- Milk Road Crypto

- Posts

- MR PRO | Where Value Flows Onchain: $GMX Edition

MR PRO | Where Value Flows Onchain: $GMX Edition

The Winner of the Next Bull Run?

GM PRO DOers! 😎

The crypto derivatives market – where crypto degens trade with leverage – has become absolutely massive.

Let me show you.

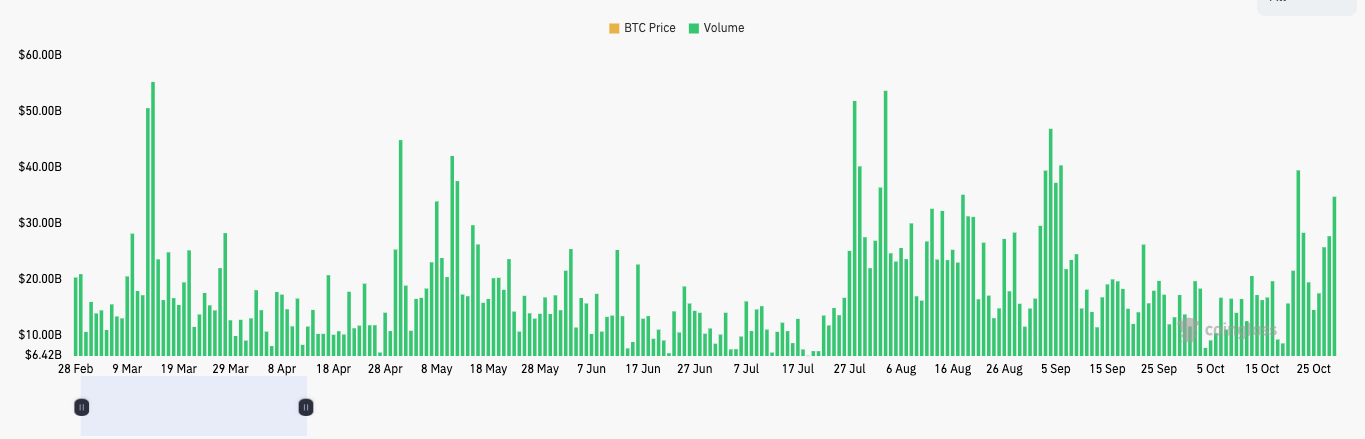

This is the futures trading volume in crypto between February 2020 and October 2020 – the period just before we entered the 2021 bull market.

It’s showing daily volumes of around $20 billion, with the occasional spikes to $30 and $40 billion.

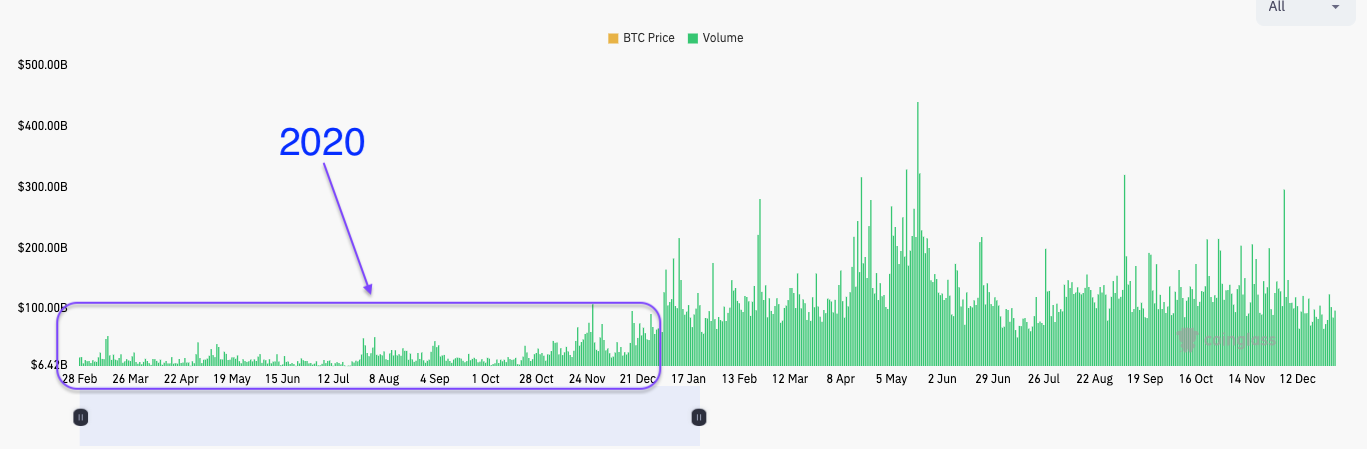

Now let’s zoom out to incorporate volumes during the 2021 bull market.

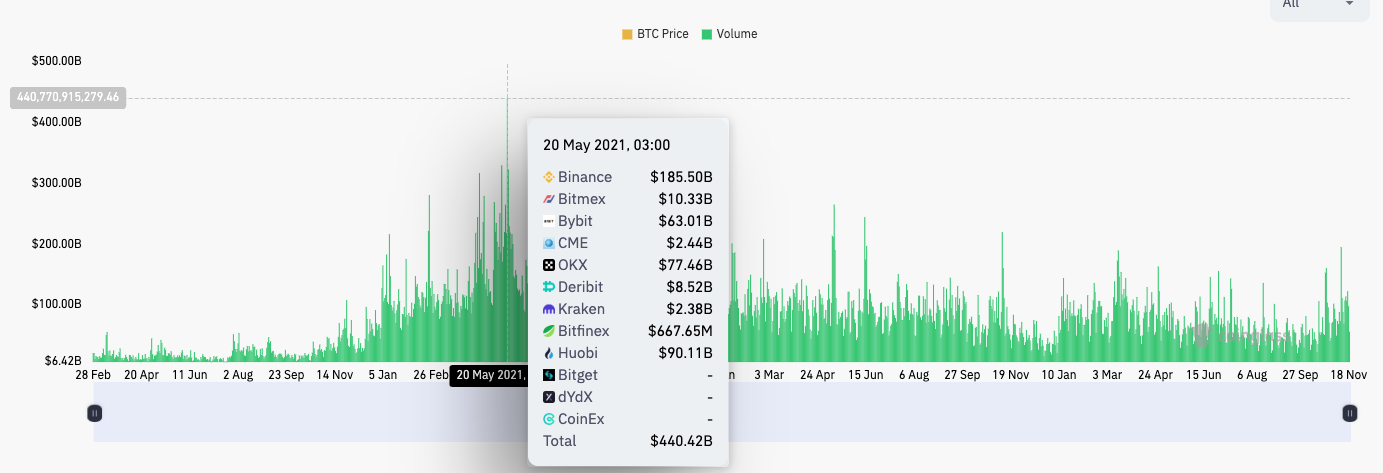

A massive increase. From 10s of billions in daily volumes, various exchanges started to collectively record 100s of billions in futures trading volumes every single day.

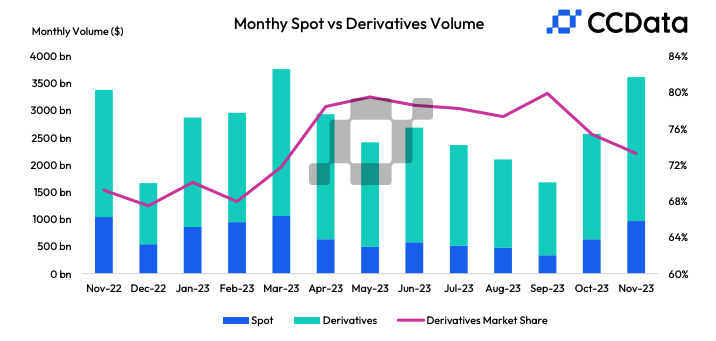

The derivatives market has become so big that over 73% of the monthly volume in crypto comes from derivatives trading, not spot trading.

In November, derivatives volumes rose by 36.8%, to $2.65 trillion in volume for the month.

So it’s clear that people love to trade with leverage.

That’s part of the reason why FTX was so successful before they imploded – they offered leveraged trading with up to 100x. 😳

But here’s the problem. Most derivatives trading is currently happening on centralized exchanges like OKX or Binance.

There’s limited availability of onchain leverage trading, with only a few decentralized and permissionless protocols offering this service.

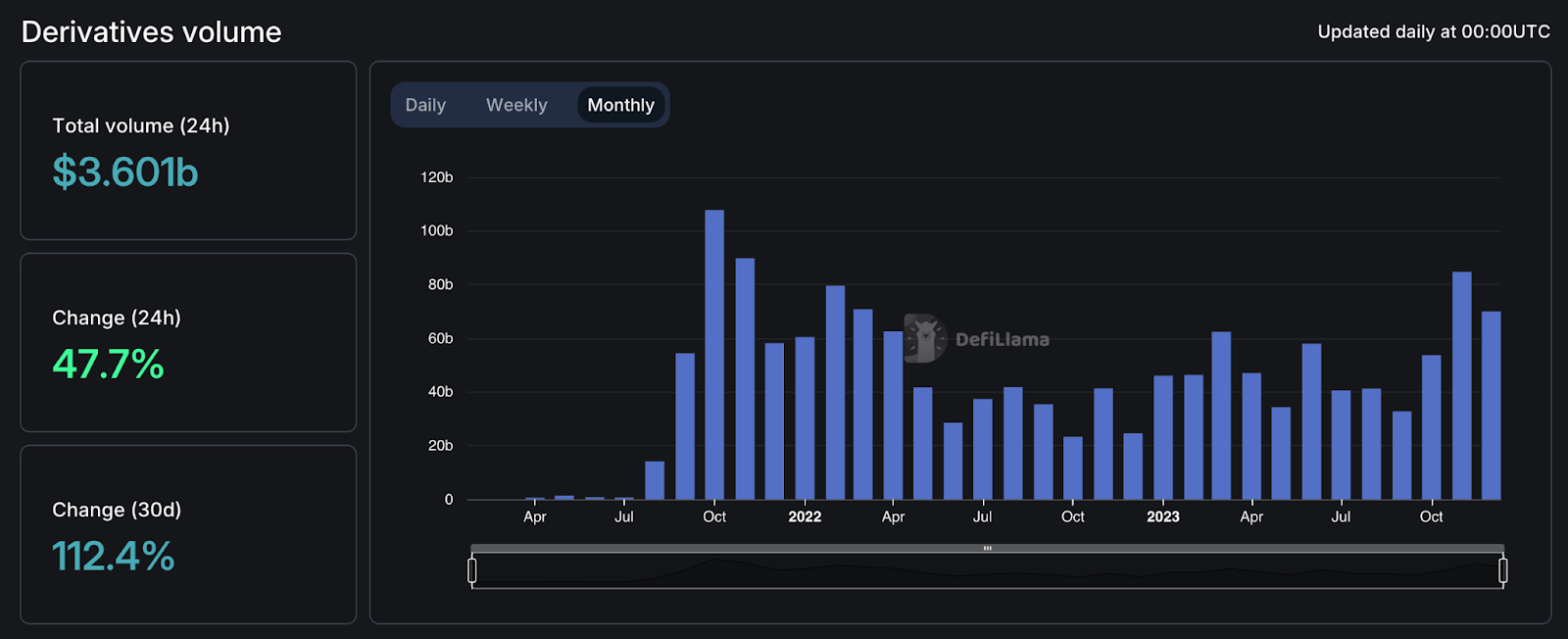

According to DeFiLlama, onchain derivatives have only breached the $100 billion mark in monthly trading volumes once.

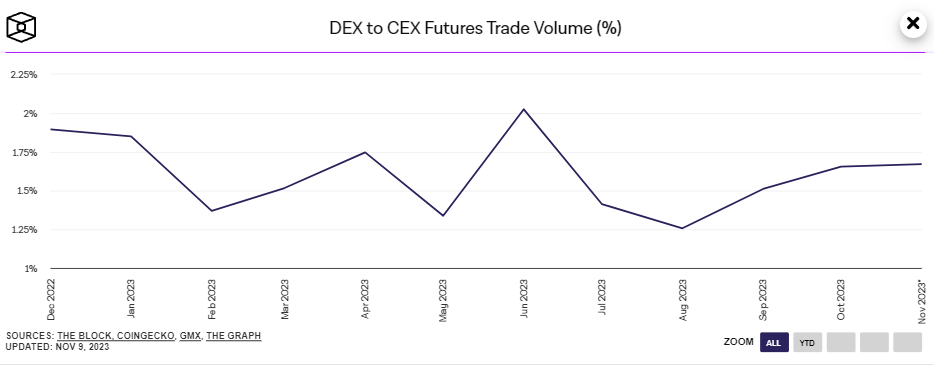

In contrast, centralized exchanges consistently settle trades worth trillions of dollars each month. This means that over 98% of all trading volume happens on centralized exchanges.

While centralized exchanges provide a seamless UX, let’s be honest, that’s not where you want to do your trading as you’re not in control of your money. Remember FTX?

So there’s clearly a need for a trusted decentralized platform where traders can use leverage. And there are a few that people can use already (e.g. dYdX, Vertex, Apex, Gains).

But, because you’re reading Milk Road, you know that solely providing a needed service is not enough. For an onchain protocol/application to be successful, they also need to have a sustainable business model put in place.

Today, I present to you GMX, a perpetual contract trading platform that provides up to 50x leverage trading options.

You might be wondering, Kyle, why are we talking about a derivatives exchange when you also don’t recommend using leverage?

Well, that’s because GMX is an onchain application with product-market-fit and also one of the only DeFi protocols that have figured out a sustainable mechanism to incentivize & reward ecosystem participation.

This is a model that other onchain applications could mimic so we want to make sure you’re aware.

Plus, leverage is extremely popular, and while we don't recommend everyone use it, playing with a small part of your portfolio won't kill you.

Here are some of GMX’s numbers.

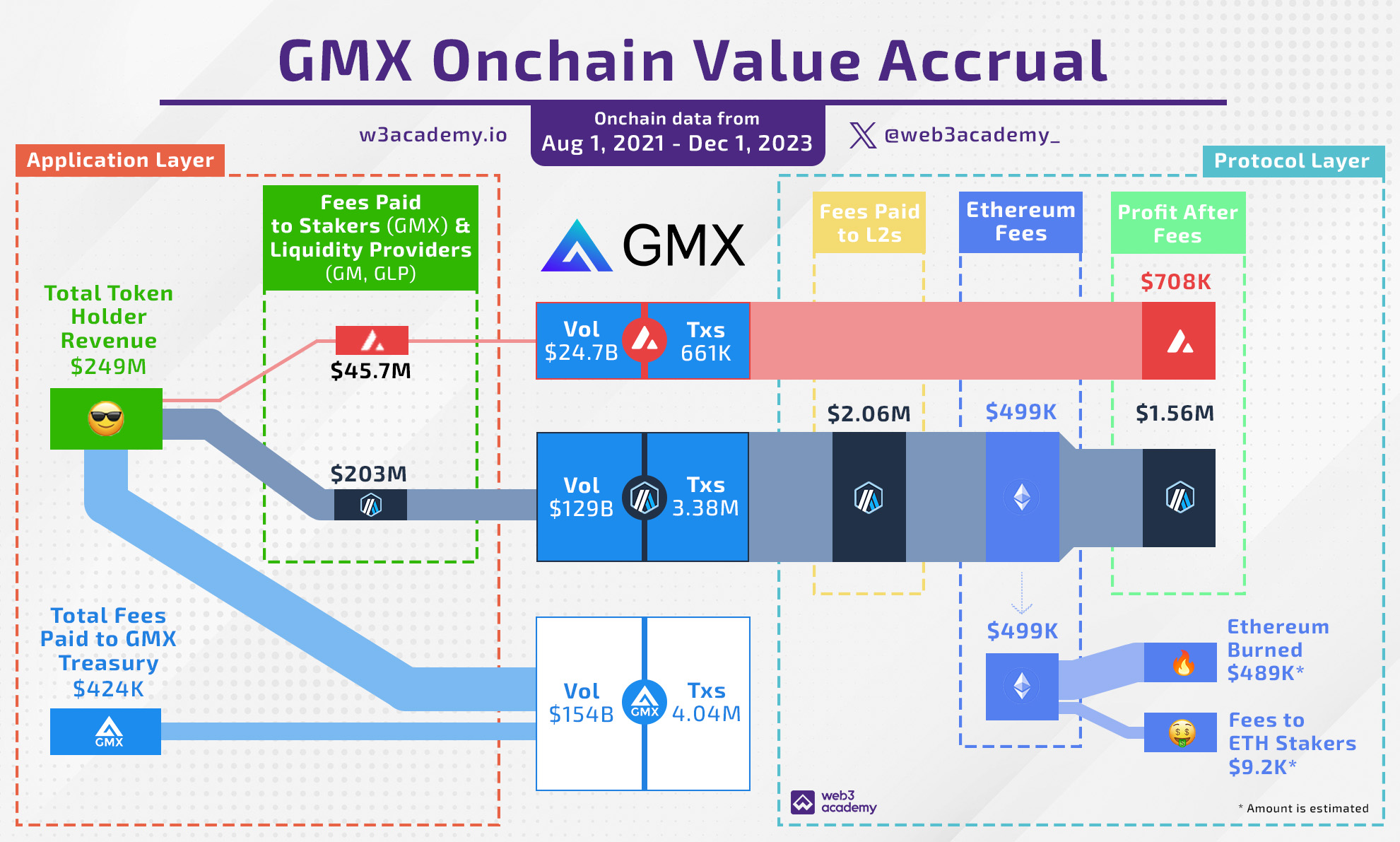

$153 billion in volume

4 million transactions

$75 million paid to $GMX holders

$2 million to Arbitrum

$700k to Avalanche

$500k to Ethereum

And here’s another kick-ass onchain value accrual visual.

Now remember that these numbers are miniscule when compared to the volumes and amount of transactions occurring on centralized exchanges.

And even if you compare this to Uniswap's almost $2 trillion volume & 270 million transactions, these numbers are insignificant.

However, GMX is an application that’s only 2 years old, and that still hasn’t been around during a bull market – when most leverage trading happens – so its best days are likely still yet to come.

By reading this report, you’ll be way ahead of the rest.

Today, we’ll go over:

What is GMX? 🫐

GMX Mechanics ⚙️

GMX Key Stats 🔑

GMX Value Accrual ⛓️

What’s Next for GMX? 👀

P.S.- At the end, I share my thoughts about whether or not this could be a good investment for the bull market. Make sure you read this through.

What is GMX? 🫐

GMX, a rebrand from the original Gambit exchange, provides perpetual contract trading with up to 50x leverage on all available pairs and charges a 0.015% fee on trades.

GMX has reduced their fee from 0.1% to 0.015% recently. Therefore, the majority of the data presented in this report reflects the period when GMX's fees were higher.

GMX now provides real-time price updates and faster on-chain execution speed due to integrating @chainlink Data Streams.

Moreover, trading fees on @arbitrum have been lowered to ~0.015%, comparable to leading CEX's VIP tiers — but available to *ALL* #DeFi traders instead.

1/2

— GMX 🫐 (@GMX_IO)

2:08 PM • Nov 20, 2023

Built on both Arbitrum and Avalanche, GMX is one of the first (and only) DeFi protocols that provides sustainable yield for both stakers and liquidity providers.

Let’s dive into how this works.

GMX Tokens & Mechanics ⚙️

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full access to the Milk Road Portfolio & weekly updates to see what we’re actively investing in

- • NEW: Unlimited access to the Milk Road PRO Token Center with token ratings and insights. 🔓

- • Weekly “Where Are We In The Cycle?” indicators to help you spot the bull market top before it’s too late 📈

- • Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

- • Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. Don’t miss the monthly live events! 🫂

- • 50% OFF the Crypto Investing Masterclass 📚️