- Milk Road Crypto

- Posts

- 🥛 Is it gonna be another SeptemBear? 👀

🥛 Is it gonna be another SeptemBear? 👀

PLUS: The biggest lesson from our investments so far...

Today’s edition is brought to you by Bitwave - their free, half-day online event brings together the top minds in enterprise finance, accounting, and compliance. Claim your free ticket to the Enterprise Digital Asset Summit (Virtual Edition) now!

GM. This is Milk Road, we dive into the crypto pool with more grace than an Olympic diver.

It’s Friday. Let’s boogie:

Is another SeptemBear coming? 👀

Mild Road Public Wallet update: How’d last month go? ⚖️

JPMorgan files a new web3 trademark 🍪

IS ANOTHER SEPTEMBEAR COMING? 👀

We’ve got some good news and some bad news…

The good news: It’s a new month. Fresh start. Fresh calendar.

The bad news: September is the worst month of the year for crypto.

Here are some (not so) fun facts about SeptemBear:

In other words, it’s open season - and the bears are the ones doing the hunting.

There are 2 popular theories as to why Septembers are red for crypto:

1/ Some investors exit their market positions to lock in crypto tax gains/losses for the year.

2/ The general markets also take a hit. Over the last century, the S&P500 has:

averaged -1.1% returns throughout September - the worst month, by far.

decreased in price 56% of the time in September. (It’s the only month that’s more than 50% likely to see a drop in price)

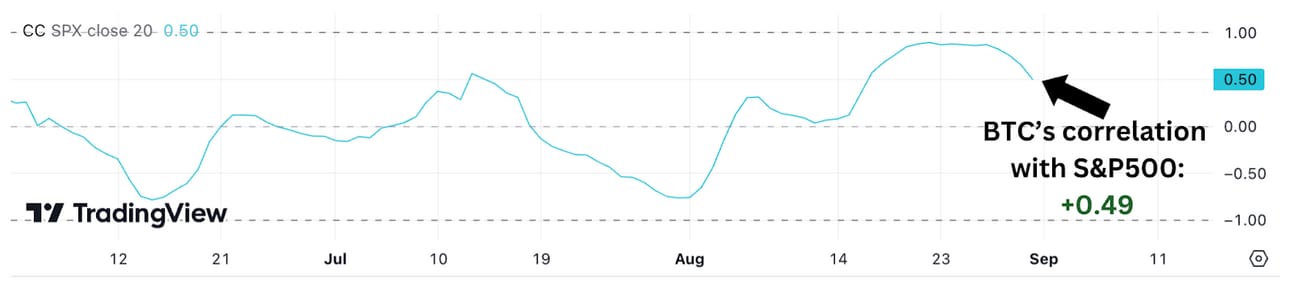

The big problem? Crypto has become more & more correlated with stocks over the last month.

Right now, it’s at 0.49. (pretty correlated)

Source: TradingView

Now the question on everyone’s minds: Will September 2023 be another red month for crypto?

I’ll be honest… if I was a betting man and saw 6 straight reds in a game of Roulette, I’d probably bet the other way. The streaks gotta end sometime, right?

Well, I’m not a betting man. (and my wife banned me from walking within 100 feet of any casino)

But there are a few big events that could make or break this month:

September 12: Gary Gensler is scheduled to testify before Congress

September 13: Consumer Price Index (CPI) data gets released

September 19-20: FOMC meeting and the Fed announces interest rate hikes. *gulp*

September 27: Gary Gensler is scheduled to testify before Congress (again)

Buckle up Roaders, it could be another rough September.

After Bitwave’s annual EDAS conference last April brought together the brightest minds in enterprise finance, accounting, and compliance, they knew they had to run it back.

Well, this time there’s a cherry on top: It’s all from the comfort of your own home. And it’s going down on September 14th, from 1-5:30 pm EST.

Here’s what participants can expect:

Expert-Led Panels & Speakers: Get insights from industry leaders and decision-makers on the most relevant topics facing the digital asset sector 🤓

Bitwave Announcements & Demos: Be the first to know about exciting, new features – and maybe even a super-secret announcement 👀

Networking Galore: Connect with like-minded professionals, potential clients, partners, or your next genius hire 🤝

And there’s a bonus: Taking part in the summit counts towards NASBA CPE credits. All while staying up-to-speed on the latest trends in the industry.

MILK ROAD WALLET UPDATE: HOW’D WE DO IN AUGUST?

We’re one month into the new Milk Road public wallet. And last night we had our first monthly portfolio review…

The dream: We’d be rich. (like Rent-Out-Six-Flags-For-The-Day rich)

The reality: Not so rich.

But that’s A-OK. We’re just getting started and our main goal was to try a bunch of cool sh*t out.

Here are a few highlights from Month #1:

Our portfolio went from $10,000 → $9,590

Of the $410 we lost, $155 of that came from gas fees

35% of our portfolio is in stablecoins

Our largest holdings are ETH, stETH, and USDC

We have two positions open on Pendle - a secondary market to trade yields

We’re holding assets across 4 different blockchains - Ethereum, Arbitrum, Optimism, and Base (call us 4Chainz)

(Try cool sh*t out: ✅)

The biggest lesson: Gas fees suck…. A lot.

In total, 38% of our losses came from just paying fees. Pardon me while I go throw up.

(Note: The value of the transactions does not impact the fees. Gas fees are based on how busy the network is at the time and the type of transaction)

No sweat though, we understand it’s the price of admission for trying cool stuff out. And we’ve got our eyes on our next big move…

Restaking. This is when you use ETH that you’ve already staked, and restake it to earn additional rewards. (hence the name)

It’s one of the more confusing things we’ve done in crypto, which is why we wrote a whole guide showing step-by-step how to restake on EigenLayer.

Check out how we restaked ETH here!

BITE-SIZED COOKIES 🍪

JPMorgan files a trademark for Chase Travel that includes plans for a “financial exchange of virtual currency”. First, they laugh, then they join.

Adidas is partnering with NFT artists to launch its first digital artist-in-residence program. The artists will get to collaborate with the sportswear giant on digital and physical items.

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) has successfully integrated the Chainlink blockchain in recent tests. BNP Paribas, BNY Mellon, and others collaborated with Swift on the experiments.

PancakeSwap has launched on the Base network. The decentralized exchange also launched on 4 other Ethereum blockchains - including Arbitrum, Linea, zkSync Era, and zkEVM.

Binance announced it is slowly phasing out support for the BUSD stablecoin. The exchange is encouraging users to start converting BUSD into other stablecoins. (R.I.P BUSD: 2019 - 2013)

Nexo dropped a new “dual mode” feature for its crypto card. The new functionality lets users toggle between debit and credit modes.

MILKY MEMES 🤣

HIT THE INBOX OF 250K+ CRYPTO INVESTORS

Advertise with Milk Road to get your brand in front of the Who's Who of crypto. The Roaders are high-income crypto investors who are always looking for their next interesting product or tool. Get in touch today.

What'd you think of today's edition? |

ROADER REVIEW OF THE DAY

VITALIK PIC OF THE DAY

Casual Friday - Let's get it Roaders 🥛

— Milk Road Images (@MilkRoadImages)

12:13 PM • Sep 1, 2023

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.