- Milk Road Crypto

- Posts

- 🥛 PRO | Finding the next MSTR 🔍

🥛 PRO | Finding the next MSTR 🔍

How $ETH treasuries could be the next big crypto bet

GM. This is Milk Road PRO, the newsletter that scours the market for hidden gems, like your thrifty aunt combing through a discount bin.

Take off your crypto-colored glasses and zoom out for a second.

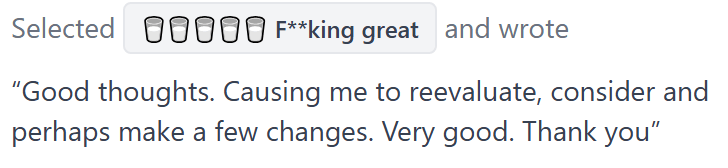

What’s been the best-performing asset in the world over the last five years?

Believe it or not, it’s Michael Saylor’s bold Bitcoin strategy, traded under the ticker $MSTR.

$MSTR delivered a staggering 3,254% return, leaving other heavy hitters like $NVDA (1,453%) and even $BTC (900%) far behind.

But here’s the kicker: MicroStrategy didn’t just ride Bitcoin’s success. It outperformed the underlying asset by nearly 4x.

Will that kind of growth slow down anytime soon? Probably not. 🤗

The market loves the strategy, and as Bitcoin adoption grows, so does the potential reach of this kind of investment play.

But now something new is emerging — something that could be the next evolution of the MicroStrategy model.

This time, it’s built on Ethereum.

And it’s not just about buying and holding $ETH. These new vehicles go a step further — they put that Ethereum to work.

👉 You're not just getting exposure to Ethereum itself, you're also tapping into the powerful world of decentralized finance (DeFi).

DeFi is like a parallel financial system, full of new ways to put capital to work — earning yield, providing liquidity, and accessing tools traditional finance can’t offer.

Sure, you've probably heard of DeFi by now. But let’s be honest — it hasn’t quite gone mainstream.

‼️ Regulatory hurdles, legal uncertainty, and a clunky user experience have kept it out of reach for most people.

Still, if you’ve been paying attention, you know the momentum is building. And more importantly, it’s not going away.

All signs point to Ethereum as the backbone of this movement.

So now imagine an investment product that gives you both: exposure to Ethereum and access to the innovation being built on top of it.

That is what these new $ETH Treasury companies offer.

And they are not just grabbing attention, they are pulling in real demand from investors. 👇

Some are even calling this the “ChatGPT moment” for crypto.

Why? Because DeFi, especially when you include stablecoins, is the most practical and impactful crypto use case we’ve seen so far.

And thanks to these new vehicles, it's finally becoming accessible to a global audience.

That’s why we’re here.

We want to dig deeper, understand this market, and build a clear thesis around where it's headed — and which players are most likely to lead the way.

Here’s what we’re exploring today:

What we can learn from Microstrategy

Why the so-called premium exists and why it matters

Why Ethereum-based treasuries could be a better product

What key risks need to be considered

How to identify the next big winners in this space

There’s a lot to unpack, but the goal is simple:

👉 Understand these new instruments, shape our view of the space, and figure out which ones are worth tracking or even adding to our portfolio.

But before we look ahead, it makes sense to look back at MicroStrategy ($MSTR). It’s one of the clearest examples of how a bold crypto strategy can play out and there's a lot we can take away from it.

So without further ado, let’s dive in.

HOW IT ALL STARTED

It’s 2020.

Michael Saylor, the guy who started the software company MicroStrategy, isn’t a big fan of holding cash.

What he does love, though, is Bitcoin.

👉 So instead of letting the company’s money just sit in dollars, he decides to put it all into Bitcoin.

But he doesn’t stop there.

He’s so convinced Bitcoin is the future that he actually borrows more money just to buy even more of it.

Then he does it again. And again. And again.

Whether the market's flying high or crashing down, he doesn’t care. He just keeps loading up on more Bitcoin.

Racking up:

~60+ purchase events since 2020.

Almost 600,000 $BTC accumulated.

About $42 billion total investment, with an average cost near $71,000/BTC.

Not sure what to make of this strategy? Let’s take a look at how the market reacted — that might help you decide what you think.

As mentioned at the top of the report, since Saylor kicked off this bold strategy, the stock ($MSTR) tied to it has skyrocketed by 3,254% — beating out big names from traditional markets like Nvidia, Tesla or Meta (by a lot!).

When something’s doing that well, it naturally grabs attention.

After all, most of us are in the market to make money. So when one strategy is crushing everything else, it’s no surprise people want to dig deeper, jump in, and try to copy it — hoping to score similar results.

But before we get into how others are trying to follow the same path, let’s break down how this strategy actually works.

HOW IT WORKS

To buy Bitcoin, MicroStrategy raises money in three main ways:

1/ Convertible Bonds – These are loans that can later be turned into company stock.

Here’s how it works when lenders give MicroStrategy money:

They get about 1% interest per year (yep, MicroStrategy managed to borrow money at just around 1% interest on average).

If the stock price ($MSTR) hits a certain level, lenders have the option to swap their loan for actual shares in the company.

So basically, they earn a little interest while also holding a kind of “call option” — a chance to cash in big if MicroStrategy (and Bitcoin) takes off.

👉 Right now, there are $8.2B worth of convertible bonds out there, and they’re paying less than 1% in dividends.

From a strategy point of view, here are some of the upsides and downsides:

✅ Low costs of capital - low interest rates

✅ No upfront dilution

❌ Adds debt to the balance sheet

❌ Converting to shares later can dilute current shareholders

❌ Risky if $BTC drops — company owes money with no extra capital

Saylor mostly used this approach in the beginning. But recently, he began raising money by offering preferred shares.

2/ Preferred Shares - These are a hybrid between bonds (low-risk) and stocks (high-risk).

When investors buy preferred shares from MicroStrategy, they’re not lending money like with convertible notes — they’re buying special stock that pays fixed dividends, usually 8–10% annually.

There are three types: $STRK, $STRF, and $STRD. Each comes with its own level of risk and return, designed to match different types of investors.

👉 Preferred shares currently total $3.5B and pay around 8–10% in dividends.

Here’s what this means for MicroStrategy:

✅ No debt added to the balance sheet

✅ No immediate dilution (only $STRK can be converted)

✅ Attracts income-focused investors who believe in the long-term $BTC bet

❌ Dividends are expensive -> 8–10% is a high cost of capital

❌ Still dilutive if preferred shares convert into common stock ($STRK)

❌ If Bitcoin crashes, sustaining dividend payments could become tough

It helps fill a gap by letting MicroStrategy reach a new group — income-focused investors. And now let’s learn about the most used strategy to raise funds.

3/ Stock Offerings – They create and sell new shares to investors to raise cash.

There are two main types:

Public Offering

A large, planned sale of new shares (usually in one go).

Often underwritten by banks and announced ahead of time.

ATM (At-The-Market) Offering ← MicroStrategy’s preferred method

The company sells small amounts of stock over time, directly into the open market.

Done quietly, at market prices, whenever it wants — flexible and efficient.

But as everything, it has some pros and cons:

✅ No repayment or interest — no debt risk

✅ Can raise a lot if stock price is high

✅ Gives flexibility to raise funds as needed (ATMs allow this)

❌ Immediate dilution for existing shareholders

❌ If overused, could lower share price due to excess supply

That said, issuing new shares is still their main way to raise capital. But before we get into why it’s the most effective, here’s a quick recap to help you see the full strategy at play.

We just covered three ways they raise money. They use all of them because each one appeals to a different type of investor and the more investor groups you reach, the more capital you can bring in.

Bonds = safer, fixed income, get paid first in case of bankruptcy.

Preferred shares = medium risk, fixed income, get paid after bondholders but before common stock.

Common stock = more upside, more risk, get paid last — only after everyone else has been paid.

So, they’ve got all the “tools” they need to keep raising money and buying more Bitcoin. Now, let’s get back into why stock offerings are actually the most effective way to do it.

It’s time to introduce “premium”.

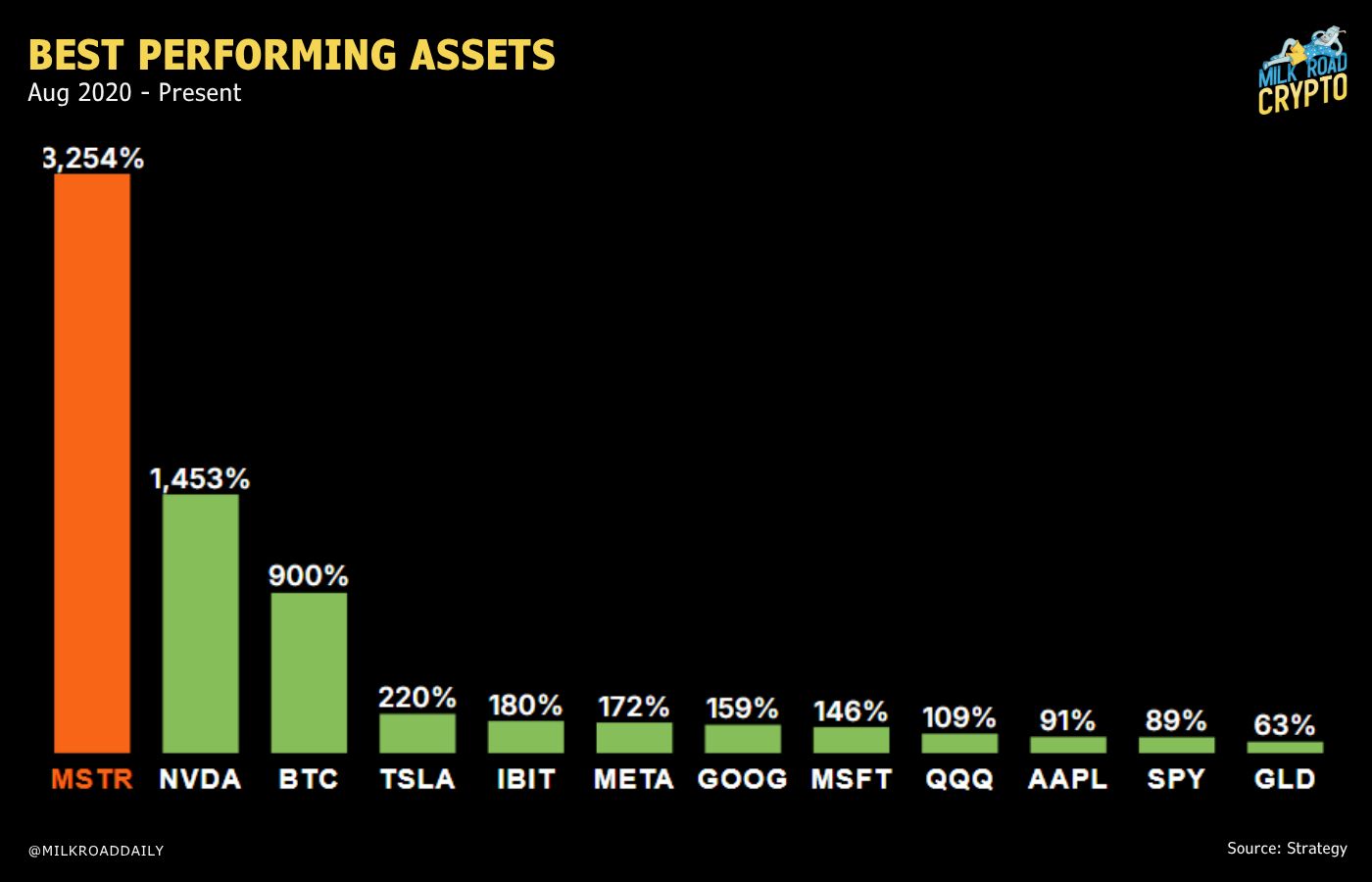

A premium happens when something is priced higher than what it's actually worth.

Imagine buying a house that's worth $10 million, but you pay $11 million — that extra $1 million is the premium.

With MicroStrategy, figuring out what it should be worth is pretty straightforward. Just check how much Bitcoin they hold and multiply it by the current Bitcoin price and deduct all their debts.

Now you’ve got what’s called Net Asset Value (NAV). From there, all you need to find is the market cap. Then you can calculate the “Premium” yourself.

Premium = MCAP / NAV

PS: When the premium is 1, it means the market cap is exactly equal to the net asset value (NAV). In other words, there's no premium at all.

Since 2024, the market prices $MSTR way above its NAV — meaning it usually trades at a big premium.

Right now, it’s trading at a 2.5x premium. That means people are paying $2.50 for every $1 of Bitcoin MicroStrategy actually holds.

And this setup creates a massive opportunity for MicroStrategy.

The premium puts MicroStrategy in a strong position.

👉 It lets them raise more money by selling new shares, like we mentioned with the ATM offerings.

But here’s why this becomes an incredible opportunity for the company. Investors are drawn to MicroStrategy because it gives them exposure to Bitcoin.

But what really sets the company apart is this:

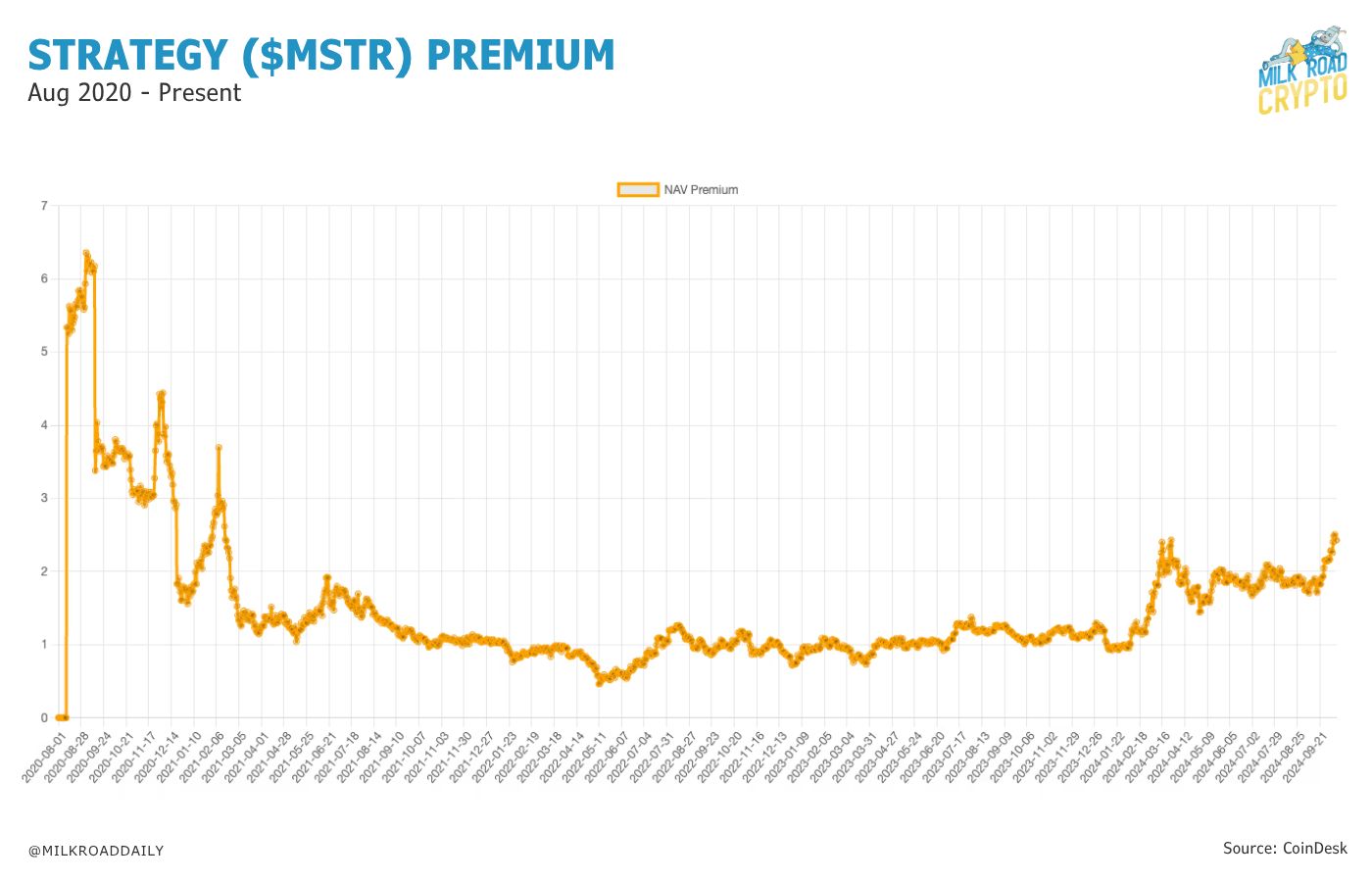

They’re actually able to grow the amount of Bitcoin per share.

Back in January 2021, buying one share of $MSTR got you 0.0005 $BTC. Today, that same share gives you 0.0022 BTC — that’s more than a 4.4x increase in your Bitcoin exposure.

PS: We mentioned earlier that $MSTR outperformed $BTC by 4x. Is it just a coincidence? 🤔

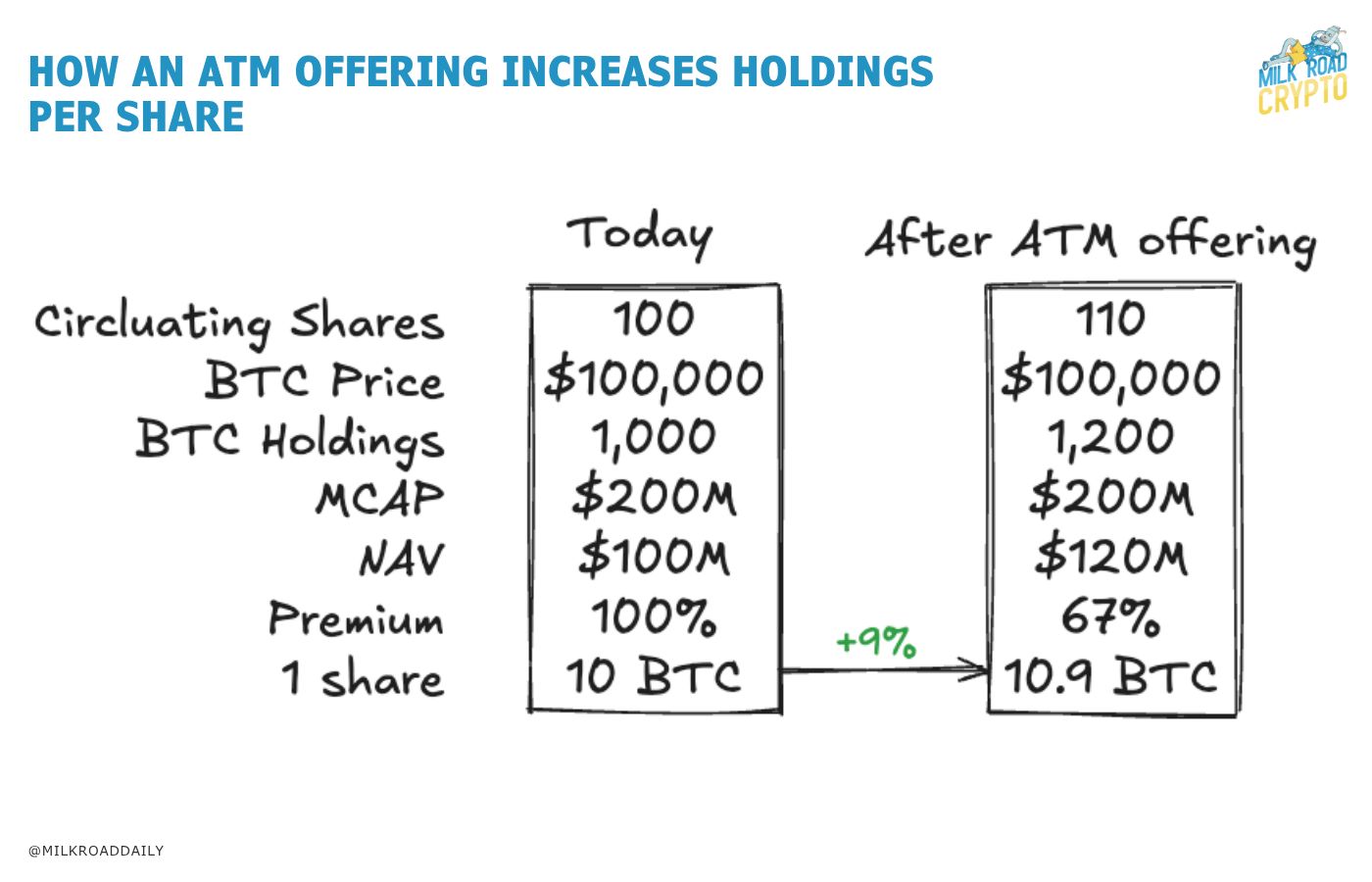

Now you’re probably wondering, how is that even possible? Well, let’s look at how it works.

Say the stock is trading at a 2x premium, and MicroStrategy decides to issue 10% more shares and sell them using an ATM offering.

Here’s how it plays out:

They issue 10 new shares, which means a 10% dilution for existing investors.

They sell those shares at market price and raise $20 million.

They use that money to buy 200 more $BTC.

Now, their Net Asset Value jumps to $120 million.

As a result, every investor ends up with 9% more Bitcoin per share than before.

It’s a pretty powerful playbook (no wonder people are into it).

BUY $BTC OR $MSTR

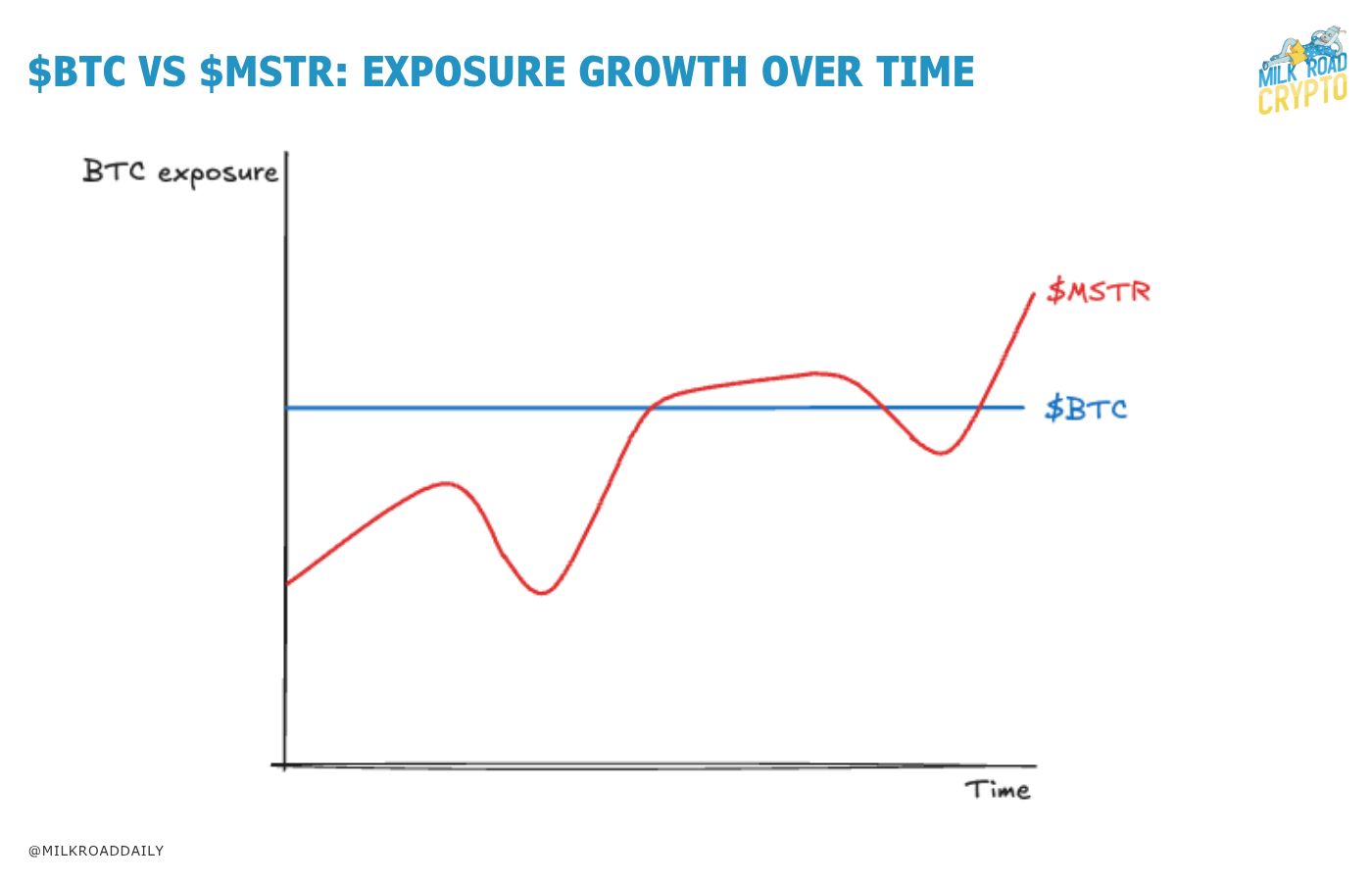

If you just buy 1 $BTC, you’ll always have 1 Bitcoin.

But if you buy shares of MicroStrategy, your exposure can actually grow over time — thanks to the way they use financial engineering (raising money) to increase Bitcoin per share.

But here’s the catch – MicroStrategy usually trades at a steady premium.

Let’s say Bitcoin is $100K and the premium is 2x. You’ve got two options:

1/ Spend $100K and buy 1 full Bitcoin ($BTC) directly. See the blue line below.

2/ Spend $100K on MicroStrategy ($MSTR) shares, which gives you exposure to just 0.5 Bitcoin, but that exposure could grow over time and maybe even pass 1 $BTC thanks to their strategy.

So while the idea of growing your Bitcoin exposure per share is definitely appealing, the constant premium makes timing your entry tricky. 😤

(What’s considered a good entry point? Is it now? When there’s a 2x premium? Or maybe 1.4? Truth is, no one really knows.)

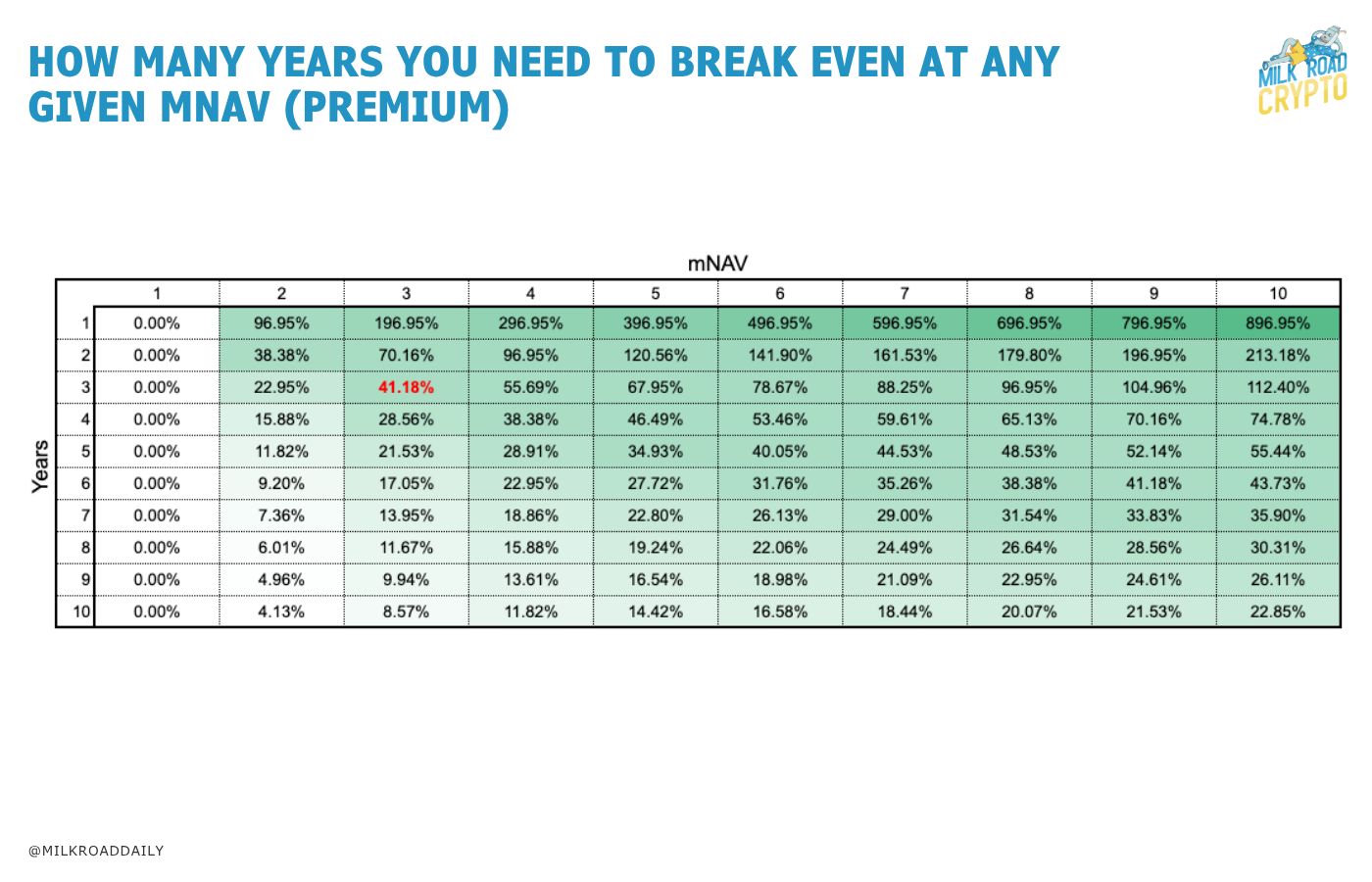

Generally, the lower the premium, the better the deal. We put this table together to help you see how much yearly growth in holdings per share you'd need to break even.

By break even, we mean the moment when holding Digital Asset Treasuries (DATs) actually put you ahead compared to just buying the crypto yourself.

If you buy a DAT that's trading at a 3x premium instead of just buying Bitcoin directly, you'd need the holdings per share to grow by 41.18% each year for the next 3 years to break even.

We can actually take a look at the premiums for all the companies out there using a similar strategy with different kinds of assets.

You’ll notice that NAV multiples vary quite a bit. And all of them trade at some premium.

But it’s smart to filter out the smaller players and focus on the bigger ones. They’re more likely to attract continuous demand and keep growing their holdings per share over time. 💪

TLDR: The market loves these digital asset treasury strategies. And lately, new Digital Asset Treasuries (DATs) are popping up almost every week.

But here’s the crazy part — everything that we just covered? It’s only scratching the surface of what makes these DATs so appealing!

Uh, Oh… 😧 The rest of this report is exclusive to Milk Road PRO members!

Already a PRO member? Log in here.

WHAT’S LEFT INSIDE? 👀

A full picture of the DAT value proposition

The current landscape for Ethereum DATs

How to pick the winners & profit from this trend

Upgrade your subscription today to unlock access to all of the milky insights above, PLUS:

Weekly reports to help you manage investments, allocate capital, take profits, and stay ahead in crypto 📊

Weekly “Where Are We In The Cycle?” indicators to help you spot the bull market top before it’s too late 📈

Access to the PRO Community, where the Milk Road crew & 1000s of fellow PROs talk crypto. 🫂

Already a PRO member? Log in here.

WHAT PRO MEMBERS SAID LAST WEEK: