- Milk Road Crypto

- Posts

- 🥛 SOL Treasuries: your next move? 🤔

🥛 SOL Treasuries: your next move? 🤔

PLUS: Confusing metric → bullish signal! 📈

GM. This is Milk Road, your 'crypto lifeguard' – here to save you from drowning in information overload.

(*blows whistle* no roughhousing in the pool!)

Here’s what we got for you today:

✍️ Ranking $SOL treasury companies

✍️ $BTC hashrate hits new ATHs

🥛 Milk Road PRO Portfolio updates

🎙️ The Milk Road Show: Surviving the Liquidity Crisis: Everything You Need to Navigate This Cycle w/ Michael Howell

🍪 This new US jobs data is rough

Bitget is one of the fastest growing centralized exchanges. Sign up to Bitget and access the platform.

COTD: RANKING $SOL TREASURY COMPANIES BY PREMIUMS 📊

Fun fact, if you’re in our Telegram group, you can just, you know – ask us things.

For example:

Well – ask and you shall receive.

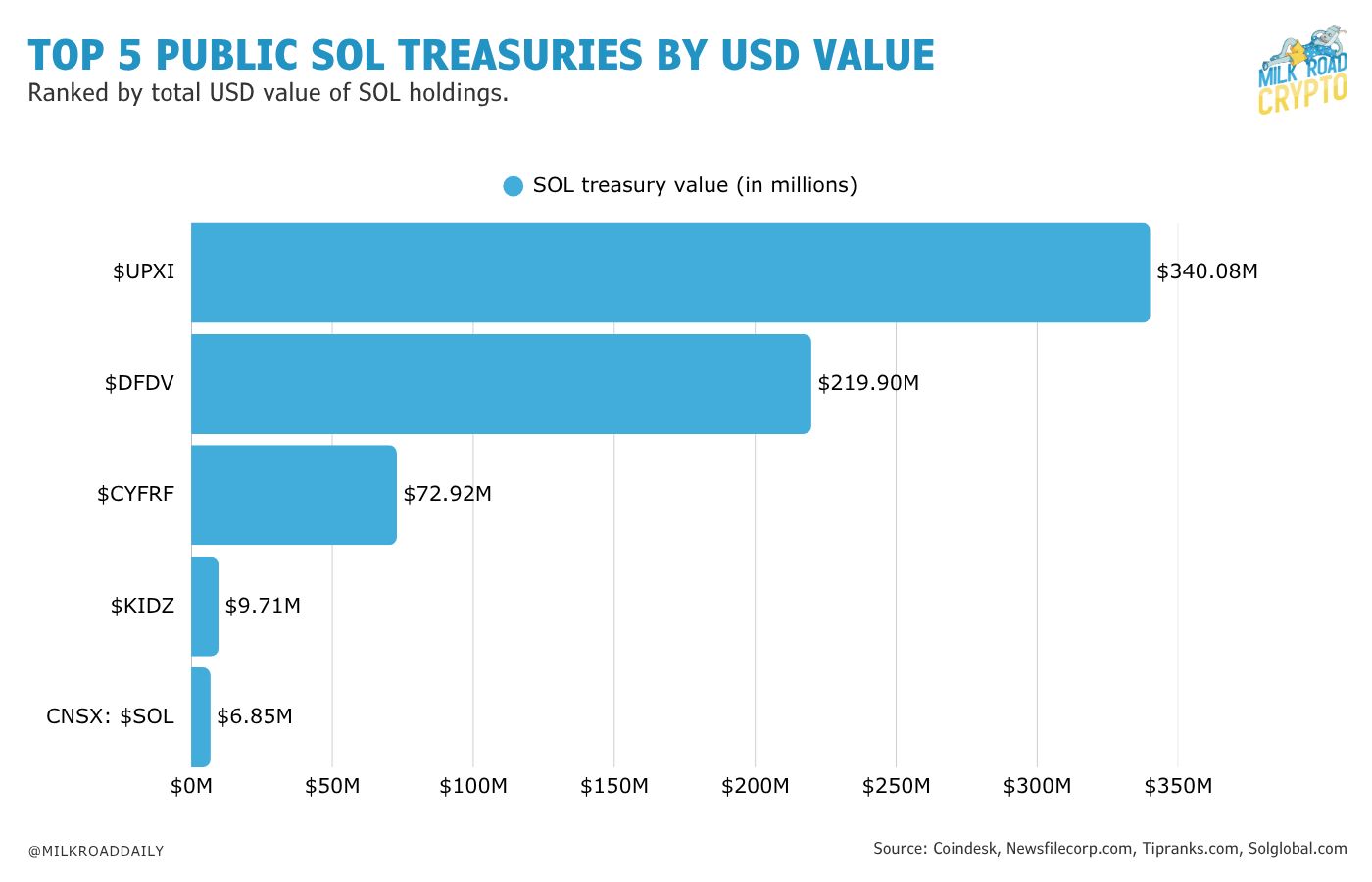

Here are the top 5 public Solana treasury companies, ranked by total $SOL holdings…

Note: This chart ranks companies that are actively growing their $SOL treasury, using the value of $SOL currently held, and doesn’t account for any other treasury assets.

Alright, that’s cool and all – but what premium do these companies trade at compared to just holding Solana?

‘Cause remember back to our $ETH treasury article last Thursday:

The idea here is that the money you invest in these treasury companies increases at a faster rate than just holding Solana itself. 👇

Upexi Inc (Nasdaq: $UPXI) – Market Cap: $267.48M / $SOL treasury value: $340.08M = a 0.787x premium

DeFi Development Corp (Nasdaq: $DFDV) – Market Cap: $292.82M / $SOL treasury value: $219.90M = a 1.332x premium

Sol Strategies Inc (Nasdaq: $CYFRF) – Market Cap: $158.36M / $SOL treasury value: $72.92M = a 2.171x premium

Classover Holdings Inc (Nasdaq: $KIDZ) – Market Cap: $32.1M / $SOL treasury value: $9.71M = a 3.306x premium

SOL Global Investments Corp (CNSX: $SOL) – Market Cap: $9.15M / $SOL treasury value: $6.86M = a 1.334x premium

Righteo, now – here they are ranked by premiums…

To drill home (yet) another point from last week’s $ETH treasury article:

The trick isn’t to find a Solana treasury with a crazy low premium and just ape in – it’s to find one that has solid momentum (i.e. growing investor interest) at a fair premium.

You want investors to push the stock up at a faster rate than its $SOL holdings – and for that, you need demand.

Here’s the math on that:

Low premium + low investor interest = dicey.

Mid-range premium + high investor interest = better chance of success.

Low premium + high investor interest = praise be! God has blessed you on this day.

P.S. If you can’t be bothered weighing premiums against momentum, and just want simple Solana exposure – you can simply buy $SOL onchain (better yet: via Milk Road Swap!)

The centralized exchange (CEX) space is crowded…

There are tons of CEXs already and more continue to pop up every other week…

Yet, while the rest of the market chopped in Q1 2025, Bitget’s trading volume shot up 159% – making it one of the fastest growing CEXs in 2025!

So, why are traders rushing to Bitget? 👇

Some of the lowest fees: 0.1%, reducible to 0.08% if you hold the $BGB token

High leverage: Up to 125x for all the degens

Bitget Academy: Free guides and tutorials for all the not-so-degens

Ready to see what the buzz is all about?

$BTC HASHRATE HITS NEW ATH’S 📈

The global Bitcoin network hashrate just hit new all-time highs! 👇

That’s awesome…because…errr…ok, I’ll just come right out and ask:

What the hell does that mean??

Bitcoin hashrate is just a fancy word for ‘amount of computational power being used to process transactions on the Bitcoin network’.

(Yeah, lacks a certain simplicity compared to ‘hashrate’.)

Here’s why a higher hashrate = a good thing:

The higher the hashrate, the more secure the Bitcoin network is.

You’d need to own 51% of the computing power plugged into the Bitcoin network in order to successfully falsify a transaction (i.e. create Bitcoin out of thin air and send it to yourself).

…and that action alone would likely send Bitcoin to $0.

So the higher the hashrate, the more money an attacker would need to spend (burn) on crazy-powerful computers in order to break the network.

(We’re talking billions and billions of dollars.)

Plus: increased hashrates sometimes hint that $BTC could soon move higher.

Higher hashrate = more miners spending money on electricity to power their computers and mine Bitcoin.

With hashrates at all-time highs, it means miners are likely spending more money on electricity than ever before…yet they’re still doing it – why?

It could be because they believe Bitcoin will be more valuable in the near future – making the higher-than-ever energy costs worth paying…

Huh, waddya know – I learned something today!

PRO ALL ACCESS PORTFOLIO UPDATES 📊

We added a new token to the Milk Road PRO All Access Portfolio last week – and it’s already up ~25%!

Wanna know what it is and what price we got in at?

Go PRO and keep scrolling to find out! 👇

Disclosure: We are not a day trading portfolio so don’t expect a high volume of trades. Read our “How To Build a Crypto Portfolio” report to learn more about our portfolio strategy.

Portfolio performance 📉

The Milk Road PRO All Access Portfolio saw a moderate decrease over the past 7 days. Our portfolio value is at $189.0K, down 6.30% since last week.

Portfolio prices are updated daily at 6:00 AM ET.

The markets didn’t end last week on a high note, slipping after disappointing U.S. jobs numbers and news of fresh import tariffs.

Almost every market took a hit on Friday, but since then, things have bounced back fast.

The total crypto market cap fell about 9% from its all-time highs, while the S&P only slipped around 3%. But now, some of those losses have already been wiped out, and the markets are making a push to climb back up.

Portfolio changes 👀

The Milk Road PRO All Access Portfolio is exclusive to PRO All Access members.

Already a PRO All Access member? Log in here.

GO ALL ACCESS AND UNLOCK:

The Milk Road PRO All Access Portfolio — See what we’re investing in, how we’re allocating capital, and what actions we’re taking each week (buy, sell, hold, watchlist) ✅

Weekly “Where Are We In The Cycle?” Indicators — Signals that help you spot the market top before it’s too late 📈

Weekly Reports Across Crypto, Macro & Degen — Deep dives, token breakdowns, market analysis, and investing frameworks that give you the edge 🧠

Access to the Milk Road Community — Full Discord access including signals, AMA invites, portfolio update calls, and exclusive All Access channels 💬

FREE Crypto Investing Masterclass — Included with all annual All Access subscriptions (30% off for monthly) 🎓

Already a PRO All Access member? Log in here.

PRO REVIEW OF THE WEEK

The $NIGHT airdrop is set to go live by August 10. If you hold $BTC, $ETH, $SOL, $XRP, $BNB, $AVAX, $ADA, or $BAT, there’s a good chance you’re eligible.*

This new US jobs data is rough! Should we be worried? Find out in today's edition of Milk Road Macro.

Coinbase releases ‘Embedded Wallets’ — allowing developers to integrate self-custodial wallets into apps with minimal coding.

Oooft! That’s gotta hurt. Shrapnel, the world’s most successful web3 game, is leaving Avalanche for the Gala Games ecosystem.

We just dropped a new review: iTrust Capital. A solid, low-cost option for U.S. investors looking to add crypto and precious metals to their retirement plan.

*this is sponsored content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY