- Milk Road Crypto

- Posts

- 🥛 Uh oh. Should we be worried? 😰

🥛 Uh oh. Should we be worried? 😰

Prices are stagnating...

GM. This is Milk Road, the daily read that’s like stepping into an air-conditioned room on a hot summer's day.

(“Ahhh, this is what I needed!”)

Here’s what we got for you today:

✍️ Should we be worried about this price stagnation?

🥛 PRO “Where are we in the cycle?” indicators

🎙️ The Milk Road Show: Mark Yusko Reveals How to Build a Bulletproof Crypto Investment Portfolio

🍪 The Circle IPO is official! The ticker is $CRCL.

Today’s edition is brought to you by Mezo - unlock stablecoins like $MUSD using your Bitcoin, without triggering taxes. Borrow $MUSD with Mezo

SHOULD WE BE WORRIED ABOUT THIS PRICE STAGNATION? 🤔

“I’m fine” often translates to “I’m not ok, something’s wrong.”

I said it right after I was hit by a Sprinter van in ‘07

My ex-girlfriend said it to me in the lead up to our split

And my dad said it after the Eagles lost the Super Bowl in 2023

All of which were veiled cries for help.

And I have an inkling that’s why we all freak out in times like this – when the crypto market is ‘doing fine’ and grinding sideways (we think something’s wrong.)

In this particular case, that might be a bit of a misconception – ‘cause right now, many of crypto’s vital signs are looking reeeal goood!

Check this out…

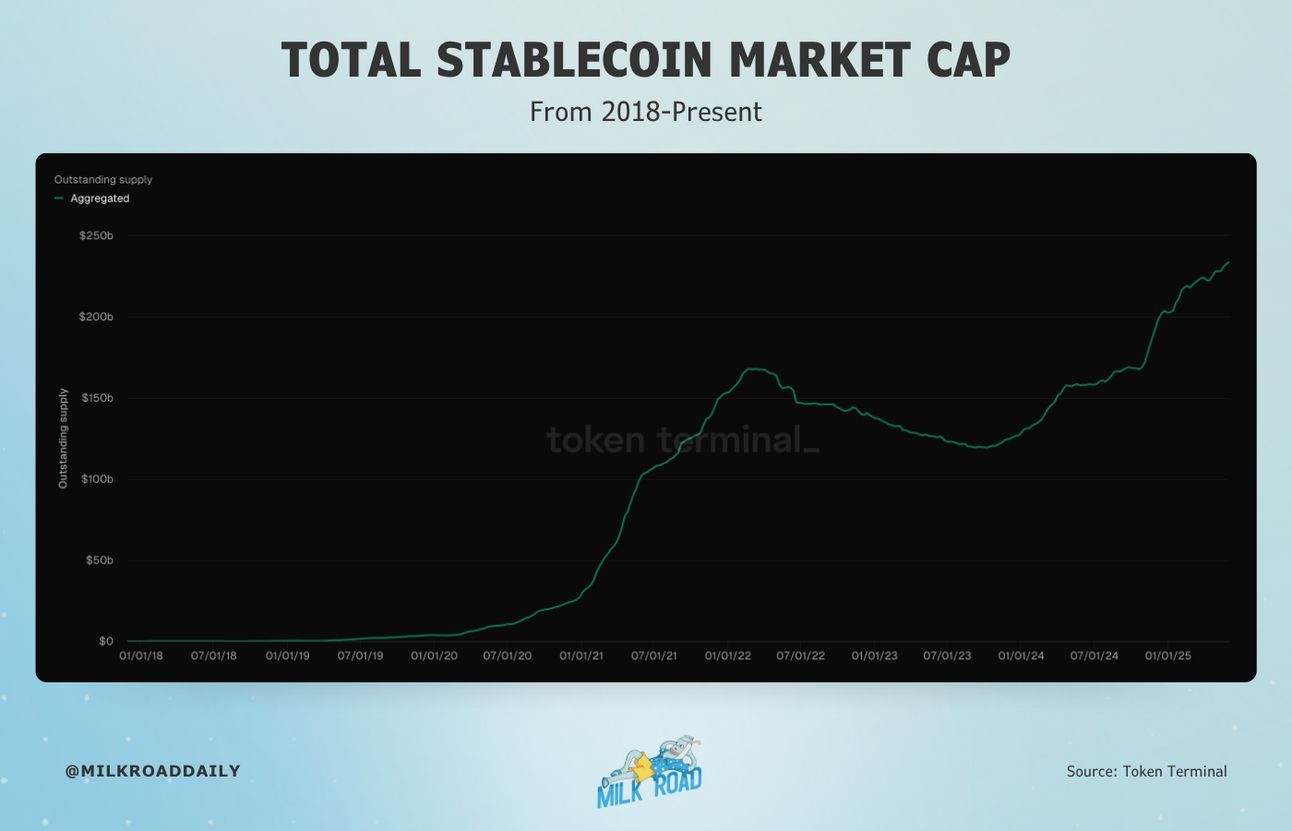

1/ Stablecoin supply: all-time highs (ATHs)

Most onchain activities are going to require stablecoins at some point.

So if stablecoin supply is growing → crypto is growing.

And over the last 365 days, the overall stablecoin supply has increased by ~$80B – recently hitting ATHs of $240B!

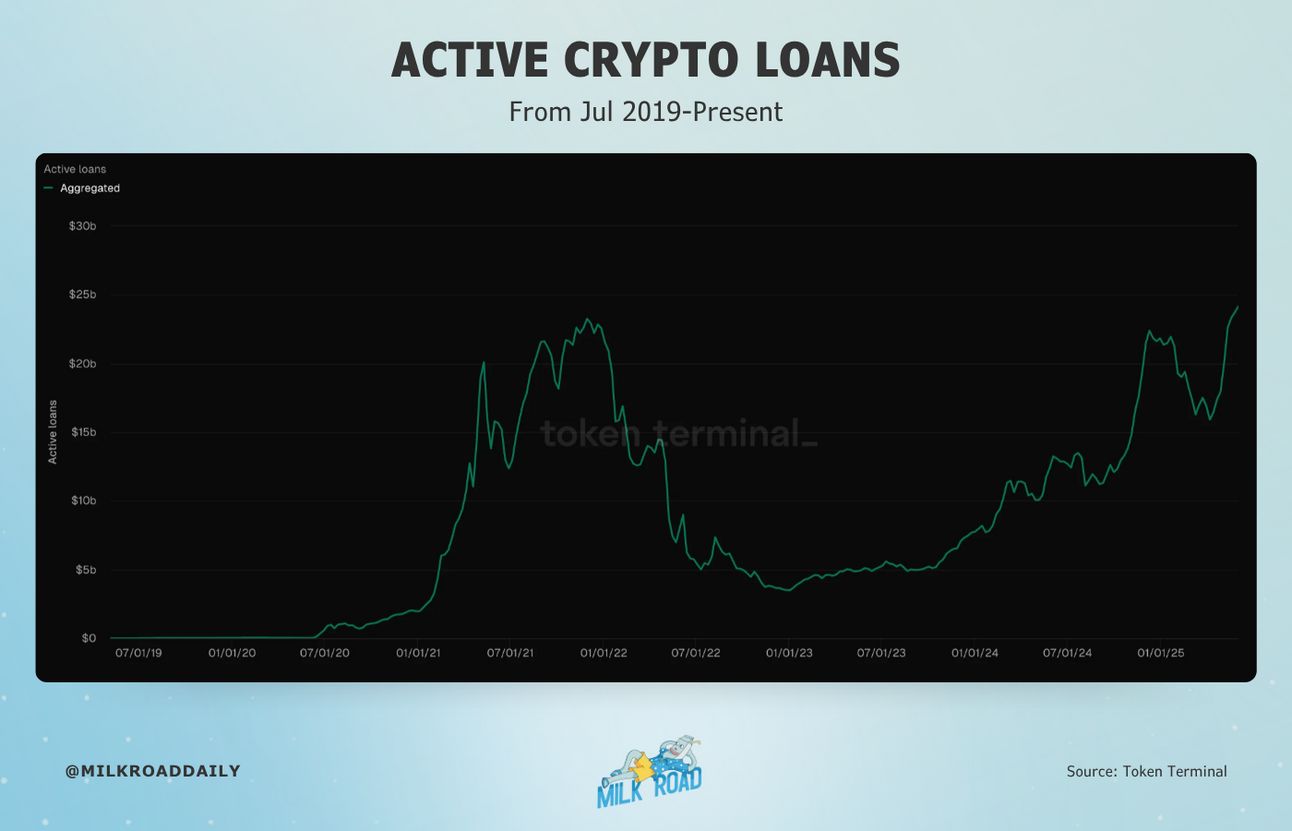

2/ Active Loans: all-time highs

How important are loans in a financial ecosystem? Lemme answer your question with another question…

Can you imagine what would happen if loans and credit ceased to exist? Entire industries would collapse (think: real estate, retail, banking.).

Point is: lending is the lifeblood of any financial ecosystem.

And right now, loans are at all-time highs, with over $24B being lent out onchain (a stat that has been pretty much up only since Jan '23.)

Still not convinced the market is genuinely ‘fine’?

Keep scrolling to the next article. We have two more key factors to calm your nerves…

Let me hit you with a quick ‘Tax 101’ lesson:

If you sell your $BTC or swap it for a stablecoin, you will have to pay capital gains tax.

BUT…

If you borrow a stablecoin (like $MUSD) against your Bitcoin? No tax owed.

Sound confusing? Let’s break it down:

Head to Mezo Borrow

Deposit your $BTC

Borrow $MUSD (Mezo’s stablecoin) using $BTC as collateral

Boom. You’ve just accessed liquidity without selling your Bitcoin and without triggering taxes.

Stack $MUSD, not tax bills.

Disclaimer: The information provided on this newsletter is for general informational purposes only. It does not constitute, and should not be considered, legal, tax or investment advice, or other type of advice. Consult with a qualified professional if in need of such advice.

SHOULD WE BE WORRIED ABOUT THIS PRICE STAGNATION? (P2) 🤔

Crypto is its own asset class.

…and what do we do with assets? We trade ‘em baaaaby!

Which makes this next data point a solid ‘crypto vital sign.’

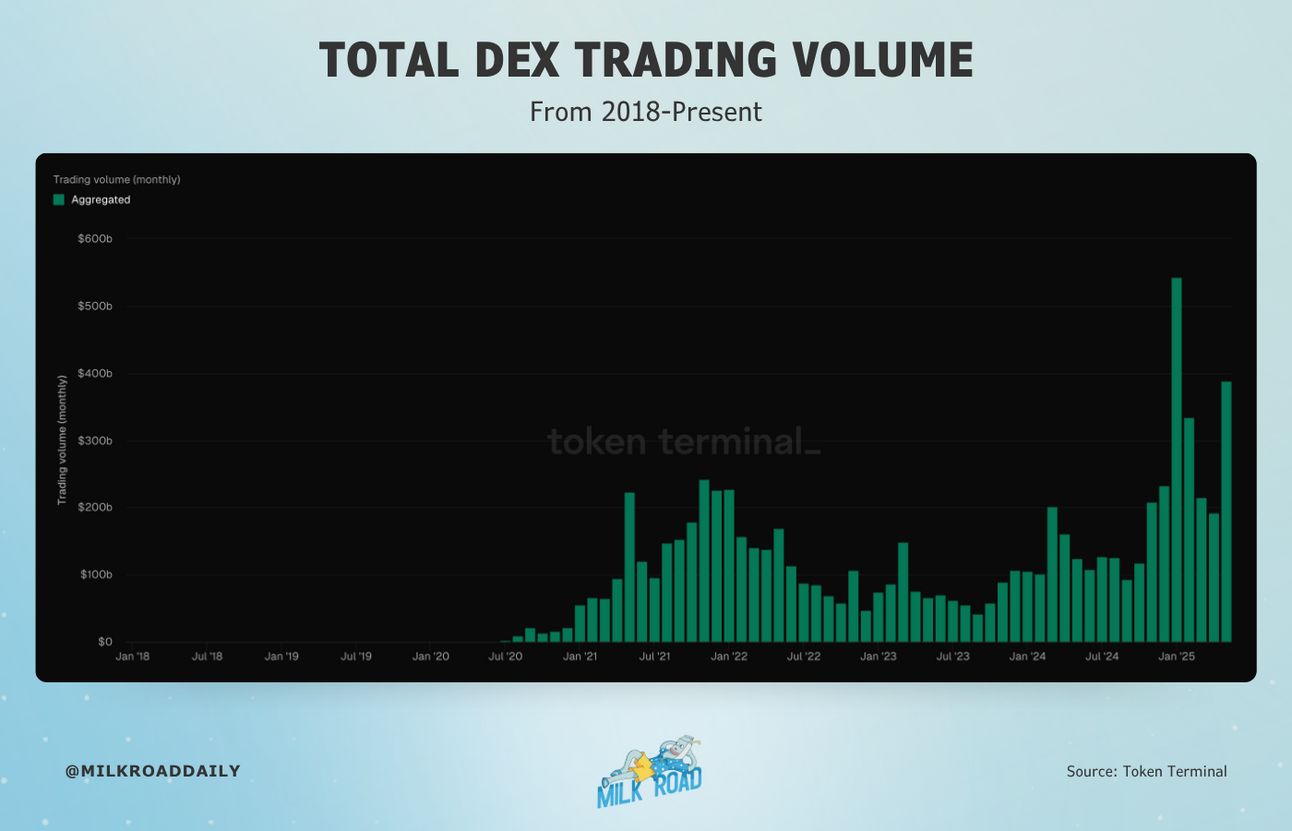

3/ Decentralized Exchange (DEX) Trading Volumes: not all-time, but still high!

The total monthly DEX volume is at ~$388B – the second highest on record.

And if you REALLY wanted to massage the numbers, you could claim January’s massive outperformance was skewed by the $TRUMP token launch…

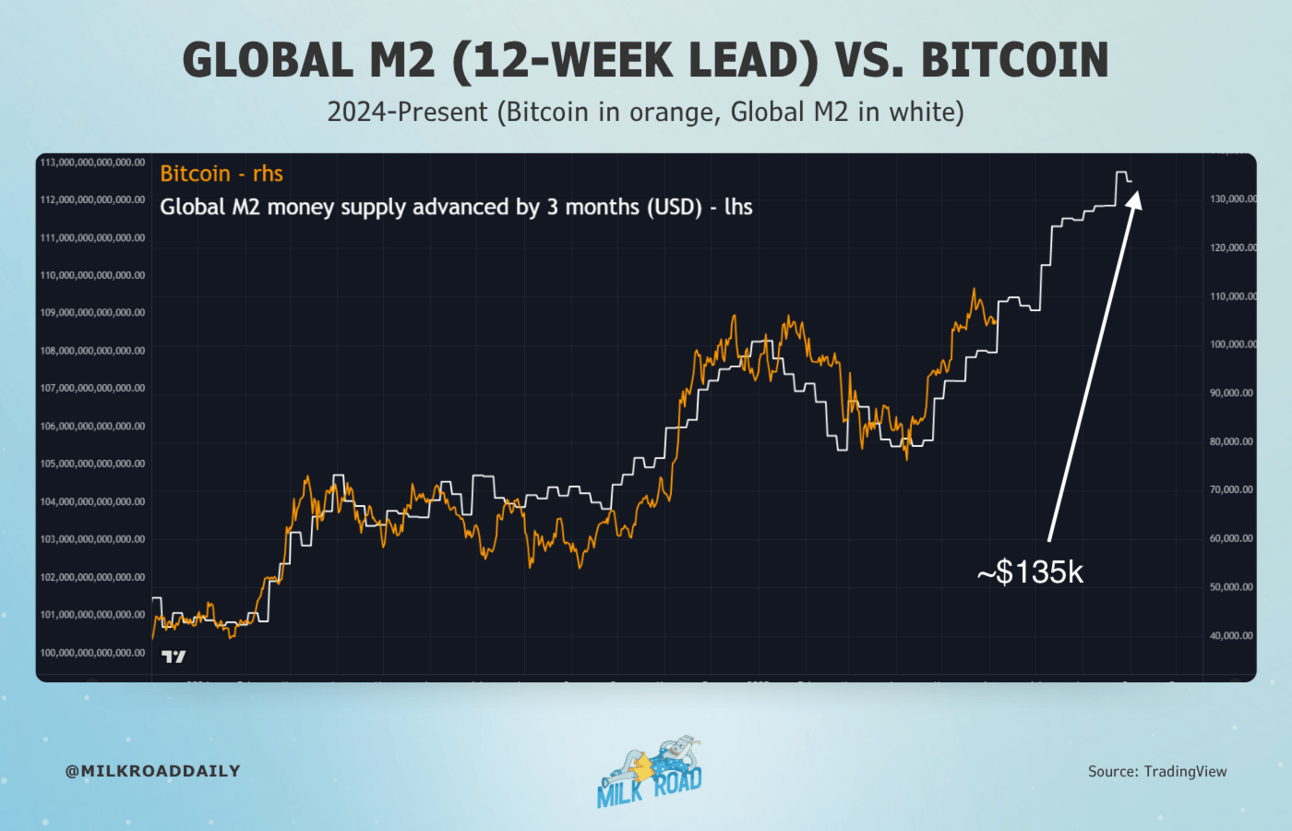

4/ Global M2: all-time highs

Global M2 = the amount of money that’s in circulation, checkable deposits, time deposits, savings deposits, and money market funds around the world.

And on average, changes in Global M2 tend to be reflected in Bitcoin (and the broader crypto market) 12 weeks later.

Now – check where Global M2 is hinting Bitcoin will go next…

If the correlation holds, we’re looking at a ~$135k Bitcoin by September!

Ok, now – a few takeaways/notes…

First: crypto is doing just fine for now (no, really – it’s good.)

Second: if you’re going to track any metric to gauge the current/near-term health of the crypto market – it should be global liquidity (which M2 makes up a part of.)

Good news is – if you want the full ‘global liquidity picture’ painted for you, we track it all in a single chart, and drop it here every Thursday.

To see it, all you need to do is go PRO and keep scrolling!

(Oh, and if you upgrade in the next 20hrs, you’ll get our limited edition Pullback Survivor Tee, free!)

PRO “WHERE ARE WE IN THE CYCLE?” INDICATORS 🤔

The liquidity chart we referenced in the last article? This is where you get it!

What’s better is – it’s one of six indicators we use to make sure you can capture the best opportunities in the current market.

The goal is to spot the bull market peak before the inevitable bear market hits your bags hard.

But since timing the top perfectly is almost impossible, we use various indicators to give us a better shot at taking profits before it's too late.

Here are the 6 indicators we track, with a color-coded system to show how close they are to signaling the market peak:

🟢 Plenty of room to run 🏄

🟡 Getting closer to the top signal, but haven’t yet reached the mark ⚠️

🔴 We’ve hit the market top indicator 🚨

Every Thursday, we update these 6 indicators exclusively for PRO members.

Our advice? Don't wait for all of them to hit 🔴. It's better to take profits as they get closer to that point.

Let's dive in and see if we're anywhere near the top of this bull market. 👇

Already a PRO member? Log in here.

GO PRO AND UNLOCK:

Full access to the 6 bull market peak indicators above to help you spot the bull market top before it’s too late 📈

The Milk Road PRO Portfolio, our yield strategies & weekly updates to help you manage investments, allocate capital, take profits, and stay ahead in crypto 📊

Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. Don’t miss the monthly live events! 🫂

Half Off the Crypto Investing Masterclass 📚️

Already a PRO member? Log in here.

PRO REVIEW OF THE WEEK

Bitget is going after the big boys. They’ve launched an incentive program for institutions, making it one of the cheapest places to trade in crypto right now.*

The European Central Bank just cut rates for the 8th time. Their interest rates are now at the lowest level since early 2023.

The Circle IPO is official! In case you missed it, the ticker is $CRCL.

The most anti-crypto bank is opening up to crypto? JPMorgan is considering letting clients use crypto as loan collateral. Big shift in their stance.

Why did markets dip last week? Our latest Milk Road Macro edition breaks down what happened and how to spot it next time. It’s a killer read!

Wanna work for Milk Road? We’re hiring across multiple roles — click here and drop us a line!

Invest as you spend with the Gemini Credit Card®. Get approved by 6/30/25 to earn $200 in Bitcoin when you spend $3,000 in your first 90 days. Issued by WebBank. Terms apply.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

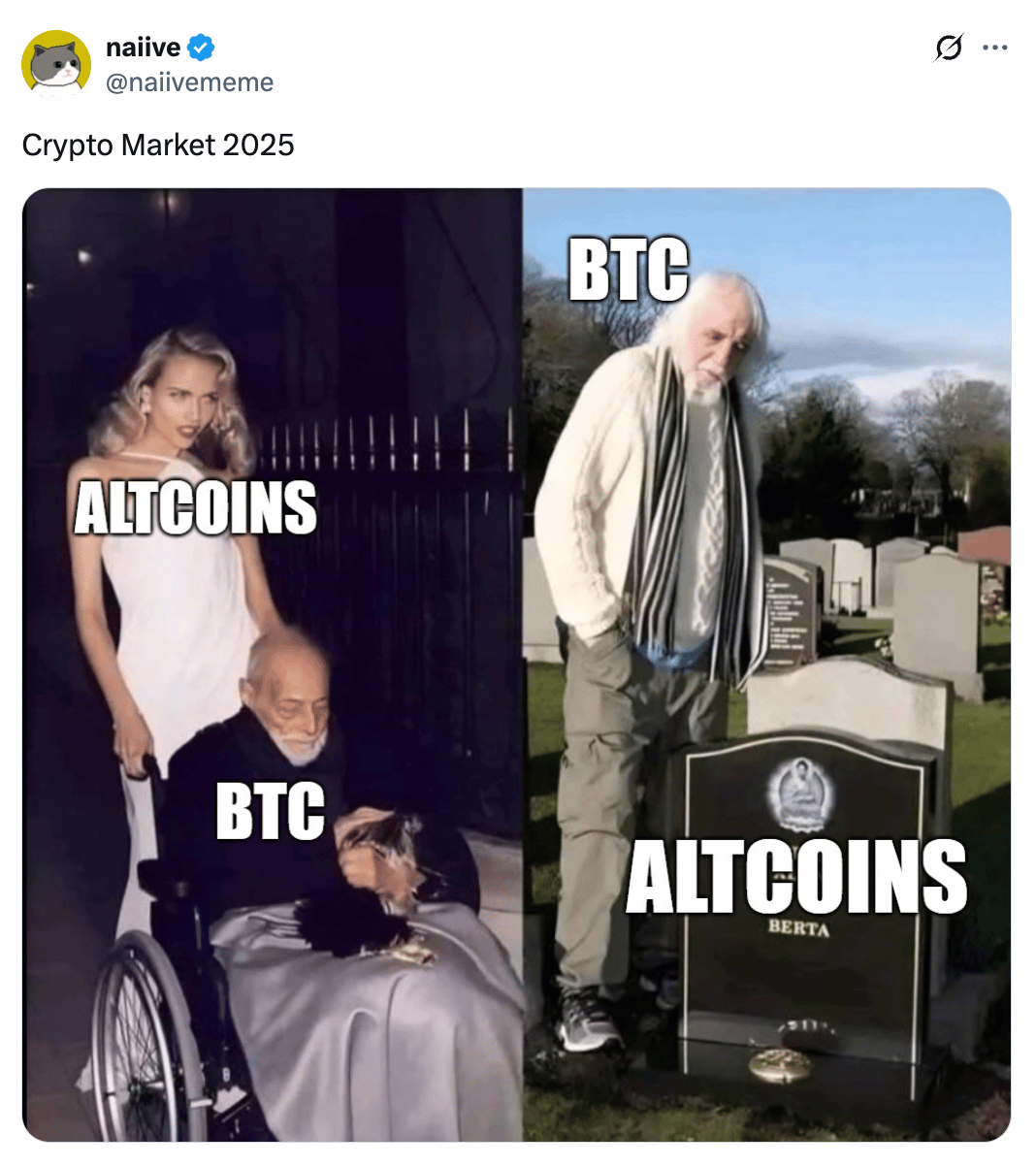

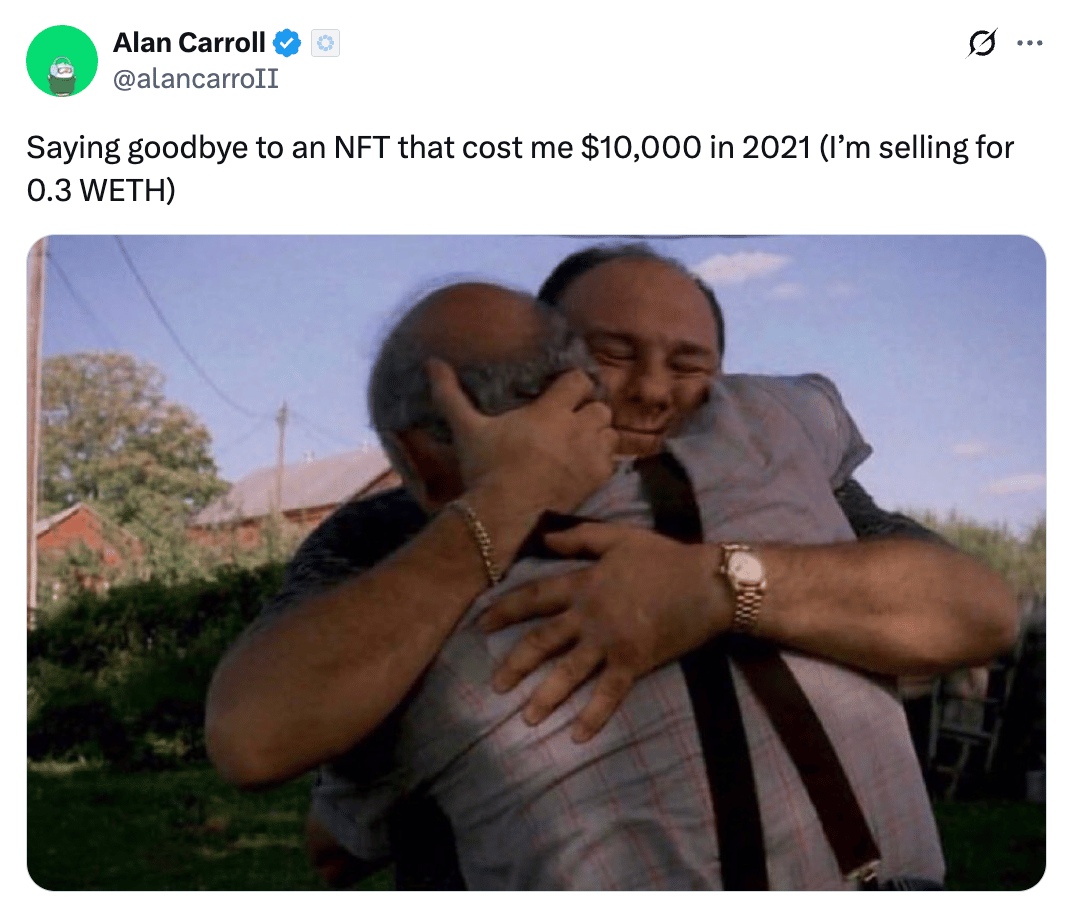

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY