- Milk Road Crypto

- Posts

- MR PRO | Where Value Flows Onchain: Friend.Tech Edition

MR PRO | Where Value Flows Onchain: Friend.Tech Edition

Base Profits $482k, $ETH Burned $254k

GM PRO DOers! 😎

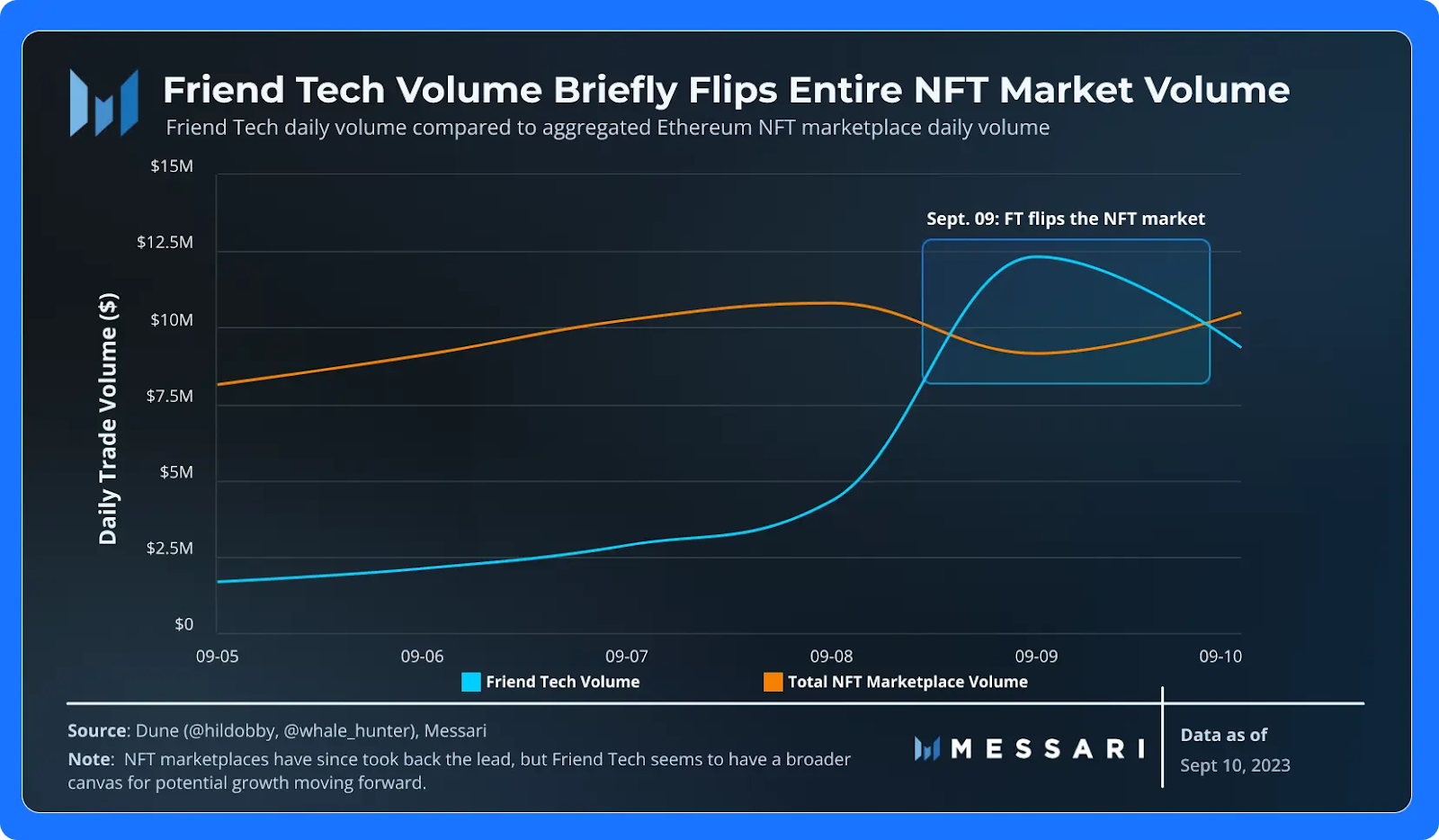

This past Saturday, the total Friend.Tech (FT) trading volume was $12.3M, vs just $9.15M for the entire NFT market. 🤯

At the same time, daily active wallets interacting with Ethereum NFTs remained below 15k while Friend.Tech surpassed 10k daily active wallets. 📈

While everyone is going crazy about Friend.Tech, we’re going crazy about the money that is flowing to the blockchains that Friend.Tech is built on.

This report is about Friend.Tech, except it’s not.

It’s about understanding Onchain Value Accrual.

Onchain Value Accrual is one of the most important concepts that we will ever teach you. This concept is vital to capitalize on the opportunity of web3. 💰

Friend.Tech Onchain Value Accrual Overview ⛓️

Since launch, Friend.Tech has accumulated $148 million in total volume across 4.1 million onchain transactions.

This has created millions of dollars in value. But where did all that money go? 🤔

How much went to Friend.Tech? And what about creators? 🎨

Also, under the hood, what about the protocols on which Friend.Tech is built: Base, OP Stack, and Ethereum?

Quick context on how Friend.Tech is built onchain:

Friend.Tech is built on Base

Base is built on the OP stack (we'll get more into this later)

Base settles on Ethereum

These blockchains play a vital role in how Friend.Tech functions, therefore they all receive a share of the financial value generated by the app. 🤳

One of the coolest things that blockchain gives us is the opportunity to see how money flows. Shout out to decentralized and transparent databases! 🗣️

This leads to so many exciting outcomes:

We can see network effects in action where an app like Friend.Tech has an immediate impact on the chains it’s built on

We can be hyper-smart investors by understanding the bottom-line impact an app has on its chain

We can see why investing in chains is like no investment ever before because we’ve never been able to invest in this kind of infrastructure layer of technology

In order to make this simple, here's the flow of money that has gone through Friend.Tech in 1 chart…

As you can see, there are multiple layers of value accrual which most of us likely do not think about. 🤷

Absolutely incredible that this is all done in a permissionless (no lawyers or contracts) and composable (seamless integration of tech) manner.

If you need a second to take a deep breath I get it. This was a HOLY SHIT moment for me too. 🙂

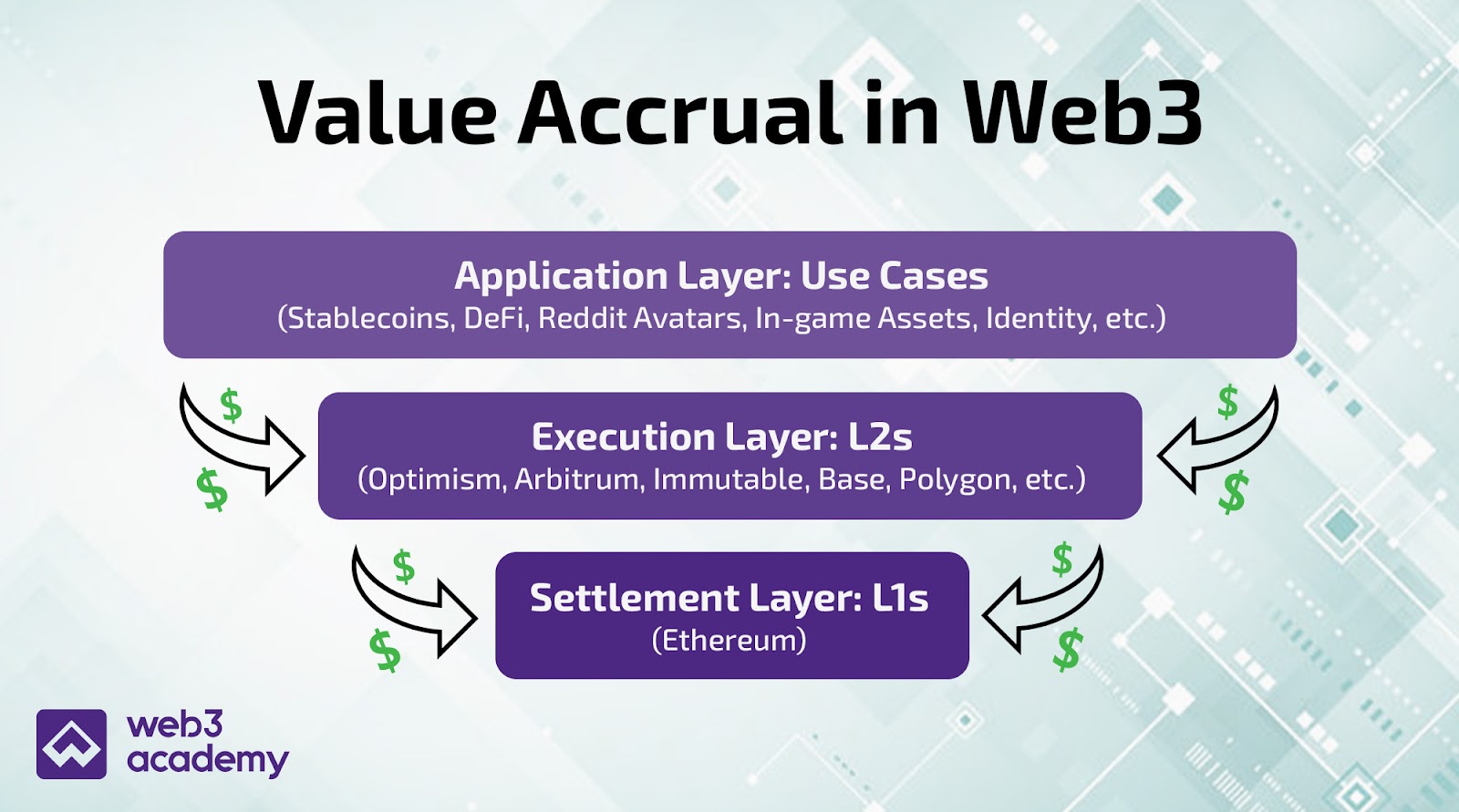

When exploring Onchain Value Accrual, it's best to think of the concept as a triple-layered cake 🍰: the Application Layer, Execution Layer, and Settlement Layer.

In this report, we’ll break down value accrual at each of the layers, which are getting paid as a result of all the activity on Friend.Tech:

Application Layer

Friend.Tech - $7.4 million

Creators - $7.4 million

Execution Layer

Base - $482K

OP Collective - $72K

Settlement Layer: Ethereum (Holders & Stakers) - $254K

What is Friend.Tech? It Doesn’t Matter. 🤷

I know what you’re thinking. What the heck is Friend.Tech? How has an app generated $148 million in trading volume in 1 month? What are people doing on this app?

Here’s the thing. It doesn’t matter.

Remember we told you this report isn’t about Friend.Tech. 😉

In order to understand onchain value accrual it’s not necessary to understand Friend.Tech.

There will be millions of apps built onchain over the coming decade. It would be impossible to understand them all, which is why onchain value accrual is such a powerful concept.

It teaches us that it doesn’t matter which apps achieve the greatest success onchain. Value will always flow to the blockchains (execution layer and settlement layer) the apps are built on.

But we never want to be like your friend leaving you hanging on a high five. So if you’re curious, here’s a bit of background on Friend.Tech. 🤝

If you're like us, and you care more about value accrual, you can skip this section.

What is Friend.Tech?

FT allows users to tokenize their social network by buying and selling keys, enabling a person who purchases another’s key to access a private group where they can see messages from the creator.

Why Are Keys Selling for 5+ ETH?

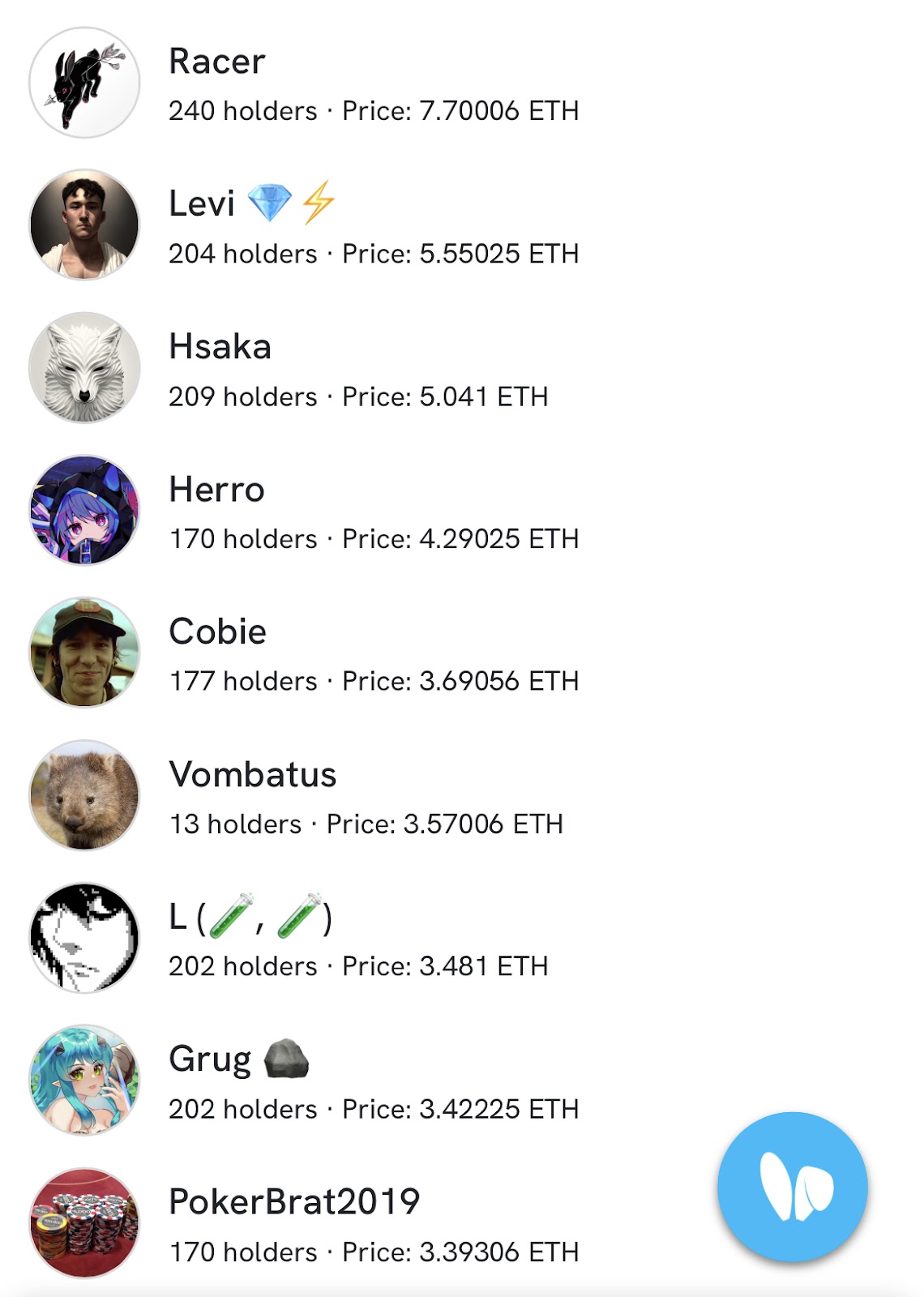

This is a great question. The highest key right now is Racer at 7.7 ETH.

Why has Racer (Friend.Tech Founder) shot up the leaderboard? Because people see his keys as buying the Friend.Tech Index. His keys have become the de facto index for Friend.Tech and are seen as the easiest way to bet on the success of the app and set yourself up to gain from the airdrop.

As for the rest of the creators?

TylerD provided a nice list of the types of people/groups using Friend.Tech and how they're using it.

Aggregators/Indexors: Those who are buying up many keys, aggregating the content, and providing it to their key holders

Builders: Teams using key token-gating for their products

Celebs/Insiders/Influencers: Big social accounts that people simply want access to

Alpha Group: Token-gated market commentary (crypto, NFTs, etc.)

Non-crypto: People outside of our bubble experimenting with the tech

Protocols: Teams launching protocols or boosting their tokens via keyholders

(3, 3): Those who promise to buy the keys of their holders (Olympus DAO throwback) or share airdrop benefits

Creatives: Artists providing special access to their content for key holders

Dormant accounts: People who signed up, set up an account and abandoned it

Value Accrual - The Application Layer 📲

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full access to the Milk Road Portfolio & weekly updates to see what we’re actively investing in

- • NEW: Unlimited access to the Milk Road PRO Token Center with token ratings and insights. 🔓

- • Weekly “Where Are We In The Cycle?” indicators to help you spot the bull market top before it’s too late 📈

- • Weekly reports that help you spot early trends, navigate the markets by limiting risk & catch those sweet cha-ching moments 💰

- • Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. Don’t miss the monthly live events! 🫂

- • 50% OFF the Crypto Investing Masterclass 📚️