- Milk Road Crypto

- Posts

- 🥛 Why this 'dead' token isn't dead 💀

🥛 Why this 'dead' token isn't dead 💀

PLUS: The flywheel fueling ETH treasuries 🔁

GM. This is Milk Road – the “Flamin’ Hot Cheetos” of crypto newsletters (spicy & addictive).

Here’s what we got for you today:

✍️ $PUMP isn’t dead, here’s why…

✍️ The flywheel fueling ETH treasuries

🥛 Milk Road PRO Portfolio updates

🎙️ The Milk Road Show: The Fed Is Wrong About AI and the Economy w/ PDS

🍪 Mortgages…paid in crypto?

YEET is crypto’s casino featuring original games, slots and live events. Sign up with Milk Road for a shot at $10K.

$PUMP ISN’T DEAD IN THE WATER…HERE’S WHY 📊

So we’re going to take the other side of the argument.

Not just so we can put ‘contrarian thinker’ in our Twitter bio (though no doubt our intern, Archie, will jump at the chance), but because there’s potentially an opportunity here…

Let’s start by ripping the band-aid off:

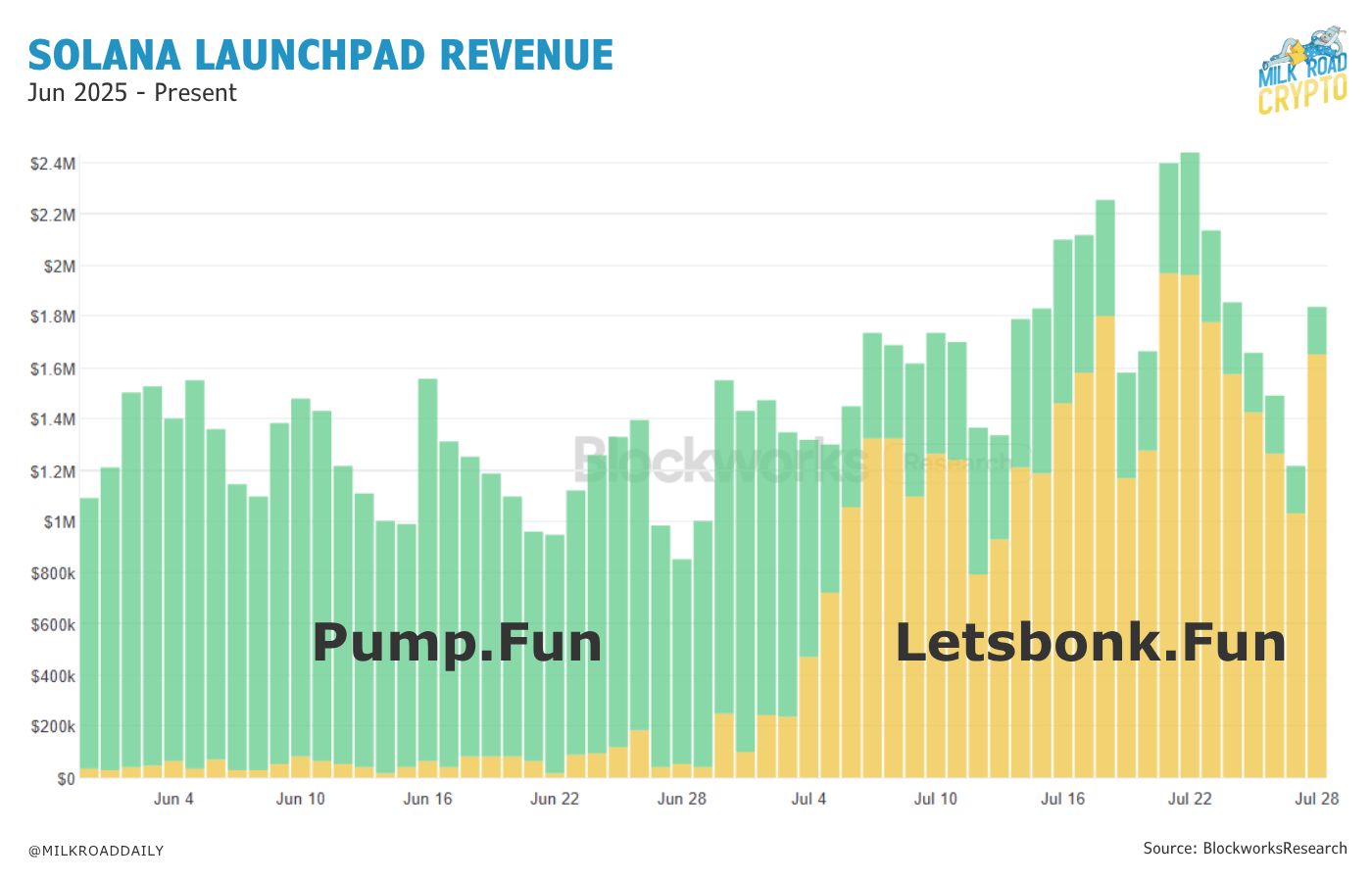

1/ PumpFun is getting smoked by LetsBonkFun right now

LetsBonk launched in April → added a bunch of financial incentives for folks to use the platform (airdrop points, creator rev-share, token buybacks) → stole the limelight from Pump.

And they’ve been MASSIVELY eating into PumpFun’s daily revenue. 👇

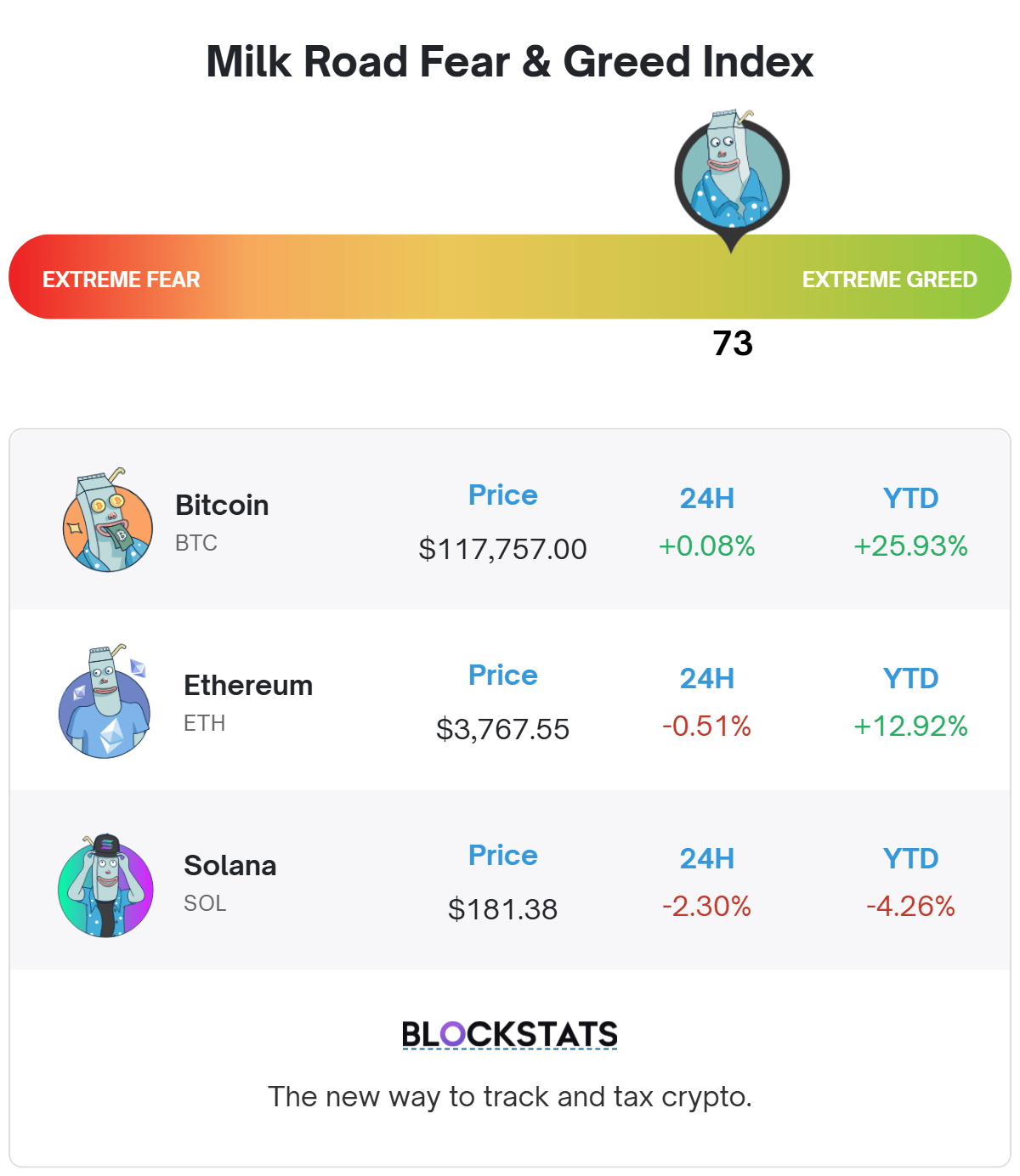

2/ Now, this drop in revenue is bleeding over to the $PUMP token

$PUMP’s market cap is down from its peak of $2.4B on July 15, to $900M as of this writing…

3/ But PumpFun has a secret weapon…

Those incentives that LetsBonkFun is handing out? It’s not like PumpFun is incapable of matching (or better yet: outpacing) those perks.

PumpFun’s secret weapon is its ~$1.8B war chest. (Yuh. Their treasury is currently worth 2x the market cap of their token.)

Meaning they can incentivize with the best of ‘em.

And any new incentive program will be added on top of their:

25% platform rev-share with $PUMP token holders (which has increased to 100% over the past two days)

50% fee split that token creators get for every transaction involving their coin on PumpSwap

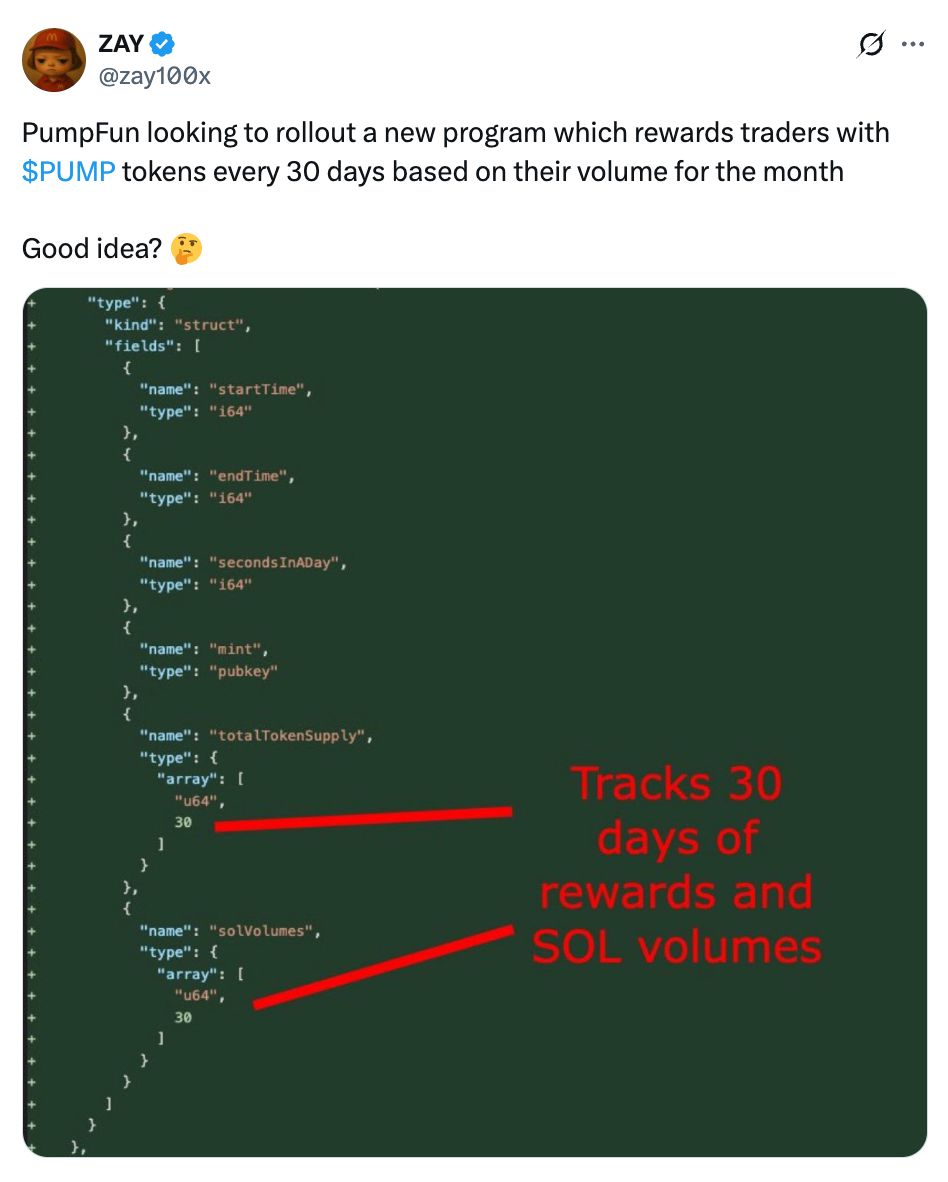

Next step is to entice traders to come back to the platform… 👇

Translation: if you trade on PumpFun → it’s rumored you’ll soon get paid for doing so (the more you trade, the more you make in bonus incentives).

4/ History doesn’t bode well for upstarts like LetsBonk

In the past, newcomers that try to topple established platforms via crazy incentive programs have, errr, ‘struggled’ (to put it lightly).

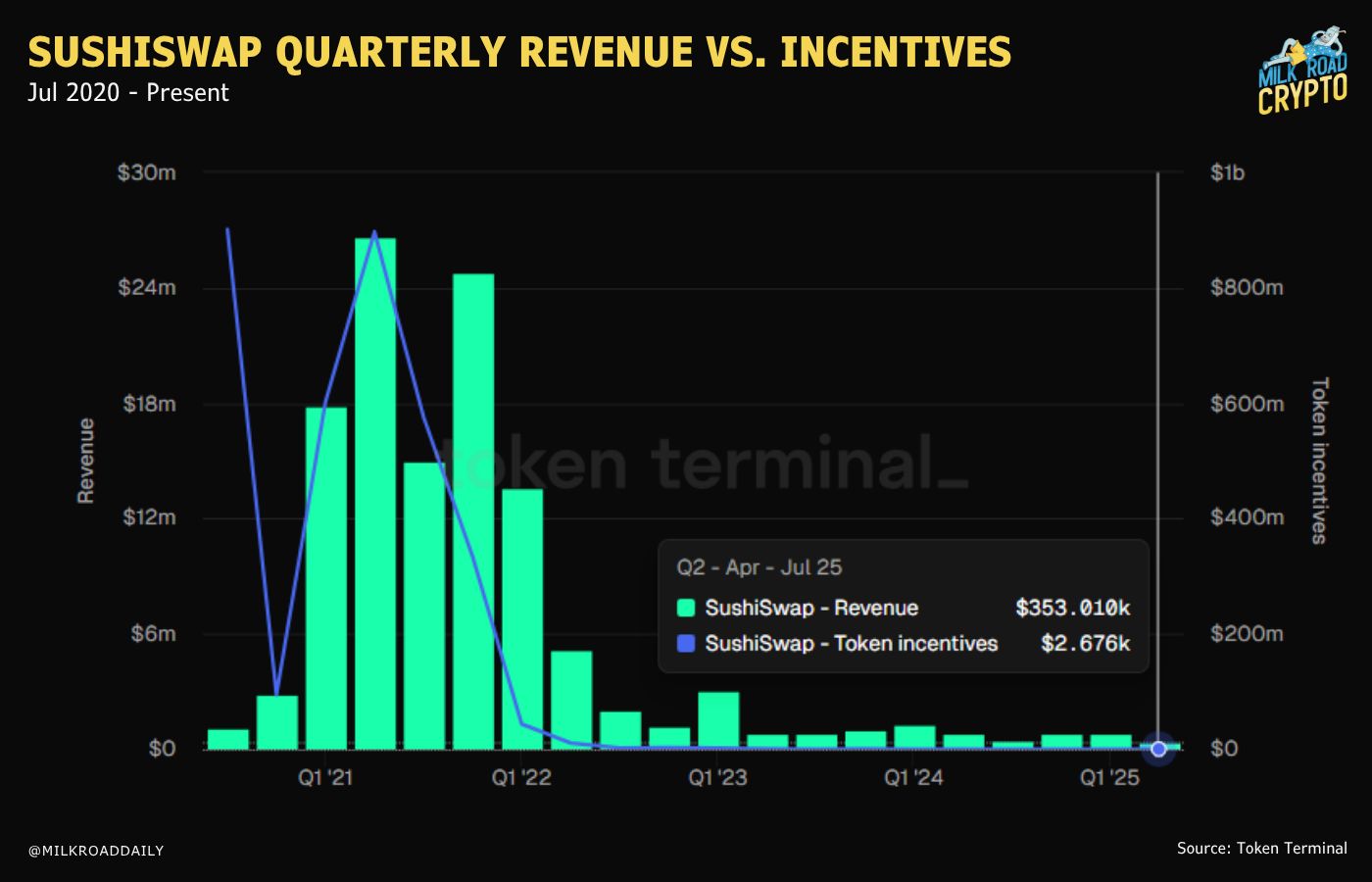

SushiSwap’s attempt to outspend/outgrow Uniswap is a prime example – they spent $3.5B on incentives to generate $120.9M in revenue. YIKES. 👇

The takeaway:

Crypto Twitter wants you to believe that PumpFun / $PUMP is out for the count.

(Kyle and Martin from our PRO team just argued about it with LG, from Milk Road Degen — here.)

But for all the noise, it’s still VERY early days in this fight for memecoin-launchpad-dominance, and PumpFun has an insane amount of money at its disposal.

Remember: when there’s broad consensus on a single trade (buy $BONK, sell $PUMP) – the real opportunity often lies in doing the opposite.

P.S. We’re about to get SUPER granular on this exact trade in Saturday’s PRO report, so keep your eyes peeled for that.

(Not PRO yet? You can fix that here.)

I’ve only been to Vegas once. I was 17, couldn’t gamble, and I’ve held a grudge ever since.

Never made it back to a real casino…

Until I found YEET - crypto’s hottest new casino with $300m volume in 3 months!

Here’s how it works:

Sign up on YEET using the MILKROAD code

Deposit crypto across multiple chains like Bitcoin, Ethereum and Solana

Play games from top providers – including YEET’s own custom crypto-themed games

Sign-up and play by August 31st. YEET is giving out 10 x $1k prizes randomly to Milk Road users.

*Disclaimer: Hey Roadies! A reality check from the Milk Man: I know my dairy, not your dollars. This partner content isn't financial advice.

THE FLYWHEEL FUELING $ETH TREASURY PLAYS 🔁

As commonplace as $ETH treasury plays feel right now, we think this is just the beginning of a MUCH larger story.

And we have new insight into how that might happen / where we’re at in the process.

SPOILER: We’re still insanely early. Here’s what we’re seeing…

1/ $ETH has a flywheel that $BTC can’t emulate

Bitcoin doesn’t have a native DeFi ecosystem, nor can it host a stablecoin on its network. Ethereum has both of those things.

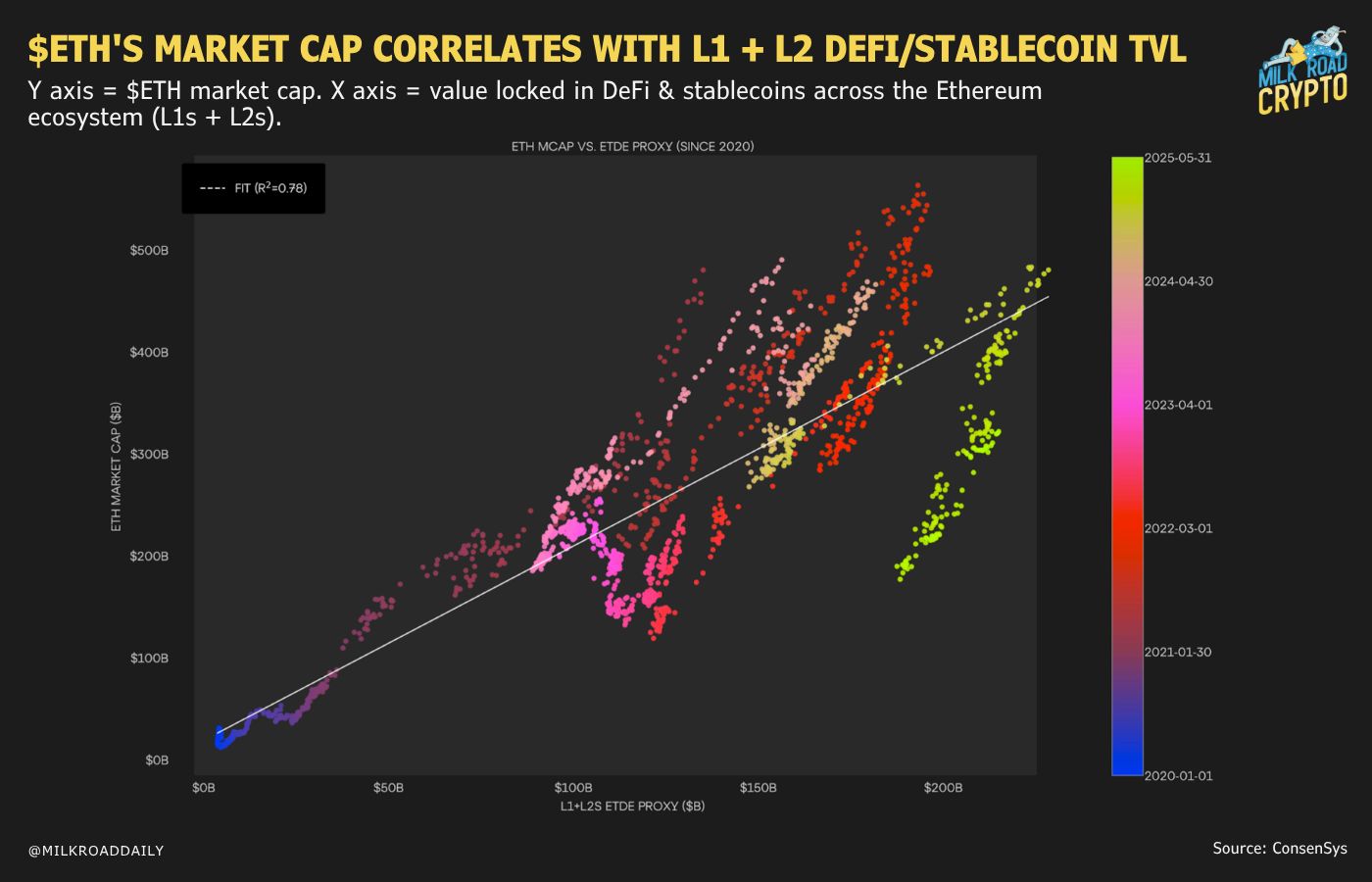

And historically, the more money that gets locked up in stablecoins and DeFi (think: staking, lending, restaking, etc.) on Ethereum – the higher its market cap tends to grow. 👇

Here’s how treasuries can contribute to / take advantage of this flywheel:

Treasury companies hold $ETH → they put it into DeFi (earning yield) → this helps to lift $ETH’s market cap over time → they take out loans → buy more $ETH → repeat.

That same DeFi-powered flywheel of incentives on the Bitcoin network? 404 not found.

2/ This flywheel will only be compounded by the Genius Act & ETFs

Multiple ETFs are looking to add staking to their products – meanwhile, stablecoins just got the regulatory greenlight in the US thanks to the GENIUS Act (which should grow the sector).

DeFi growth + stablecoin growth across Ethereum = growth in $ETH’s market cap over time.

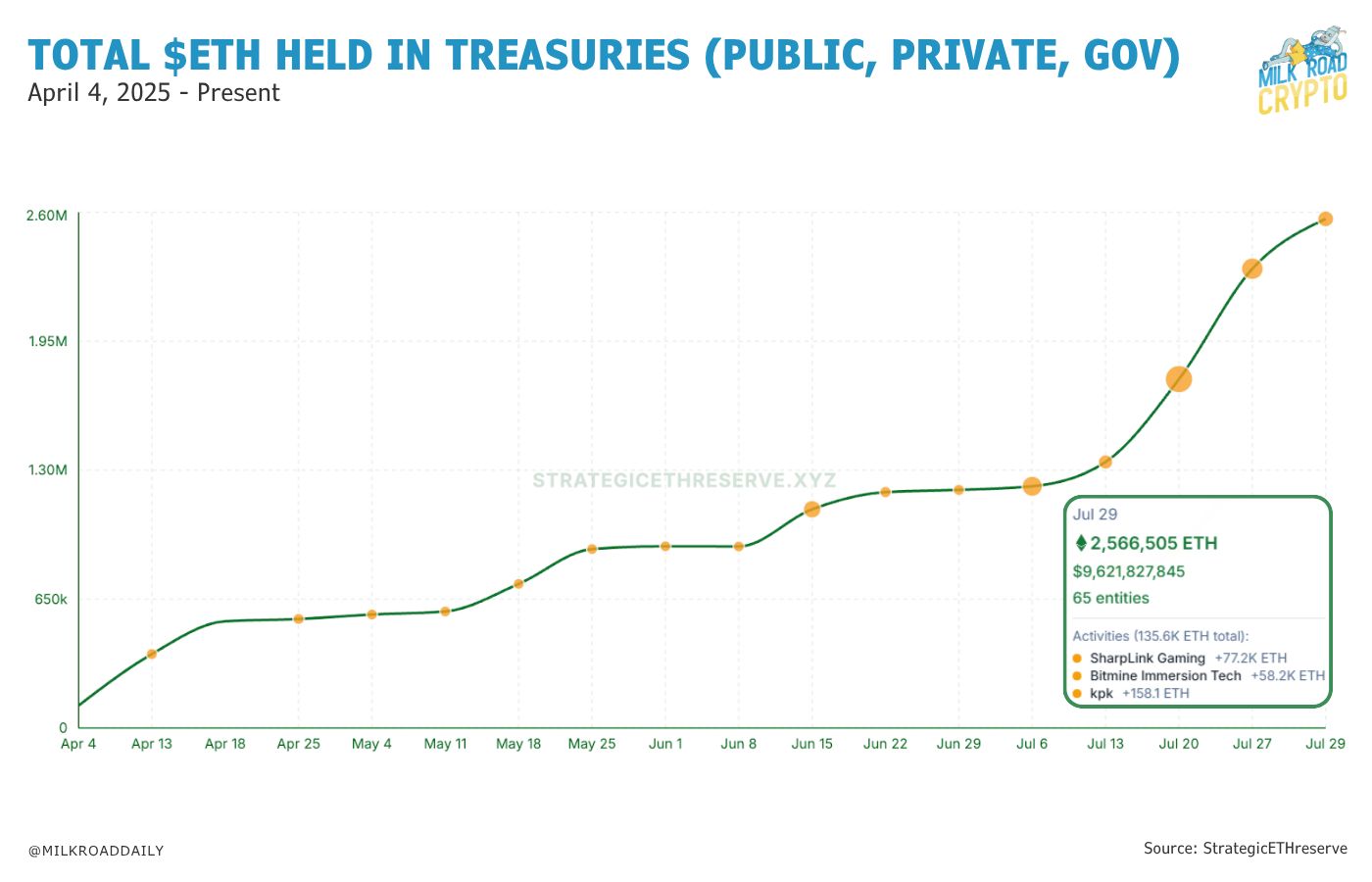

3/ The incentives are established…but the accumulation has just begun

There’s roughly $110B worth of Bitcoin sitting in public treasuries right now…

Meanwhile, all public, private, and government $ETH treasuries combined only hold a measly $9.6B.

The takeaway:

$ETH has a flywheel (fueled by DeFi and stablecoins) that Bitcoin can’t match – which we believe will help lead to $ETH becoming the dominant public crypto treasury asset.

And as it stands right now, the entire $ETH treasury space (public, private, government) is just 9% the size of public Bitcoin treasuries alone.

(That’s room to grow, and then some!)

Say it with me now:

“Still. So. Early.”

MILK ROAD PRO PORTFOLIO UPDATES 📊

TL;DR of today’s update:

We just added a new token to our watchlist (maaaan is it tempting us!)

And one of our portfolio tokens ripped 20% over the last 7 days

Wanna know what the tokens in question are? Go PRO and keep scrolling to find out. 👇

Disclosure: We are not a day trading portfolio so don’t expect a high volume of trades. Read our “How To Build a Crypto Portfolio” report to learn more about our portfolio strategy.

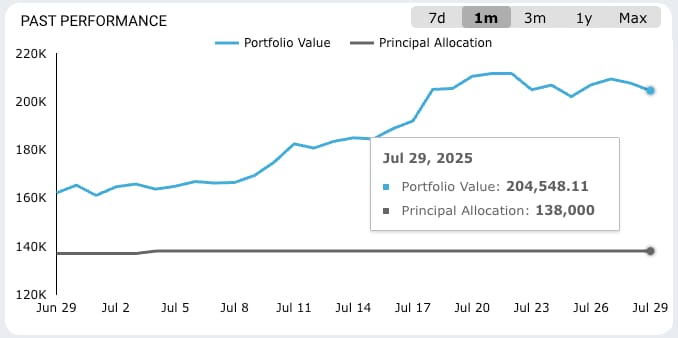

Portfolio performance 📉

The Milk Road PRO Portfolio saw a moderate decrease over the past 7 days. Our portfolio value is at $204.5K, down 2.93% since last week.

Portfolio prices are updated daily at 6:00 AM ET.

After a few strong weeks, we've given back some gains, but that’s not surprising. As we mentioned last week, a slowdown or minor correction was likely. Markets never move straight up.

That said, stock indices are still sitting near all-time highs, and there are no clear signs of a bear market. So the best move for now? Stay patient.

Portfolio changes 👀

The Milk Road PRO All Access Portfolio is exclusive to PRO All Access members.

Already a PRO All Access member? Log in here.

GO ALL ACCESS AND UNLOCK:

The Milk Road PRO All Access Portfolio — See what we’re investing in, how we’re allocating capital, and what actions we’re taking each week (buy, sell, hold, watchlist) ✅

Weekly “Where Are We In The Cycle?” Indicators — Signals that help you spot the market top before it’s too late 📈

Weekly Reports Across Crypto, Macro & Degen — Deep dives, token breakdowns, market analysis, and investframeworks that give you the edge 🧠

Access to the Milk Road Community — Full Discord access including signals, AMA invites, portfolio update calls, and exclusive All Access channels 💬

FREE Crypto Investing Masterclass — Included with all annual All Access subscriptions (30% off for monthly) 🎓

Already a PRO All Access member? Log in here.

PRO REVIEW OF THE WEEK

Wanna save on crypto taxes? We just dropped an article breaking down how investing through IRAfi can help you save big on taxes.*

*vacuum sound intensifies* — SharpLink Gaming bought $780M worth of Ethereum this month.

Mortgages…paid in crypto? This newly introduced bill wants to make crypto-backed mortgages an everyday option in the US.

The ‘tariff fog’ is slowly lifting. But our macro team sees a potential hit to US growth in the short-term…

Crypto cashback, baaaby! The Gemini Credit Card gives you 4% back on gas, 3% on dining, 2% on groceries and 1% on everything else.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY