to confirm it just yet… but we can feel it coming.

Here’s what we’re seeing:

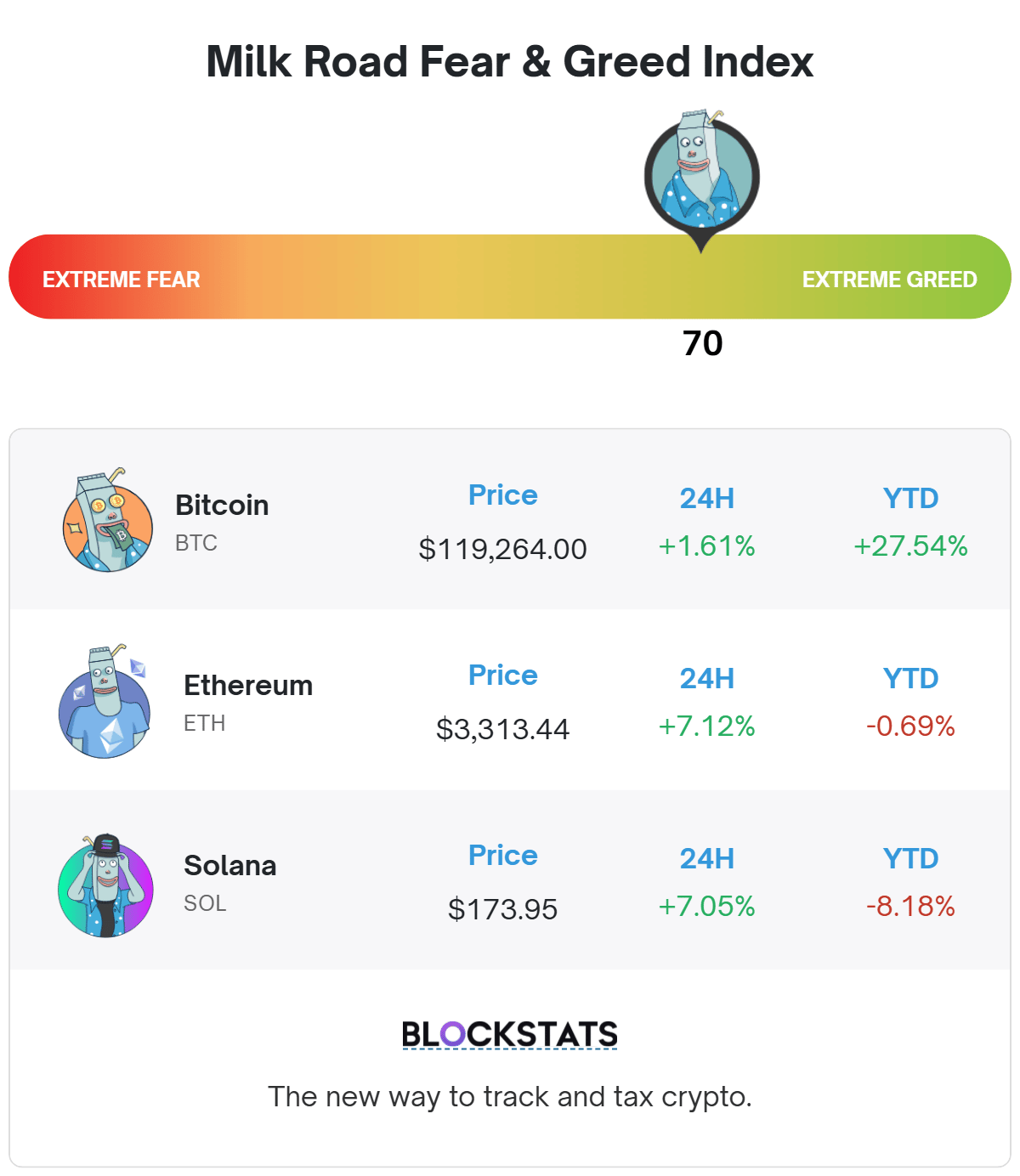

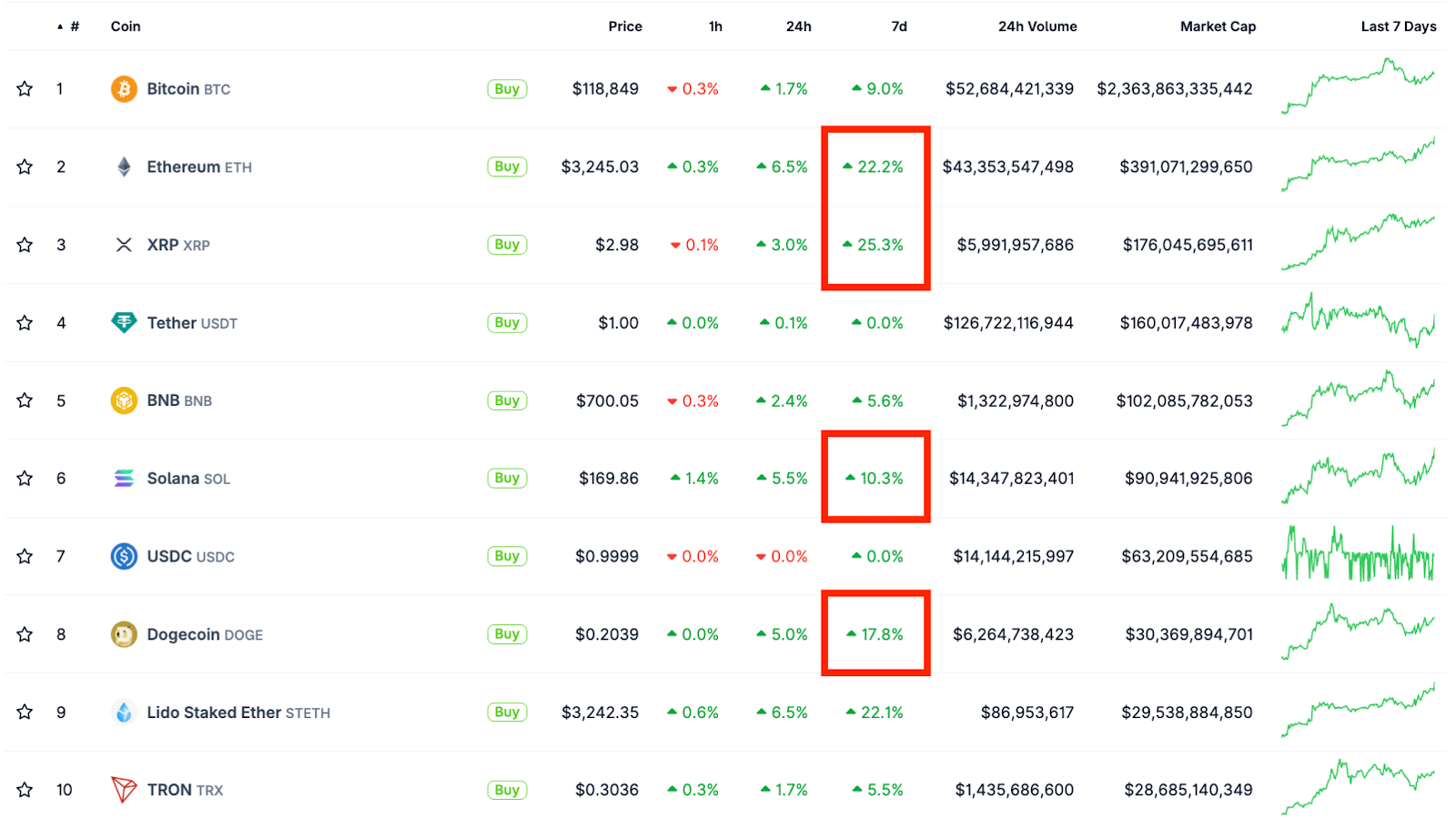

1/ Altcoin outperformance is bleeding into the top 10 🩸

Four altcoins in the top 10 cryptocurrencies by market cap have outperformed Bitcoin over the past 7 days.

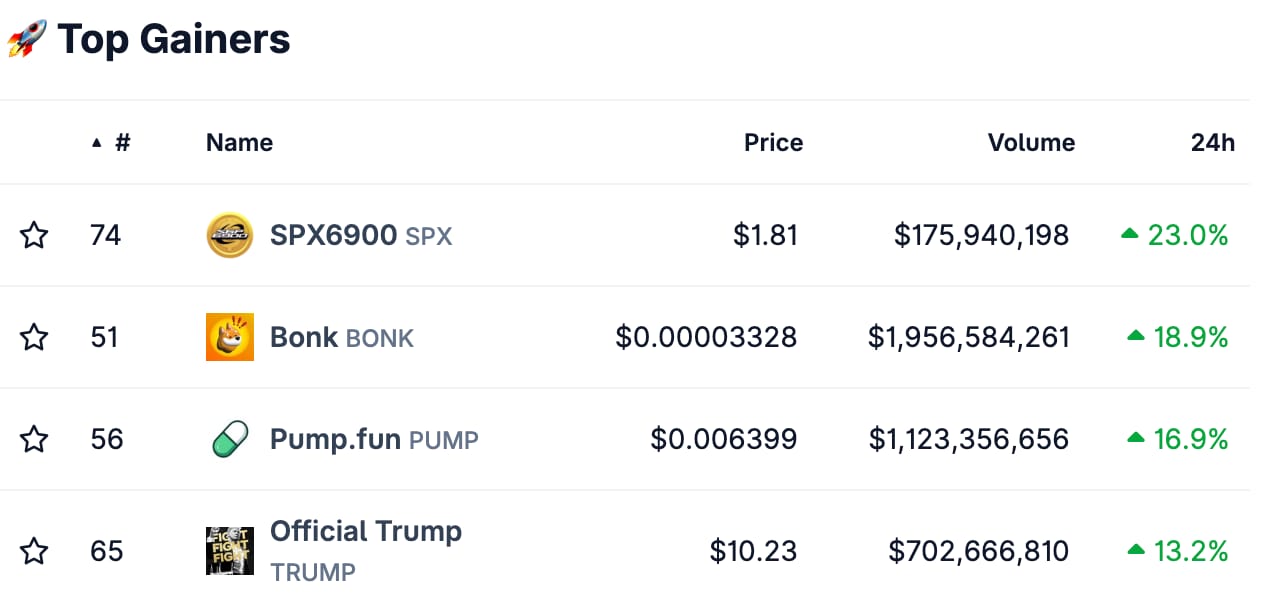

2/ The top 24hr gainers are all risk-on 🚀

The biggest gainers of the top 100 tokens over the last 24hrs are largely memecoins, or memecoin-adjacent. 👇

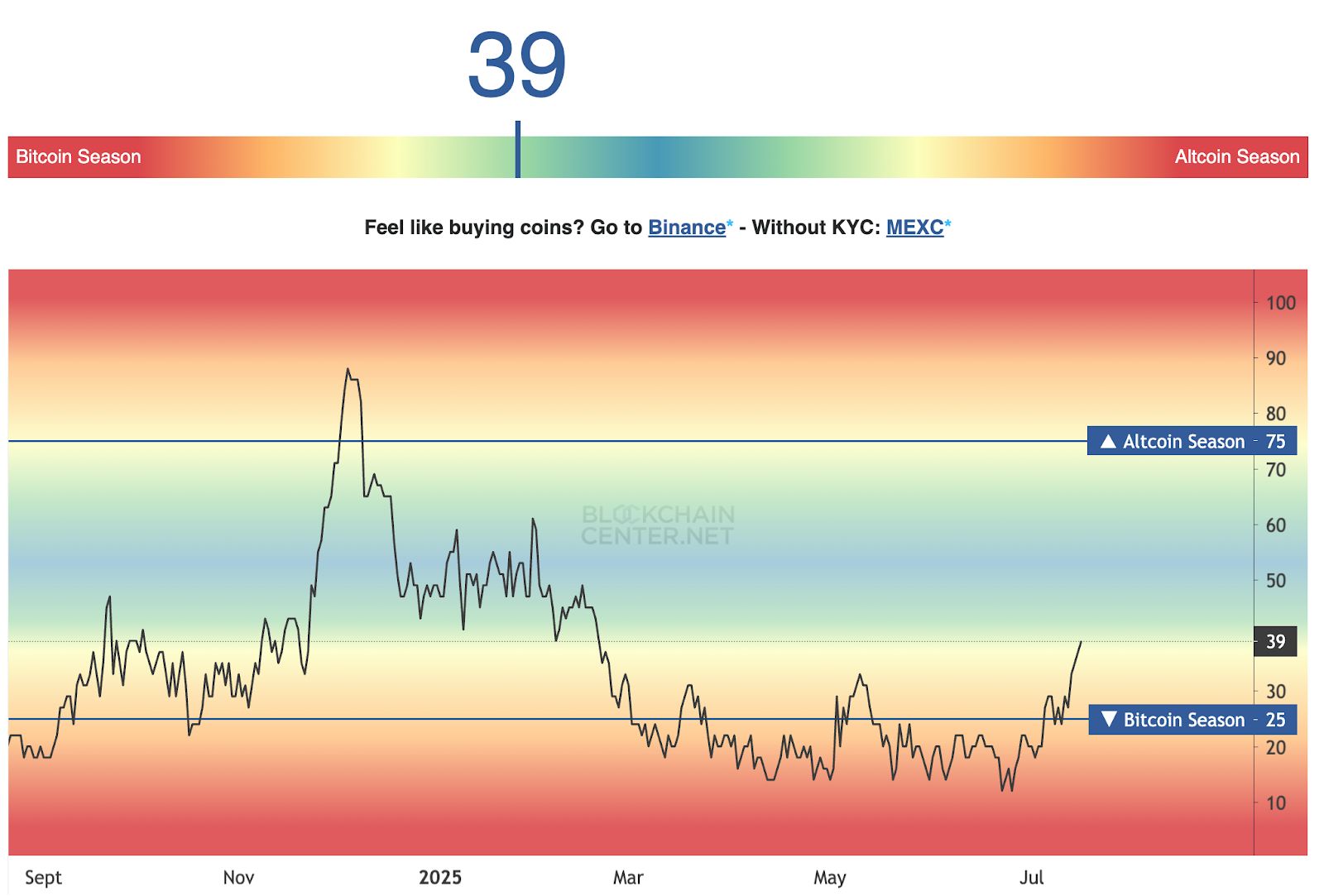

3/ We’re no longer in Bitcoin season ✈️

Altcoin season = 75% or more of the top 50 tokens outperforming Bitcoin over 90 days.

Bitcoin season = 25% or less of the top 50 tokens outperforming Bitcoin over 90 days.

Right now, we’re in limbo at 39% – but that’s up from 23% (aka: Bitcoin season) less than a week ago.

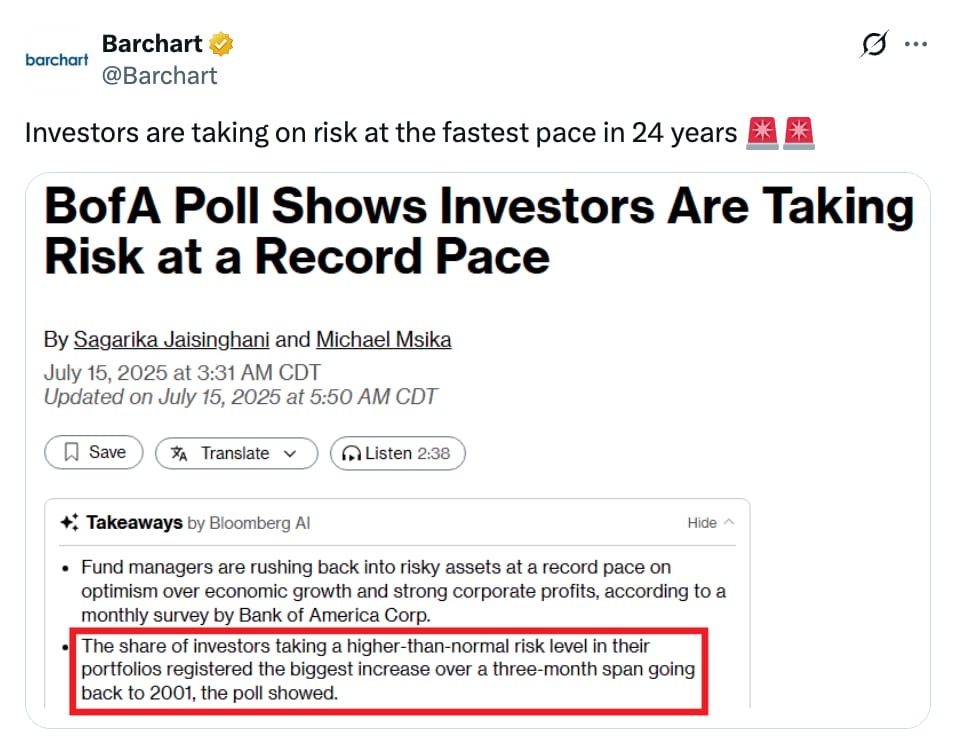

4/ TradFi is feeling it too 🏦

Risk taking from traditional investors is increasing at the fastest pace in a quarter century!

Sweet, so how do we gauge when to officially go risk-on?

(‘Cause by the time the altcoin index chart hits 75% – the biggest gains will have been gobbled up.)

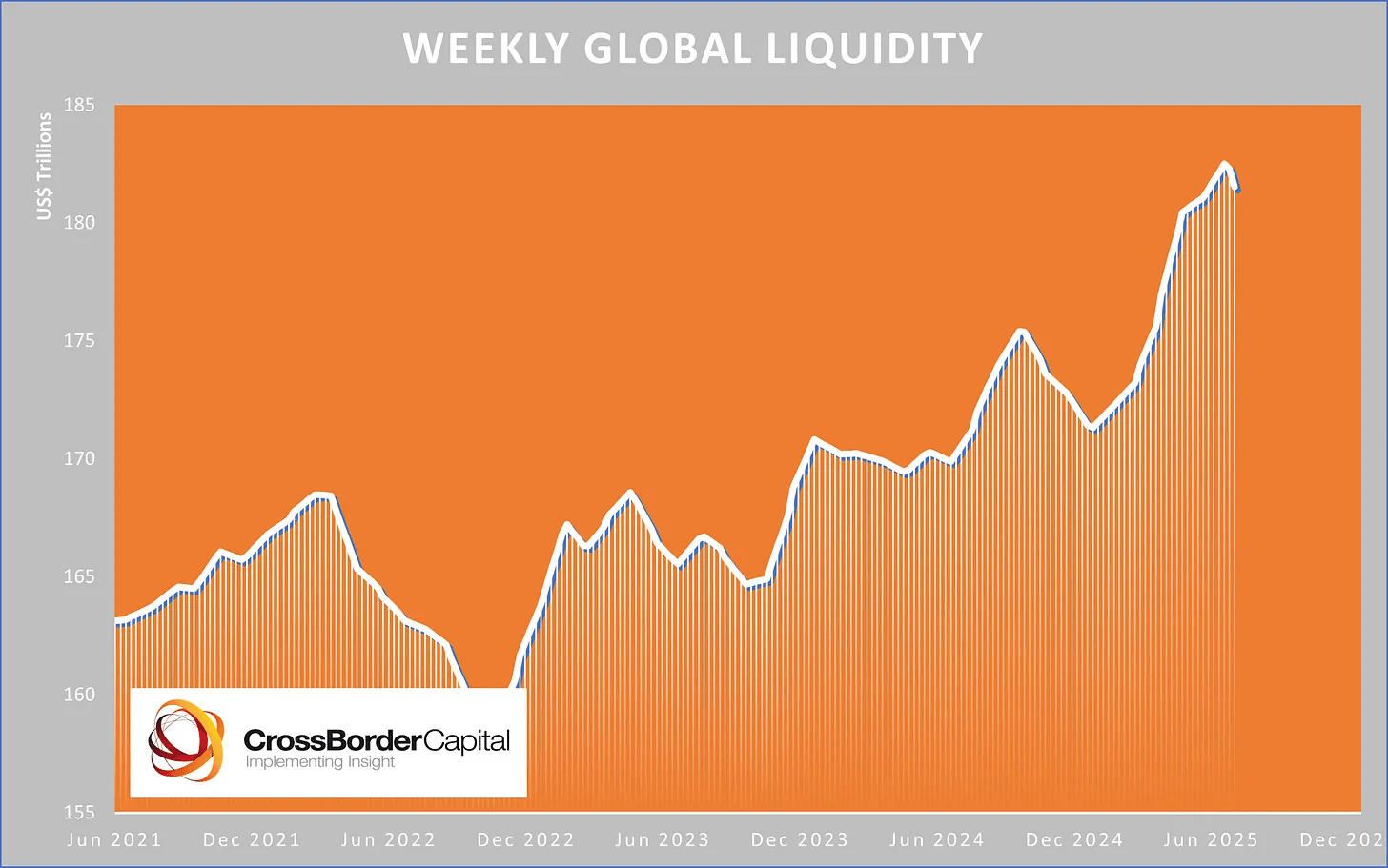

Our trick is to wait for ISM's Purchasing Manager Index to cross 50 (it's currently at 49) then watch global liquidity.

(Aka: a measure of how much fresh cash is sloshing around the global economy.)

An ISM over 50 + rising global liquidity = growing risk-on sentiment.

…and right now, global liquidity is near all-time highs:

And for those that want even more clarity on where we are in the current cycle, we share global liquidity in a simplified chart, along with 5 other cycle top indicators every Thursday in this-here newsletter.

You just need to go PRO to see them!

First mover advantage is a real thing.

Apple had it in smart phones, NVIDIA had it in AI chips, and Coinbase led the charge as the first major US-based crypto exchange.

Last week, REX Osprey racked up three first mover milestones, becoming the first US-based ETF to give investors access to:

Solana exposure

Active asset staking

100% of staking rewards (paid monthly)

The ticker is $SSK. The asset is $SOL. Ready to learn more?

IS FED CHAIR JEROME POWELL ABOUT TO BE FIRED? 😰

I know, I know – DRY topic. But lemme reframe it:

Think of this as an episode of “The Real House Husbands of The Federal Government”.

Fed Chair Jerome Powell = JJ. President Trump = Big T.

JJ has been on a high over the past few years (we’re talking Jordan-in-his-prime-level performance).

This man raised rates and lowered inflation all WITHOUT pushing us into a recession (that’s the equivalent of hitting a bomb from half-court, right at the buzzer).

But Big T is currently in search of a (needed) legal reason to cut JJ from the Fed’s roster – ‘cause JJ won’t aggressively lower rates.

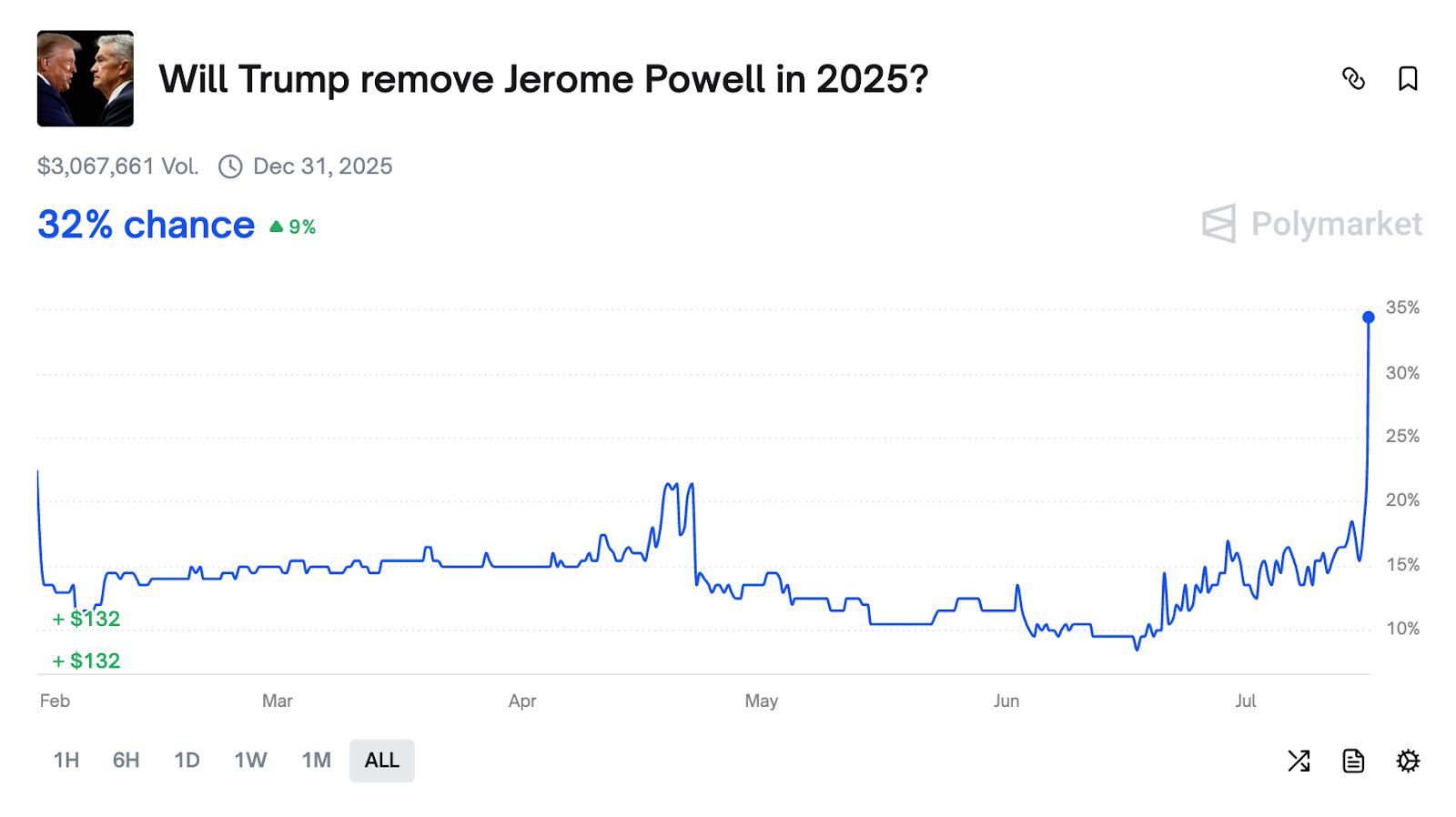

And the likelihood of this happening has doubled since yesterday according to Polymarket:

But JJ’s holding firm on ‘no aggressive cuts’ because the economy is in a good spot right now – and rate cuts are a lever you typically pull when it’s weakening.

(Cuts lower loan repayments → giving people/companies more disposable income and easier access to cash → boosting the economy.)

…but why not cut rates and juice an already solid economy even further??

Well, you can only pull that lever so many times before rates are at zero.

So using them when things are good is not only seen as a waste, but can increase inflation a worrying amount – which is typically fought with rate increases.

The issue here is… Big T loves himself a booming economy, and sees fast n’ frequent cuts as a cheat code to getting there.

So there’re now whispers that he and some of his friends in Congress have been cooking up a plan to get JJ on a technicality.

That being: he over-spent on the renovation of the Fed building and lied about it to Congress.

(We took a closer look at that and more in yesterday’s edition of Milk Road Macro.)

If this firing takes place, it could put the fear of god into the financial market, who may see this as overreach from the executive branch.

(The Fed is meant to operate independent of the government.)

Here’s where we stand on all of this, as of right this second:

A 32% chance of this happening ain’t great – but it still leaves a 68% chance that it WON’T happen.

JJ’s contract with the Fed is up in May of next year, so Big T can simply wait him out if he wants.

If anything, we’d sooner bet on this…

“I’m too old and too rich for this sh*t” – JJ, probably.

But of course, we’ll update you further as (or if) it continues to unfold.

🚨 JUST LAUNCHED: DEGEN PRO 🚨

For the wild ones...

Degen PRO is our new premium tier for unfiltered plays, early-stage chaos, and deep dive research into the spiciest corners of crypto.

Here's what you get:

Weekly Degen diary – See everything LG is aping into and walking away from.

Buy / sell signals – What to ape into. What to avoid. And when to GTFO.

Live AMAs – Grill LG directly, twice a month.

Private Discord access – Get the alpha and talk shop with other sickos.

Coming soon – Token screener plus full Degen portfolio.

All you have to do is upgrade to a Degen PRO membership (or PRO All Access).

Oh and did we mention it’s 20% off for a whole week too? 👀

Don’t want to pay capital gains tax on your crypto gains? IRA Financial lets you invest in Bitcoin & over 40 other tokens tax-free within a Roth IRA.*

PumpFun has already started token buybacks. Yesterday, they bought approximately $19M of their $PUMP token.

Corporate Bitcoin adoption is not stopping. Cantor Fitzgerald is planning to purchase $3.5B of Bitcoin from Adam Back’s Blockstream.

There’s a massive airdrop-farming opportunity in crypto right now. In our latest Milk Road Degen edition, we break down a step-by-step guide to farming airdrops on Hyperliquid.

Is spot trading a little too boring for you? dYdX lets you trade perpetuals onchain with zero gas fees.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

Today, we’re shining the spotlight on a standout review from Milk Road Macro:

VITALIK PIC OF THE DAY