- Milk Road Crypto

- Posts

- 🥛The NFT royalty game just changed 😳

🥛The NFT royalty game just changed 😳

PLUS: ETH's staking yield hits ATH 💪

GM. This is Milk Road, the telescope of crypto news. Our updates can help give you a clearer view of the digital currency world.

Here’s what we got for you today:

Wtf is an ERC721-C? 🧐

ETH staking returns highest since Shapella🫰

From $0 → $7M in one weekend 📈

Binance is leaving Canada 🍪

Today’s edition is brought to you by Origin Protocol, whose newest offering OETH is changing up the ETH staking game and bringing user’s additional yield.

WHAT’S AN ERC721-C? 🧐

Look, we like cartoon jpegs as much as the next person.

But there’s 1 pesky problem with the NFT world: royalties. They’re the extra fees (5-10%) you pay on marketplaces like OpenSea when you buy an NFT.

The upside: the NFT artist gets paid (woo!)

The downside: more fees = NFT traders get less money (boo!)

That’s where ERC721-C comes in.

It’s the new remix to the ERC721 standard for Ethereum-based NFTs. It’s designed to help NFT artists earn more royalties from their work (the “C” stands for “Creator.”)

Here’s how:

Programmable royalties. Creators can distribute NFT collection royalties directly to holders that buy their NFTs?

OpenSea/Blur can’t set royalties to 0%. Marketplaces will do this to compete against each other, even though that means creators don’t get paid. Tsk tsk

So…what next? Well, first an NFT collection needs to actually start using this - no one really has yet.

But this is a pretty cool way to implement royalties (more $$ for creators), while also benefiting traders (creators can share royalties with buyers).

Wanna read more? Check out our Milk Road Guide to ERC721-C below.

Ever since Ethereum’s Shanghai Upgrade, liquid staking has been the talk of the town. The battle between providers has been fierce.

And now, a new challenger has entered the arena. And it’s not just any contender, it’s the veteran DeFi protocol, Origin Protocol.

They just launched Origin Ether (OETH) - an innovative approach to staking your ether to earn that juicy yield.

Here’s the breakdown:

It aggregates yield across liquid staking derivatives such as Lido, Rocketpool and Frax

In addition to earning rewards from only staking, OETH earns significantly higher APY by providing liquidity in DeFi

Yield is provided passively so you don’t have to pay any gas fees

And they’re serious about security. The protocol is audited by OpenZeppelin, the same folks that audit Coinbase, The Ethereum Foundation, and Aave.

Start earning yield on your Ether with OETH today, or boost the yield from your stETH, rETH, or frxETH by depositing them with Origin!

ETH’S STAKING RETURNS ARE HIGHEST SINCE SHAPELLA 🫰

Ethereum stakers are earning BANK. That’s because the annualized rate of return just hit a whopping… *checks notes*…. 8.76%.

This is the yearly return for staking ETH to help validate transactions on the network.

That’s the highest it’s been since the network’s Shapella update. AKA when Ethereum started letting people unstake their holdings.

⚠️ The current annualized rate of return for #ETH staking stands at 8.6%, which is a historical peak.

Since the Shanghai upgrade, ETH2.0 contracts have seen 3.4 million $ETH deposits and 2.67 million ETH withdrawals, resulting in a net pledge of 734.92k ETH (worth $1.4… twitter.com/i/web/status/1…

— BecauseBitcoin.com (@BecauseBitcoin)

3:35 AM • May 15, 2023

So what? This is good! More staking & returns = more people are confident in the Ethereum network.

There’s one caveat though…

The line to stake ETH is longer than 7/11’s free slurpee line on July 11 every year.

At the moment, there are about 50K validators waiting in line. And you’ll have to wait about a month to become an Ethereum validator and start earning yield. Womp womp

Ethereum’s quite literally the coolest kid on the block right now.

FROM $0 → ~$7M IN ONE WEEKEND 📈

Wow, do we have a story for you. It involves an NFT personality (ben.eth), two trending meme coins and $6.9M…

Buckle up, Roadies. Here’s the story in 5 parts:

PART 1: CREATE A SH*TCOIN

One cool thing about sh*tcoins is they don’t do anything, so you can name them whatever you want. In this case, ben.eth took the easy route and named his after himself, $BEN.

PART 2: LAUNCH SH*TCOIN WITH A PRESALE

ben.eth didn’t go the traditional presale route, he started collecting ETH directly to his wallet. He was able to raise 55 ETH from over 300 contributors - around $100K at the time.

PART 3: GIVE AWAY OWNERSHIP TO YOUTUBER

$BEN was on a fast track to 0 until another Ben jumped in to save the day. An unlikely “hero” who seems to always find himself in the midst of Twitter controversies.

The infamous Bitboy Crypto.

Guys $BEN is live. People all want to invest in themselves and now Bens can do that.

The facts:

- The coin has my name

- We have a Ben DAO on telegram

- Bens are better than Jeffs so we should easily take over JeffCoin as the number one name on the blockchain— Ben Armstrong (@Bitboy_Crypto)

8:26 AM • May 8, 2023

While he joined as a team member, he ended up taking over the whole damn thing a day later. A classic case of the student becoming the teacher.

And even though ben.eth abandoned his prized creation within 72 hours, Bitboy’s tweets were enough to pump the price more than 10x in a day.

HUGE $BEN Announcement

I did not launch the project. But I am now taking it over 100%. @eth_ben and I have agreed in principle to an agreement where all of the assets and liquidity for @bencoin_eth will be transferred to me within a week.

@eth_ben will become an advisor.

— Ben Armstrong (@Bitboy_Crypto)

11:22 PM • May 11, 2023

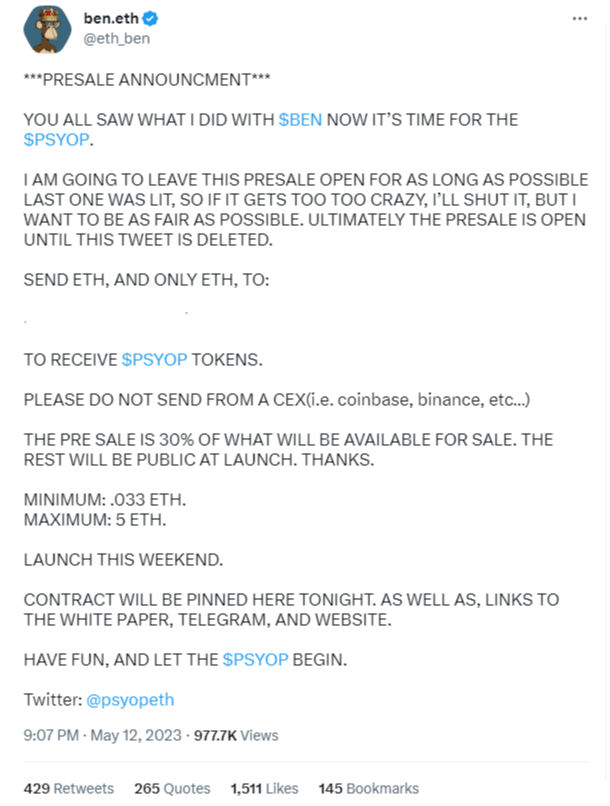

PART 4: ANNOUNCE A NEW SH*TCOIN

So what do you do when a Youtuber buys out your sh*tcoin right after launch? You create another one.

ben.eth called it $PSYOP.

Within an hour he had already raised $1M. And at the end of the presale, his wallet was holding ~$6.9M (nice).

PART 5: REPEAT STEPS 1 AND STEP 2

And steps 3 and 4, if you’re lucky enough to come across someone as passionate about their name as Ben Armstrong is.

The craziest part of all this? People don’t care know about what they are buying. And some were sending over multiple ETH. As of writing, $PSYOP hasn’t even launched.

So what? This says a lot about the current crypto landscape.

While we wait for true value to be created and adoption to continue, the space is dominated by attention and FOMO.

MILK & COOKIES 🍪

NFTfi just launched a brand-new phase in their popular loyalty program. In EARN SEASON 1 you can earn exclusive, non-transferable reward points for NFT borrowing/lending on their platform. (Sponsored)

Binance leaves Canada amid increased regulation. The latest victim of the regulatory crackdown sweeping North America.

Quadriga CX customers finally receive their payout. Creditors are only receiving 13% of their claim after waiting for ~5 years… Pour one out.

Crypto attacks and cyberattacks fund about 50% of North Korea’s missile program. They’ve stolen over $2.3B total, with 30% of stolen funds coming from Japan.

Binance CEO CZ recently unfollowed Elon Musk on Twitter. An interesting follow up to Binance investing $500M in the Twitter takeover. There’s speculation CZ isn’t happy with Elon’s plans to launch a crypto wallet within the app.

MILKY MEMES 🤣

HIT THE INBOX OF 250K+ CRYPTO INVESTORS

Advertise with the Milk Road to get your brand in front of the Who's Who of crypto. The Roadies are high-income crypto investors who are always looking for their next interesting product or tool. Get in touch today.

What'd you think of today's edition? |

ROADER REVIEW OF THE DAY

VITALIK PIC OF THE DAY

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.