- Milk Road Crypto

- Posts

- 🥛 Wait, are we bearish on the ETH ETFs? 😰

🥛 Wait, are we bearish on the ETH ETFs? 😰

PLUS: How Coinbase is fixing web1’s “402 error” ❌

GM. This is Milk Road, the newsletter that doubles as your own personal team of crypto obsessed researchers, tasked with hunting down daily insights.

Here’s what we got for you today:

✍️ $ETH ETFs vs. Treasuries

✍️ Coinbase is fixing the internet’s “402 error”

🥛 PRO “Where are we in the cycle?” indicators

🎙️ The Milk Road Show: Why Hyperliquid Could Flip Solana & Ethereum w/ Ryan Watkins

🍪 RWAs on ETH just hit $8B

Grayscale is the asset manager with 30+ different ways to invest in crypto. Explore all the funds offered by Grayscale.

$ETH ETFS WEREN’T THE UNLOCK, TREASURIES WERE 🔓

As of today, the $ETH ETFs have been live for a year!

(Happy birthday y’all 🥳)

Ok, now – lettuce bring the mood down real quick.

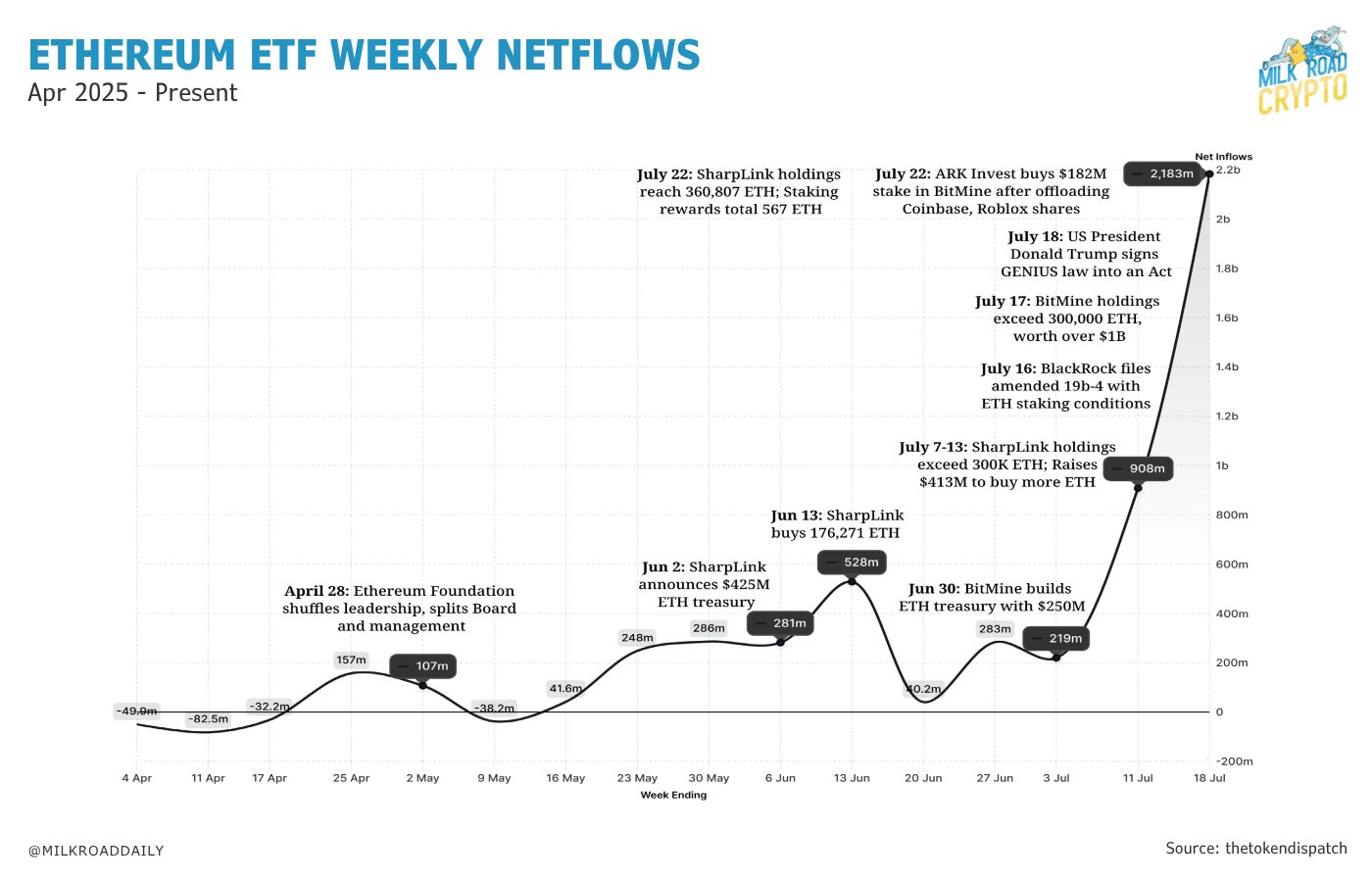

‘Cause we just found a chart that suggests the ETFs aren’t all they’ve cracked up to be.

We know, we know – feels weird, because it seems like institutional adoption of Ethereum has been hitting a new milestone every other day of late.

The thing is: it might not be the ETFs that unlocked these recent Ethereum institutional flows, as much as it was the rise of $ETH treasury companies.

(Aka: companies that hold/stake $ETH → take out loans → buy more $ETH → repeat.)

Check this out:

Of the 10 market-moving events listed on that chart, 7 of them are about (or involve) $ETH treasury companies.

And it kinda makes sense when you think about…

When the Ethereum ETFs launched, their closest comparison were the Bitcoin ETFs, which had been around all of 7 months (a blink of an eye and still very unproven in the eyes of institutions).

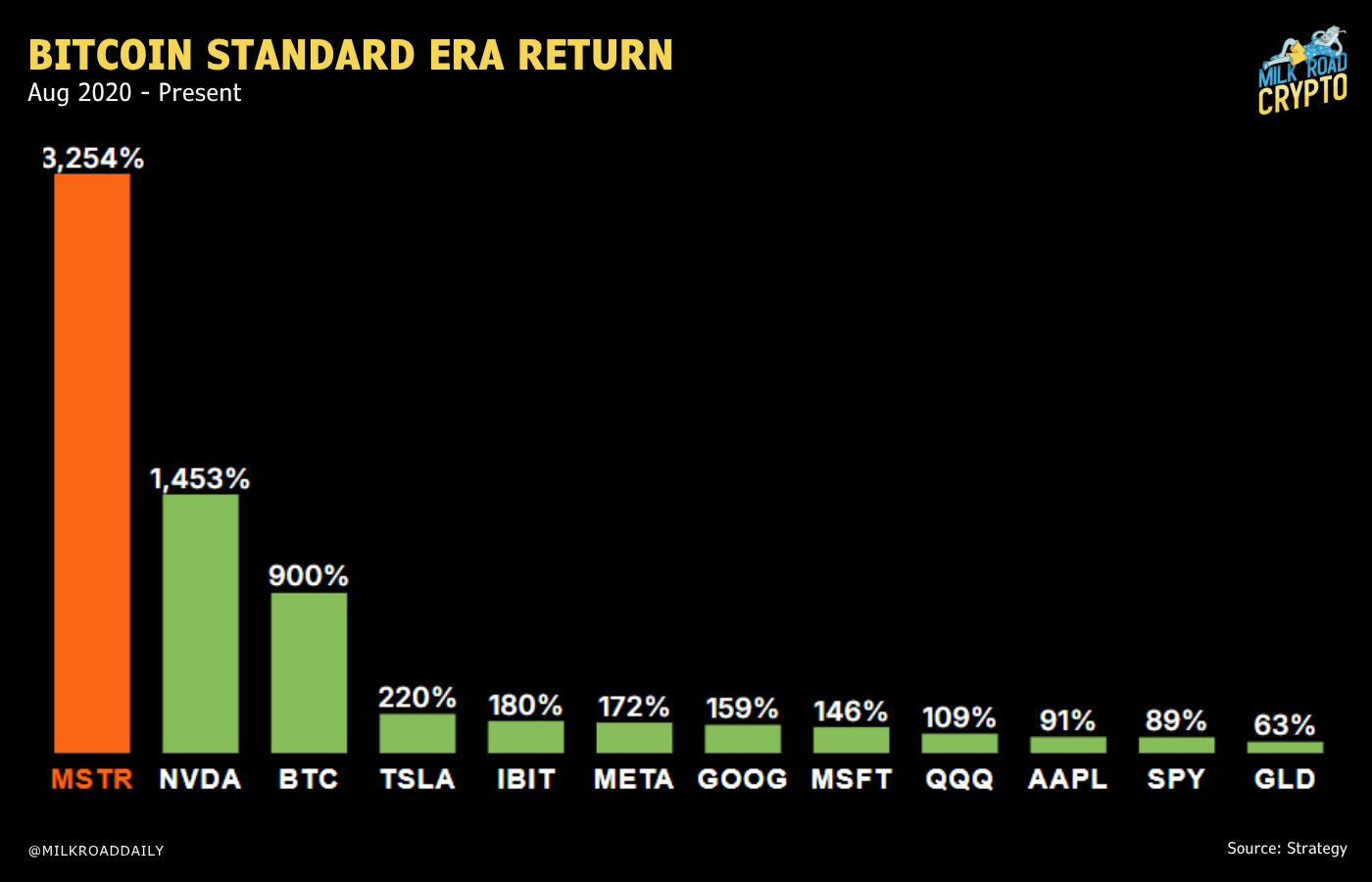

But $ETH treasury companies have Strategy (formerly MicroStrategy) to point to, which has ~5 years on the clock and is the best performing stock in that time period. 👇

(Yuh…hard to argue.)

The takeaway here:

TradFi understands the treasury model

They’ve seen what it can do, thanks to Saylor

And (judging from the violent uptick in flows of late) they’re buying in

P.S. I stole that last chart from this coming Saturday’s PRO report, which covers how to profit from $ETH treasury companies. Go PRO to get it straight to your inbox!

If you know crypto, you probably know Grayscale.

But did you know that Grayscale offers 30+ different crypto investment funds including:

Single asset funds (exposure to individual cryptocurrencies)

Diversified funds (exposure to multiple cryptocurrencies in one fund)

Thematic funds (exposure to themes like Bitcoin mining)

The best part about Grayscale’s products? You can invest in many of them through existing brokerage and tax-advantaged accounts like IRAs.

Investors have chosen Grayscale since 2013 - now it’s your turn.

Invest in your share of the future.

COINBASE IS FIXING THE INTERNET’S “402 ERROR” ❌

Early internet developers were smart cookies.

They foresaw a time when the internet would need an open/universal payments system, capable of supporting micro payments.

Now – that tech didn’t exist back in ‘97, so instead, the folks building out HTTP (a protocol that’s a backbone of the internet) put a placeholder for a future solution into their codebase.

But when you try to access this ‘placeholder’ function today, you tend to get a “402 Payment Required” error, because this universal payment system still doesn’t exist.

Or at least…it didn’t.

“Ok…that’s cool and all – but this ain’t 1997. We have a wide range of online payment providers. Feels like the problem is solved, no?” – You, probably.

Kinda. But it’s actually the range that is the issue here – none of it is universal.

If a human, app, or AI agent wants to request access to a paid resource (e.g. a tool, data resource, or content), they need to play nice with that site's combination of payment systems.

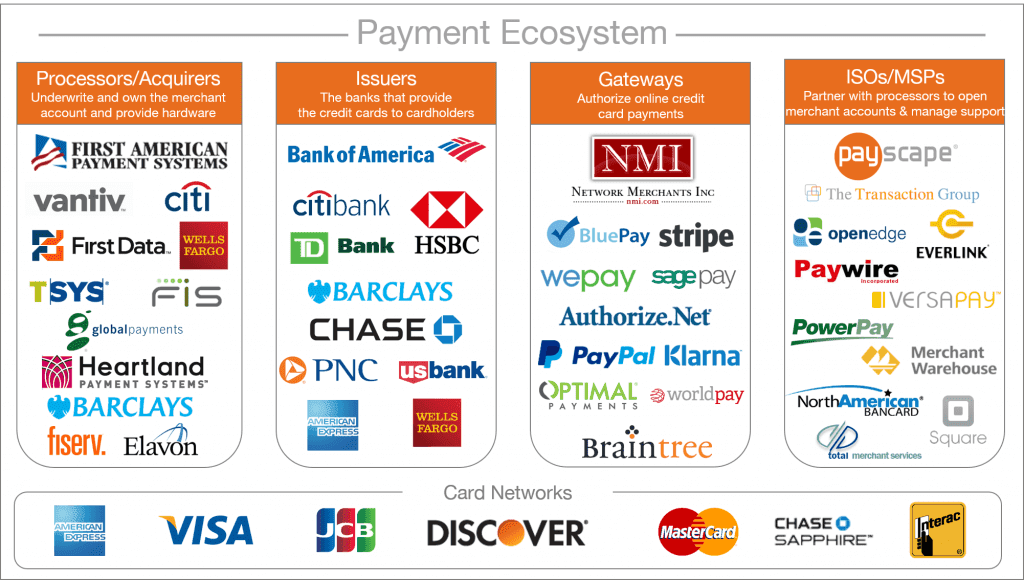

I.e. Any handful of these (and/or more):

It’s kinda like the internet-equivalent of having a different style of power socket for every city in the world vs. a universal standard for each global region (US, EU, UK, etc.)

Which, in a world where AI agents are a thing, is an issue – not just in compatibility, but cost.

Most payment providers charge merchants ~3% + $0.30 per transaction, a cost that will need to be passed on to consumers when micropayments (think: ~$0.01) are being made.

(Increasing the cost to the end user by ~31x in this example.)

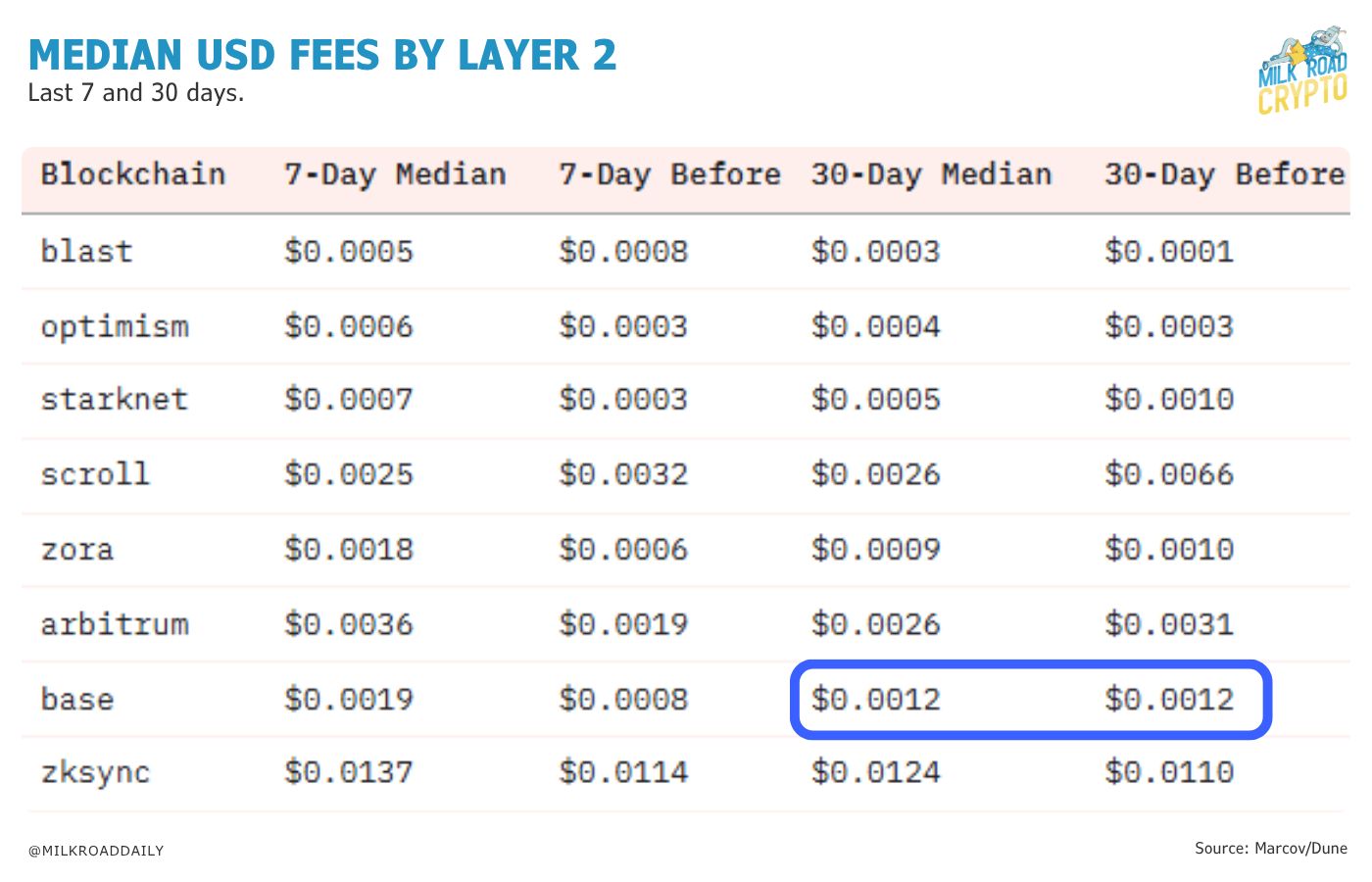

Today, Coinbase can facilitate near-instant $USDC payments for roughly 1/10th of a cent, MASSIVELY reducing these fees. 👇

And now, they’re trying to make this payment system a standard across the internet.

…all developers need to do to integrate it is add a single line of code to their site/app.

(Can I get a “hooooiii yeeauh!”)

PRO “WHERE ARE WE IN THE CYCLE?” INDICATORS 🤔

In the past two weeks, we’ve seen risk-on behavior rip up n’ to the right.

…but how long can it sustain this run? To answer that, we should check in with the crypto cycle indicators.

‘Cause knowing where we are in the crypto cycle is crucial for capturing the best opportunities.

The goal is to spot the bull market peak before the inevitable bear market hits your bags hard.

Since timing the top perfectly is almost impossible, we use various indicators to give us a better shot at taking profits before it's too late.

Below are the 6 indicators we track, with a color-coded system to show how close they are to signalling the market peak:

🟢 Plenty of room to run 🏄

🟡 Getting closer to the top signal, but haven’t yet reached the mark ⚠️

🔴 We’ve hit the market top indicator 🚨

Every Thursday, we update these 6 indicators exclusively for PRO members.

Our advice? Don't wait for all of them to hit 🔴. It's better to take profits as they get closer to that point.

Let's dive in and see if we're anywhere near the top of this bull market. 👇

Already a PRO member? Log in here.

GO PRO AND UNLOCK:

Full access to the 6 bull market peak indicators above to help you spot the bull market top before it’s too late 📈

Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. 🫂

Already a PRO member? Log in here.

PRO REVIEW OF THE WEEK

Are fan tokens the next big thing? Our article covers why Chilliz’s fan tokens could be a game-changer for sports fans around the world.*

ZORA surged over 80% after its integration with the Base App — which lets users mint and trade “creator coins” from social posts.

Where to from here? The 17 most important charts our Milk Road Macro team are looking at right now.

RWAs on $ETH just hit $8B! And that’s up from ~$2B in March…this market is heating UP!

Crypto cashback, baaaby! The Gemini Credit Card gives you 4% back on gas, 3% on dining, 2% on groceries and 1% on everything else.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY