- Milk Road Crypto

- Posts

- 🥛 Introducing Milk Road Gone Wild

🥛 Introducing Milk Road Gone Wild

GM. This is the Milk Road. We’re your buddy who explains crypto to you.

And I mean a real buddy. Like, if your phone was plugged in charging at 15%...and our phone had 2%...we’d leave your phone plugged in. #realbuddy

So check this out. I have something special for you today.

It was a public holiday yesterday (Memorial Day)

..did I spend time with the family?

…. did I catch up on some household errands?

OR… did I record a 10-minute video RANT about losing nearly a million dollars on Luna?

YES! Yes, I did!

Honestly, it turned out pretty funny. I got in the mood, and just went OFF. Zero f*cks given.

I’m calling this video series: Milk Road GONE WILD.

Wanna see it?

Go to the new youtube channel and subscribe. After we hit 5,000 subscribers, we’ll drop the Luna video.

WHY ARE YOU STILL HERE? GO SUBSCRIBE NOW!

OK onto the news… What do we have for you today?

🖼️ Can NFTs hold value in a down market?

🍩 Bite-sized treats

😂 Meme of the day

CAN NFTS HOLD VALUE IN A DOWN MARKET?

2021 was the year of NFTs.

NFT sales ramped up to ~$40B, way up from the year before (less than $100M in 2020)

Celebrities like Snoop Dogg, Madonna, The NBA, etc.. all created NFT projects

It was a scorching hot market. I’m talking the-floor-is-lava-game hot.

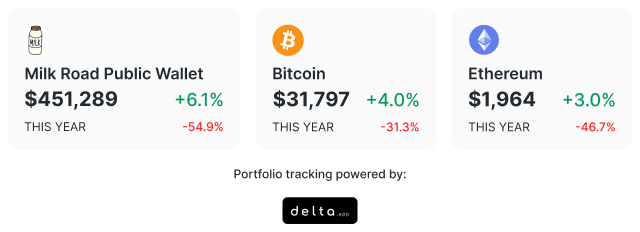

But 2022 has been a brutal market for every kind of investor:

S&P 500 down ~13%

Tech stocks (Tesla, Facebook, etc.) down ~35%

Bitcoin down ~31%

Ether down ~46%

The Milk Road public wallet down ~55%

Which got us wondering - what’s going on with NFTs in a down market? Are people still investing in NFTs?

Do I want to buy a picture of a drawing of an Olive Garden when the market is down and gas costs $7 a gallon?

Well - here are a few quick data hits that we grabbed from Nansen:

#1 - NFT volume has gone way down

#2 - Major project (aka blue chips) prices are down ~45% (in terms of USD)

#3 - NFT projects lost more value than ETH

Most NFT projects are priced in ETH. So if an NFT was selling for 100ETH, not only has the floor price gone down to 80ETH, but the price of ETH has been cut in half too. So in dollar terms, you’re down 60%.

The Milk Road's Take: We thought that NFTs might hold their value in terms of USD with ETH going down…looks like it’s been the exact opposite so far. NFTs are down in both ETH terms and, even worse, in dollar terms.

By holding NFTs you’re getting hit twice… at least in May. Let's see what happens from here!

TODAY'S NEWSLETTER IS BROUGHT TO YOU BY WILLOW

Wanna make more money from your socials?

Willow turns your link-in-bio into a landing page with your most important links.

Their Gumroad integration and tipping feature means you can boost revenue by allowing audiences to buy things and tip directly from your bio. You can also customize the layout and background to match your brand.

Willow is the perfect tool for online professionals who want to make it easy for their audience to find and support their work.

So, why wait? Sign up for Willow today!

BITE-SIZED TREATS

Moneygram is launching a new stablecoin-based platform for international money transfers. Users will be able to easily send stablecoins and convert them to their local currency.

China is airdropping some residents $4.5M in e-CNY (native crypto token) to help bolster the local economy. Not a fan of government tokens... But hey, stimmy is stimmy.

The South Korean government calls in all Terraform Labs Employees for questioning. Do Kwon goes to the principal’s office!

SpaceX will be accepting DOGE payments for merch. Another Elon company giving the thumbs up on the memecoin. Is Twitter next?

The latest Digital Asset Funds Report is out: a total of $87M worth of crypto was bought by crypto funds over the last week.

Mirror Protocol (Terra network) was exploited for ~$90M. A user found a flaw in the smart contract and drained the money over 7 months ago. The team just found out about it...

MEME OF THE DAY

The grind never stops

— sΞΞcrits.ethᵍᵐ🍞 (@SEECRITS)

5:36 PM • May 28, 2022

See ya tomorrow!

A Review from the Road...

What'd you think of today's email?

DISCLAIMER:

None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.