- Milk Road Crypto

- Posts

- 🥛 The Base App vs. PumpFun 🥊

🥛 The Base App vs. PumpFun 🥊

Data showdown! 👀

GM. This is Milk Road – the newsletter so thick with sauce you might as well call us carbonara.

Here’s what we got for you today:

✍️ The Base App vs. PumpFun

✍️ BlackRock is getting its employees poached

🎙️ The Milk Road Show: Why Ethereum Treasury Companies Will Send $ETH to $10k in 2025 w/ Charles Allen CEO of BTCS

🍪 Is the 4-year cycle dead?

Babbel helps you master new languages quickly with fun, interactive lessons designed for real-life conversations. Grab lifetime access for just $239.

THE BASE APP VS. PUMPFUN (DATA SHOWDOWN) 🥊

We recently saw MASSIVE pushes towards onchain social, by two of the biggest names in the space…

And we’re excited about them both! But for two very different reasons…

PumpFun because of its big/new idea – adding social features to an app that doesn’t look/feel anything like a traditional social feed.

The Base App because of its distribution power – a familiar looking social feed, but with the backing of Coinbase’s MASSIVE existing user base.

So which one is winning out so far – the big new idea, or the distribution powerhouse?

Here are some stats on each platform before each respective announcement (the first week of July) vs. the week of/following each announcement (July 14-20). 👇

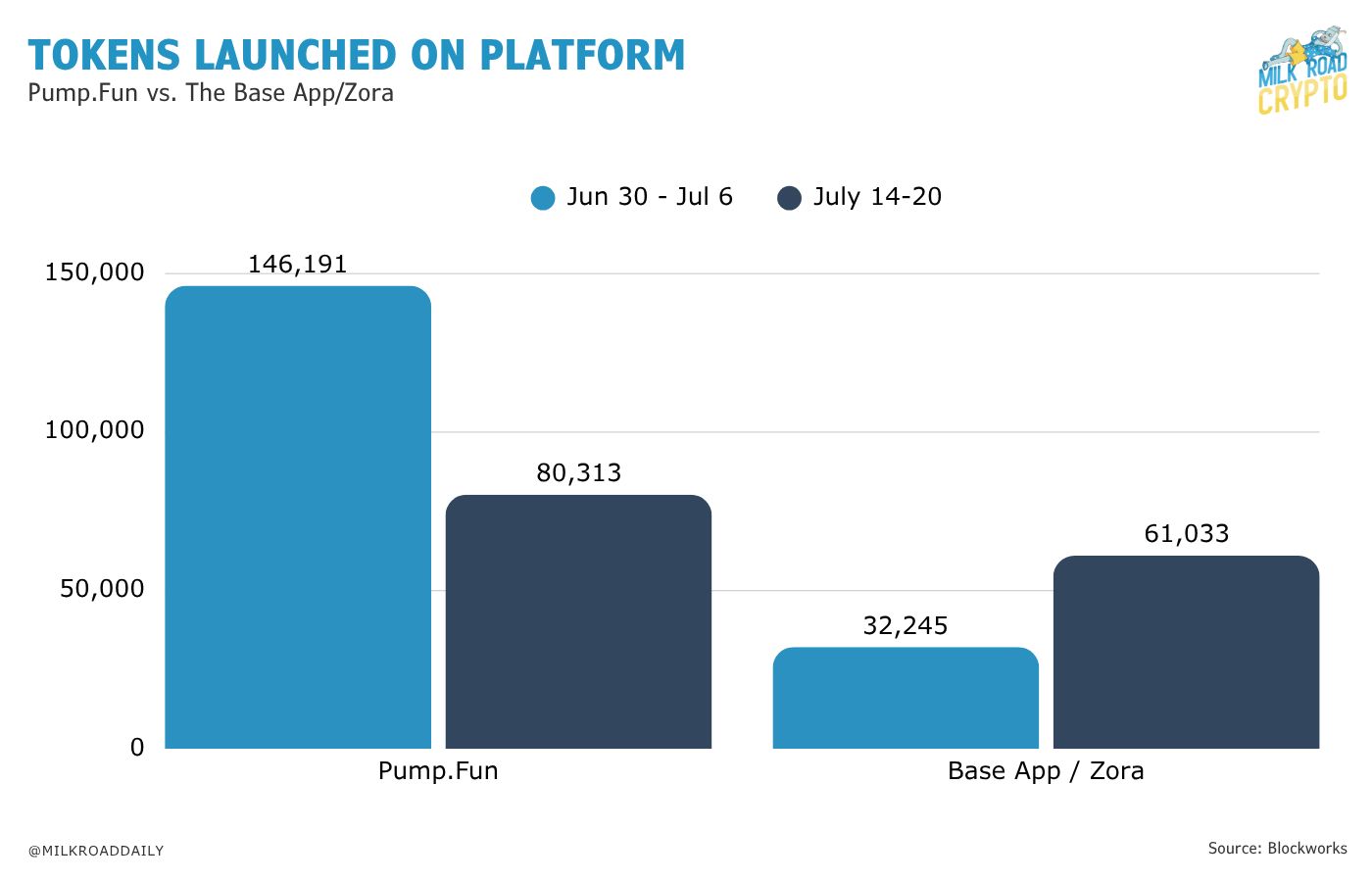

1/ Tokens launched on platform 🚀

PumpFun is pulling the hard numbers – but it’s The Base App/Zora that are leading in growth.

The weekly amount of tokens launched on PumpFun fell ~45% after its $PUMP launch & social rebrand.

Meanwhile, The Base App/Zora ripped ~89%. 👇

Note: The Base App social feed and Zora’s native app currently share the load of users with a ~50/50 split, so not ALL glory be unto Coinbase here.

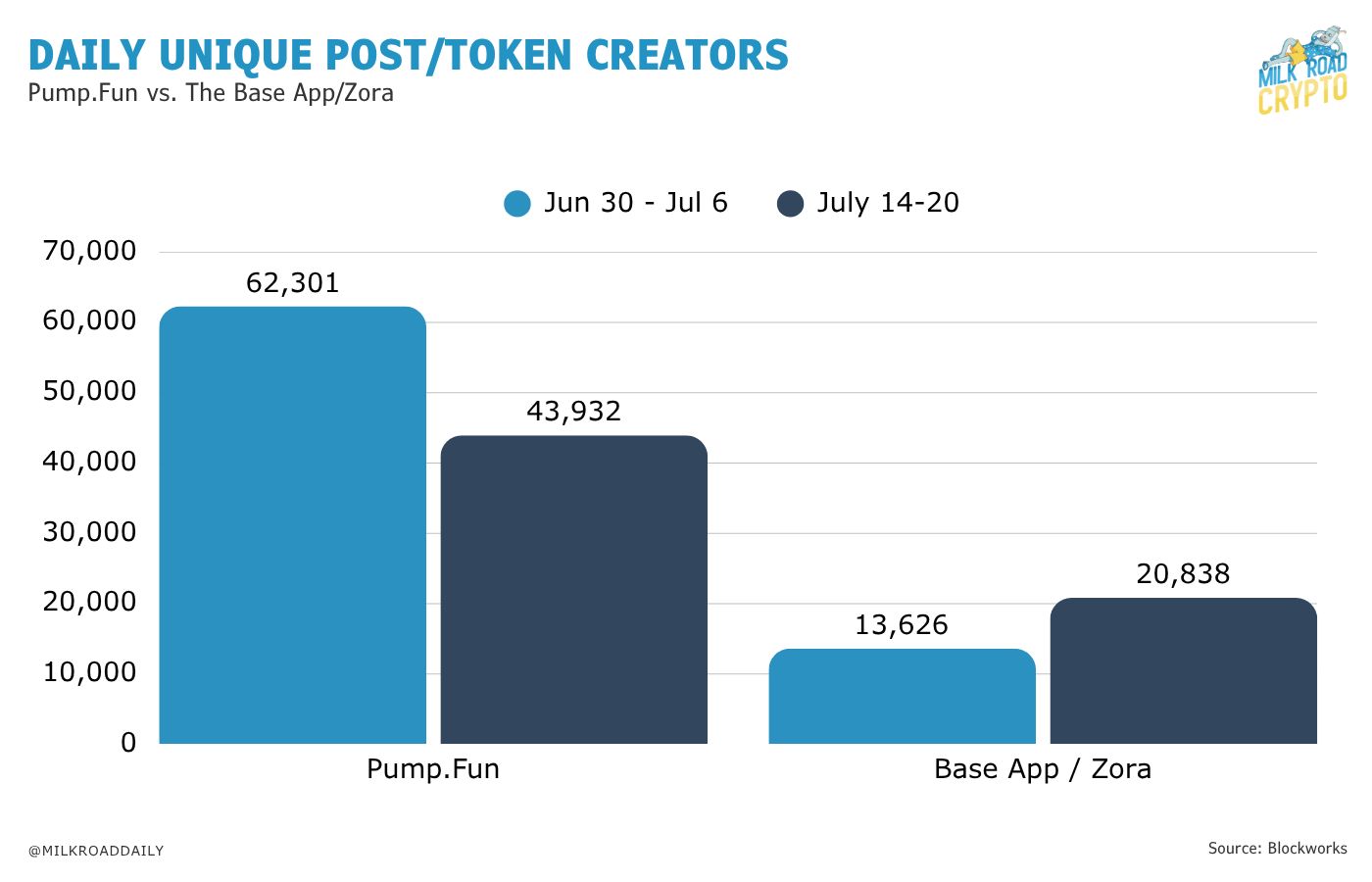

2/ Daily unique posters/token creators 🚀

On PumpFun, you create tokens (simple as that).

On The Base App, you post content → that content has a token associated with it.

And the changes here seem to mimic the ‘tokens launched’ data…PumpFun is still winning in raw output, but The Base App/Zora is rinsing the growth stats.

Daily unique creators fell ~29% on PumpFun, while The Base App/Zora grew ~53%. 👇

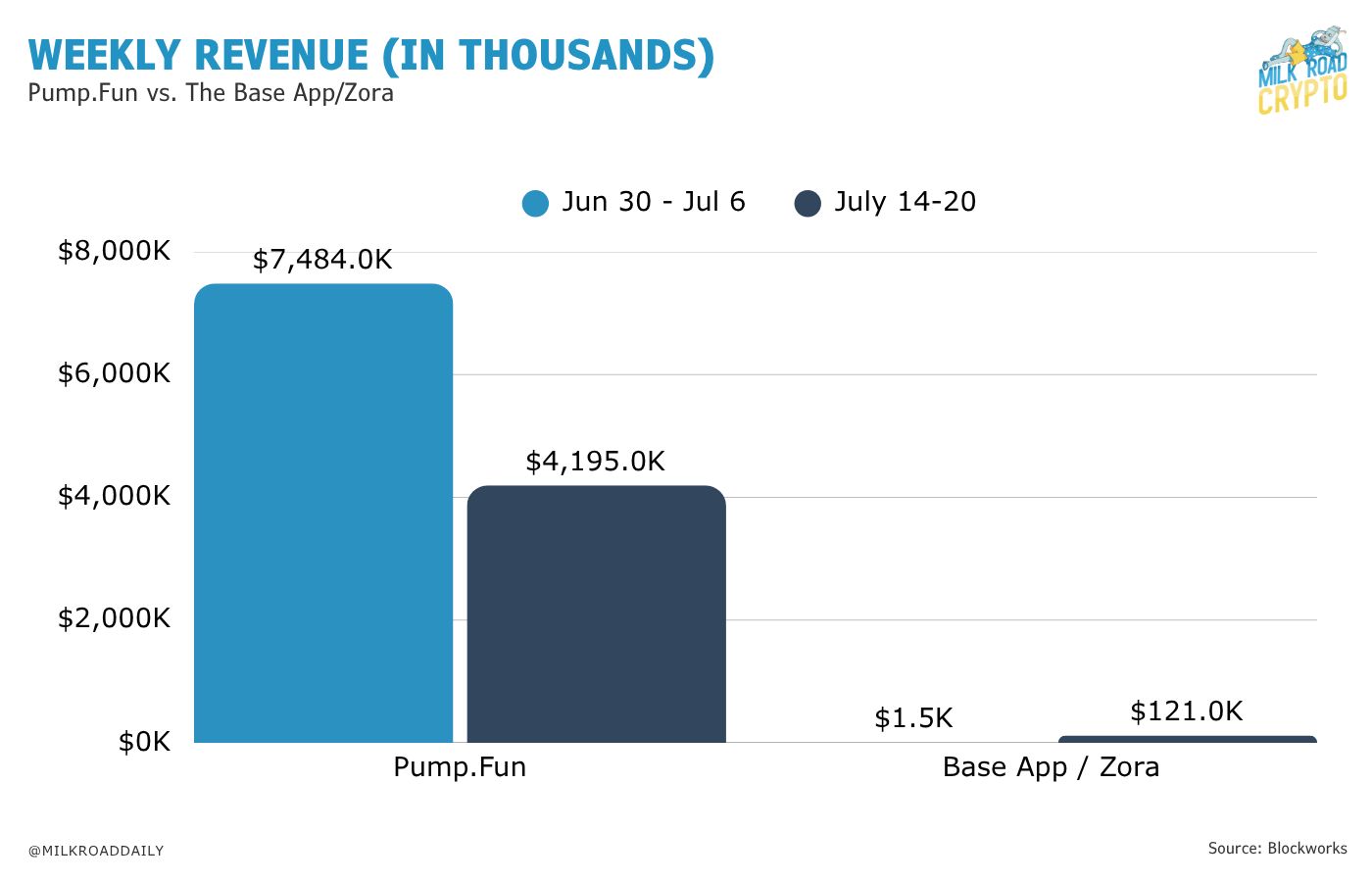

3/ Revenue 💰

Ok. ‘Strength in raw numbers’ doesn’t even begin to describe the lead PumpFun has here…

~$7.4M to $4.1M per week, compared to The Base App/Zora’s $1.5k to $121k.

But again, The Base App/Zora are showing post-announcement growth vs. PumpFun’s decline (7,966% vs. -44%). 👇

The throughline here:

When comparing pre/post announcement numbers, The Base App/Zora are winning in growth across the board.

BUT!

They’re going to need it – and then some, if they want to catch up to Pump.

‘Cause together, The Base App/Zora made an average of ~$2 in revenue, per post token launched across their combined feeds last week.

While PumpFun is raking in ~$93 for every token launched on its platform.

(That’s a ~46x difference.)

We’ll be keeping our eyes peeled for any further changes in this data once The Base App moves out of early access/into full public release.

And, of course, we’ll report any interesting changes here. 🫡

Traveling this summer? Need to pick up a new language fast? Headed somewhere that doesn’t speak “point and gesture”?

With Babbel, you can start having real conversations in as little as three weeks.

Whether you're beachside, 30,000 feet in the air, or café-hopping abroad, Babbel’s bite-sized daily lessons go wherever you do.

Here’s why Babbel works:

No expensive classes

No gimmicky gamified apps

Just expert-crafted lessons designed to help you speak confidently

And right now, for Babbel’s birthday sale, you can get lifetime access for just $239.

NEW TREND? CRYPTO COMPANIES POACHING FROM BLACKROCK 🪤

Get this…

The guy behind BlackRock’s $BTC ETF, $ETH ETF, and BUIDL fund (a tokenized fund, built on Ethereum), is leaving to become Co-CEO over at SharpLink Gaming, aka: $SBET.

(One of the world’s biggest Ethereum treasury companies.)

Moving from the ETF space to a straight up DeFi proxy? That’s the TradFi equivalent of a degen move right there! (We love to see it.)

His battle cry leading into this new role:

“Stablecoins, tokenized assets, AI agents, are all moving onchain.

And it’s happening on Ethereum.

That’s where the future is being built.

We’re [$SBET] building a bridge between institutional capital and Ethereum-native yield, packaged in a single public equity.”

(Chills, literal chills.)

But you know what?

$SBET ain’t the only ones poaching VPs from the world’s largest asset manager…

We just convinced former BlackRock macro and digital asset research lead, John Gillen, to come and host the Milk Road Macro podcast – full time!

(Yeah, I dunno how we managed it either – he must have lost a bet w/ our CEO or something.)

So it’s probably wise to subscribe to our brand new Milk Road Macro YouTube channel and turn on notifications, so you don’t miss any episodes.

(You know, before John figures out what he’s gotten himself into.) 😂

Wanna save on crypto taxes? We just dropped an article breaking down how investing through IRAfi can help you save big on taxes.*

The market is getting a little rich in potassium, no? The Ethereum treasury company, GameSquare, just bought a Crypto Punk.

Is the 4-year cycle dead? Analysts from Bitwise and CryptoQuant believe it is.

Another win for BlackRock/Ethereum! Blackrock’s $ETH ETF just became the third fastest ETF to hit $10B in assets (ever).

Water is wet, the sky is blue. Saylor will hold more Bitcoin than you. $MSTR just upped their latest raise to $2.5B.

Crypto cashback, baaaby! The Gemini Credit Card gives you 4% back on gas, 3% on dining, 2% on groceries and 1% on everything else.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY