- Milk Road

- Posts

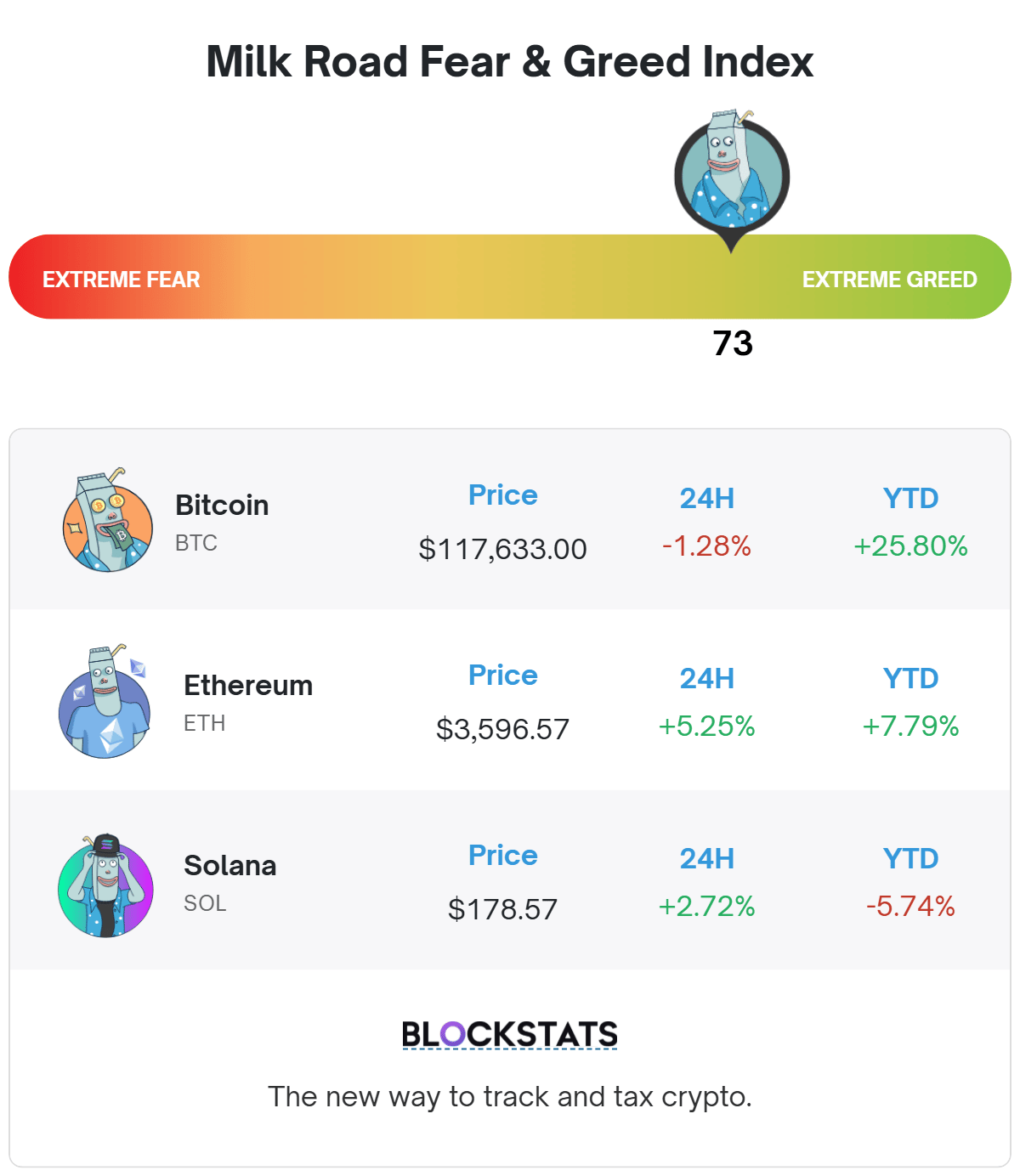

- 🥛 ETH supply crunch: incoming? 🥊

🥛 ETH supply crunch: incoming? 🥊

These charts point to “YES!” 📈

GM. This is Milk Road – the newsletter that turns its nose to sniff out market movements, so you get the alpha ahead of time.

(*sniff sniff* …is that…a supply crunch?)

Here’s what we got for you today:

✍️ $ETH supply crunch: incoming?

✍️ 2 crypto apps you probably haven’t heard of

🎙️ The Milk Road Show: What Happens When Wall Street Enters DeFi? w/ Nic Roberts-Huntley

🍪 This executive order could be huge for crypto

Grayscale is the asset manager with 30+ different ways to invest in crypto. Explore all the funds offered by Grayscale.

$ETH SUPPLY CRUNCH: INCOMING? 🥊

Remember that time you got in a fist fight with your little brother over which one of you got the last peanut butter cup?

Ok, good – so you’re familiar with the concept of a supply crunch.

The difference is, when it happens in crypto, fists don’t fly – prices do.

And it looks like we could be on the verge of an Ethereum supply crunch…

Check this out:

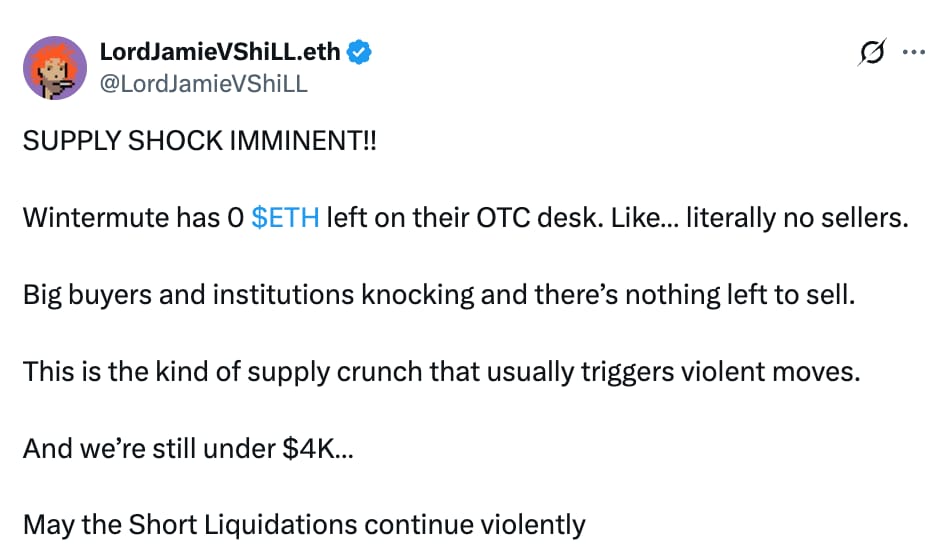

1/ Reports of major OTC desks drying up

OTC trades = ‘Over The Counter’ purchases of crypto – i.e. it’s not being bought on a public exchange, so it doesn’t affect the asset’s price.

Big dogs buy OTC so their billion dollar bids don’t push prices up before their trades confirm (which would result in them buying-in at a higher price).

Problem is: OTC markets aren’t infinite – with enough demand, they can start to dry up.

And when things dry up…they get crunchy. 👇

For context:

Wintermute isn’t some small shop – they’re one of the world's leading crypto market makers, providing liquidity (aka: access to fresh tokens) to centralized exchanges looking to fill orders.

2/ The $ETH premium is growing on Coinbase

Coinbase is a major gateway for US investors (especially institutions), which can result in stronger-than-usual demand on their platform.

When this happens, it often causes an asset’s price to be higher on Coinbase than those of other global exchanges.

Translation: when the Coinbase premium is going up, it indicates that demand is outpacing the platform’s supply.

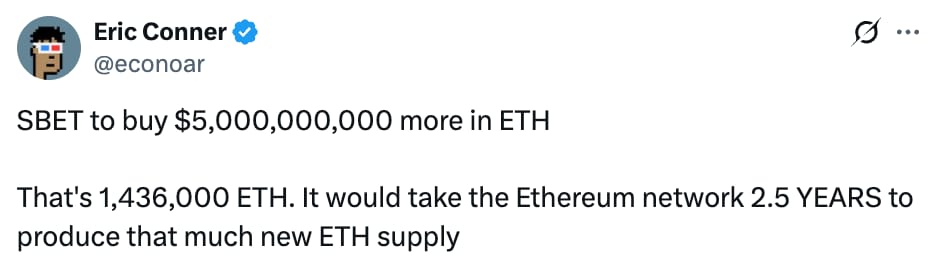

3/ The Digital Asset Treasury (DAT) vacuum continues sucking up $ETH

Remember yesterday when SharpLink Gaming ($SBET) bought $100M worth of $ETH?

Yeah, well, they just announced plans to buy a further $5 billion (with a B)!

On top of ALL of that you have the fact that:

The BlackRock $ETH ETF sucked up another $500M yesterday (that’s now $1B, from 1 ETF, in 2 days)

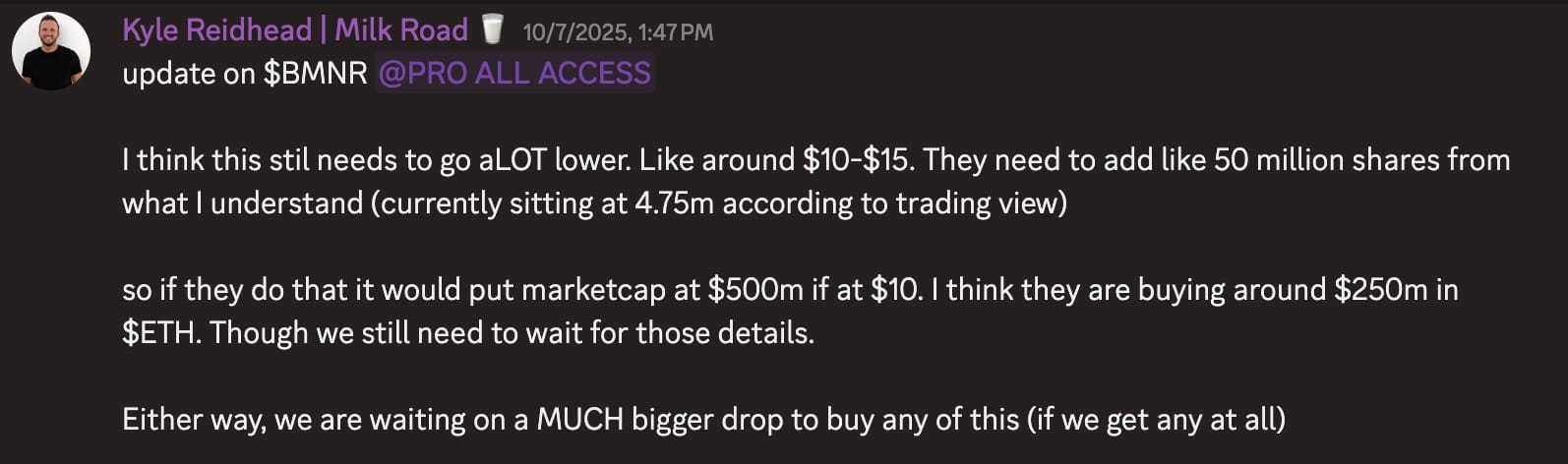

Bitmine ($BMNR) is still set to buy a further $1B in $ETH

BlackRock is looking to bring staking to its $ETH ETF (the yield from which will likely attract even more institutional capital)

BitDigital ($BTBT) just bought another 20,000 $ETH (that’s ~$72M at current prices)

$SBET alone has absorbed all of the new $ETH supply hitting the market over the last 30 days

Side note, while we’re on the topic of $ETH treasury companies:

Our PRO Team called to buy $SBET a few weeks back at $10 (now over $30), $BTCS at $5.80 on Tuesday (which hit $8.40 today), and to hold off on buying $BMNR (down 18% since then — even though they just bought $1B worth of $ETH). 👇

Source: PRO Discord

(Cold take: it’s probably about time you go PRO.)

Combine all of the above points together and what do you see?

The fight for the last peanut butter cup is brewing…

If you know crypto, you probably know Grayscale.

But did you know that Grayscale offers 30+ different crypto investment funds including:

Single asset funds (exposure to individual cryptocurrencies)

Diversified funds (exposure to multiple cryptocurrencies in one fund)

Thematic funds (exposure to themes like Bitcoin mining)

The best part about Grayscale’s products? You can invest in many of them through existing brokerage and tax-advantaged accounts like IRAs.

Investors have chosen Grayscale since 2013 - now it’s your turn.

Invest in your share of the future.

TWO CONSUMER CRYPTO APPS YOU PROBABLY HAVEN’T HEARD OF ✌️

This one’s for our intern, Archie.

If he loves two things, it’s:

Using the Milk Road X account to slide into famous investors’ DMs, requesting insights – and throwing a couple of “I told you so’s” at Tyler, our General Manager.

Today, we’re looking at two apps speaking specifically to Archie’s interests (getting access to the big-dogs, and being proven right).

…both of which have been shamelessly stolen from today’s debut edition of Degen PRO. 👇

1/ TimeFun ⏰

Creators mint “minutes” that you can buy to access group chats, calls, or streams – and these minutes trade freely, with market caps and all.

So you can spend your minutes, or (if you think a creator’s time is going to be worth more in the future) hold on to them.

It’s essentially the next evolution of FriendTech, which allowed users to buy permanent access to a creator’s group chat by purchasing their ‘keys’.

The twist here is that TimeFun allots access in, well, time – so creators aren’t exchanging an uncapped amount of hours for a one-off purchase.

(This should help to attract creators and push users to ask better questions.)

2/ OpinionsFun 🧐

This one’s still in its early stages.

The core mechanic: you can tokenize a hot take and let the market trade “Agree” or “Disagree” tokens (similar to Polymarket).

E.g. tokenize a narrative like “Crypto no longer has cycles”, and let the market bet on whether that take will age well.

(Which means the Archies of the world will soon have a quantifiable chart to point towards and say “See, most people agree with me that you’re wrong”.)

If you want to get access to the full Degen PRO report, including which tokens LG is currently buying/selling/watching (along with real-time trade notifications) – you can get discounted access here.

Alright, now go and enjoy your weekend!

The 11th edition of the European Blockchain Convention returns to Barcelona. With the EU opening up to crypto, you don’t want to miss this conference. Use code “MiLkROADebc” for a 20% discount on tickets.*

This executive order could be huge for crypto. Trump is reportedly considering allowing 401(k) retirement plans to invest in crypto.

People are still eyeing Injective? Seems like it as Canary Capital just filed for a staked $INJ ETF.

Nasdaq just filed to add staking on Blackrock’s $ETH ETF. If approved, expect an explosion in inflows.

Is spot trading a little too boring for you? dYdX lets you trade perpetuals onchain with zero gas fees.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY