- Milk Road Crypto

- Posts

- 🥛 4 numbers to keep your eyes on 👀

🥛 4 numbers to keep your eyes on 👀

PLUS: What caused prices to go up??

GM. This is Milk Road, the crypto newsletter that never sleeps. We’re like New York, minus the big-ass rats.

Here’s what we've got today:

Crypto prices are up

Numbers of the Day: $197M hack

Tennis 🤝 NFTs

The evolution of the crypto market

Today's edition is brought to you by ConsenSys, our handy dandy guide to the Ethereum Shanghai upgrade coming up soon.

CRYPTO RALLY

Yesterday was full of green. Prices across the board were green. The Milk Road wallet was in the green. Hell, I even added some veggies to my plate for dinner to keep the green going...

In total, the crypto market gained ~$70B.

Bitcoin was up 9% on the day

Ether was up 7%

Cardano was up 12%

Solana was up 10.3%

Why the optimism? Could be good ole confidence in decentralized assets like crypto after seeing banks fall. Could also be that the government is rescuing SVB and Signature depositors.

But there’s also the rest of Binance’s $1B recovery fund that CZ just pumped into the market in the form of BTC, ETH, and BNB (Binance Coin.)

Given the changes in stable coins and banks, #Binance will convert the remaining of the $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund movements will occur on-chain. Transparency.

— CZ 🔶 Binance (@cz_binance)

4:12 AM • Mar 13, 2023

Whatever it was, at least crypto’s prices aren’t in the gutter like its banks are…

NUMBERS OF THE DAY

$12B - Uniswap daily volume after crypto banks collapse

The decentralized crypto exchange’s trading volume hit 11 digits for the first time ever, and nearly doubled the previous daily record of $6B. #BusinessIsBoomin’.

Why? With Silicon Valley Bank’s collapse and Circle’s $3.3B in reserves stuck there, customers rushed to Uniswap to exchange USDC for wrapped ether and other tokens.

And fellow DEX Curve saw ~$8B in trading volume too for the same reason.

Seems like people are learning Milk Road Rule #49: There’s no safe CEX in crypto. Use a DEX for protection.

$197M - Funds stolen from crypto lender Euler Finance

Ladies & gents, the largest DeFi hack of 2023 just happened. The attacker snatched:

$136M of staked Ether

$34M of USDC

$19M of wrapped Bitcoin

$8.7M of DAI

How did it happen? The attackers carried out six different flash-loan attacks. This is when lenders offer smart contract loans without collateral, but they’re canceled if the borrower doesn’t quickly repay the loan within the same block.

Scammers typically exploit flash loans by using those borrowed funds to buy huge amounts of crypto and artificially raise its price before selling. They then repay the loans and keep the profits.

In this case, the attackers specifically targeted a vulnerability in Euler’s smart contract that allowed them to walk away with ~$200M more than they should have. Oops

2/ The hack is made possible due to the flawed logic its donation and liquidation. Specifically, the donateToReserves needs to ensure the donator is still over-collateralized. And liquidation needs to ensure the *correct* conversion rate from borrow to collateral asset.

— PeckShield Inc. (@peckshield)

10:50 AM • Mar 13, 2023

Euler’s price fell 50% Monday.

Be safe out there, y’all.

$120K - How much PeopleDAO lost in a Google Sheets hack

The group that wanted to buy a copy of the U.S. Constitution in 2021 just got hacked for 6 figures.

But here’s the thing: It wasn’t a sophisticated attack. No flash loans. No breaking into buildings. None of the cool sh*t from the movies.

The hack was done using something we all know & love hate: Google Sheets. And it’s all because the accountants made a bit of a hiccup.

PeopleDAO accidentally shared a link to an editable payables spreadsheet in a public Discord channel

The attacker found it and inserted a row for a 76 ETH (~$120,000) payment to their own wallet address

Then they hid the row so people couldn’t see it

When the PeopleDAO team signed off on all the payments, they inadvertently green-lit the attacker’s payment and sent them the $120k

*face palm*

Someone send this person a Google Sheets YouTube tutorial.

$2M - What an investor lost trying to swap USDC

On today’s episode of 1,000 Ways to Die In Crypto, someone paid $2.08M in USDC (Circle’s stablecoin) for a measly $0.05 of USDT (Tether.)

So what happened? The investor forgot to set their slippage, which is how traders decide if they still want a transaction to go through if the price changes for the better…or for the worse.

So if you set your slippage to 6%, that means you’re okay with a trade that’s either 6% over or under what you originally wanted to buy at.

It’s like telling your boyfriend: “If Taco Bell is out of Cheesy Gordita Crunches, get me a Crunchwrap Supreme. If they’re out of those too, I don’t want anything.”

The poor soul got rekt with MEV bots (software that profits from assets priced differently in separate markets.)

Moral of the story: review your swap details as closely as you do your March Madness bracket.

BE A PART OF WEB3 HISTORY WITH CONSENSYS

A big change is coming to Ethereum. It’s called the Shanghai Upgrade. And no, it has nothing to do with China or the city of Shanghai.

Ethereum is upgrading its infrastructure to enable ETH staking withdrawals.

What does this mean for stakers? What does this mean for Web3?

Our friends at ConsenSys have you covered.

They are offering a FREE Report that walks through:

What is the Shanghai/Capella upgrade?

The role of stakers in Ethereum’s governance

Full and partial withdrawals

The impact of withdrawals on the Ethereum staking and DeFi ecosystems

Competition and innovation in the sector

In celebration of the upgrade, ConsenSys will also launch its second commemorative NFT collection. Their first collection, The Merge Regenesis, was among the largest and most distributed NFT drops of all time.

Click the button below to claim your piece of Web3 history.

THE AUSTRALIAN OPEN IS USING NFTS TO CREATE FAN EXPERIENCES

POP QUIZ: What are two things that make people grunt, scream, and sweat?

Tennis and NFTs.

Well, today we’re gonna show you how The Australian Open is using NFTs to create new fan experiences. Here’s how it all works:

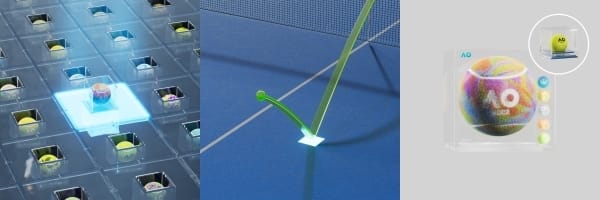

The Australian Open uses a Hawk-Eye system (i.e. a bunch of cameras and computers) to split the court into thousands of small plots to precisely track where the tennis ball lands.

Each plot on the court is tied to a specific NFT.

Whenever a player hits a match point shot (AKA a game winner) on the court, the specific NFT tied to it gets updated with game info like the player’s name, type of shot, round of tournament, etc.

NFTs that get tied to historic moments throughout the tournament can soar in price.

NFT holders also get rewards & benefits like tickets, merch, etc.

Here’s a quick visual to explain it all in action:

So far, The Australian Open NFTs have been a success. The collection has done ~$3.5M in trading volume since it launched and some holders have seen some nice returns.

An NFT for Rafael Nadal's game-winning shot sold for over a 4,000% return. Another holder of Novak Djokovic’s game-winning shot just got 2 free tickets to next year’s finals.

It’s a pretty cool use case and we predict it’s only a matter of time before other sports start using the same concept to turn historic moments into digital collectibles.

VISUAL OF THE DAY: WALL STREET CHEAT SHEET VS CRYPTO’S MARKET CAP

A few years ago Wall Street created a famous “cheat sheet” for investors. It’s a chart on the psychology and feelings of a market cycle.

It shows how things go from hope → thrill → euphoria → anxiety → panic → depression over the span of a market cycle. (It’s also what happens during my Oreos-eating cycle.)

Well check it out, a crypto founder on Twitter put a graph of crypto’s market cap since 2019 on top of Wall St’s Cheat Sheet to see how they compare.

The crazy part? Both graphs are nearly identical.

The big takeaway: If the trend continues then buckle up, we have a lot of anger & depression to go through before the next cycle.

But don’t worry, we’ll be here to make you chuckle every step of the way.

MILKY MEME

🤣🤣

That's a wrap for today. Meet us on Twitter to talk all about it. It’s kinda like a family BBQ but better - no screaming kids, awkward photos, or drunk uncles telling weird stories (@MilkRoadDaily)

HIT THE INBOX OF 250K+ CRYPTO INVESTORS

Advertise with the Milk Road to get your brand in front of the Who's Who of crypto. The Roadies are high-income crypto investors who are always looking for their next interesting product or tool. Get in touch today.

What'd you think of today's edition? |

A ROADER'S REVIEW

VITALIK PIC OF THE DAY

Happy Tuesday from V God

— Milk Road (@MilkRoadDaily)

11:54 AM • Mar 14, 2023

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.