- Milk Road Crypto

- Posts

- 🥛 21 market catalysts to watch this week ⏰

🥛 21 market catalysts to watch this week ⏰

PLUS: The current market setup ♟️

GM. This is Milk Road – the daily newsletter that connects the crypto market’s dots, so you can see the full picture.

Here’s what we got for you today:

✍️ The current market setup

✍️ What to look out for from here

🎙️ The Milk Road Show: Bitcoin Predictions, ETH / BTC Up Only & Pre-IPO Investments w/ Slava Rubin

🍪 The two degen tokens that won July!

YEET is crypto’s casino featuring original games, slots and live events. Sign up with Milk Road for a shot at $10K.

THE CURRENT MARKET SETUP 💪

…take this over here…add it to that over there…carry the 1, and…

*counts fingers*

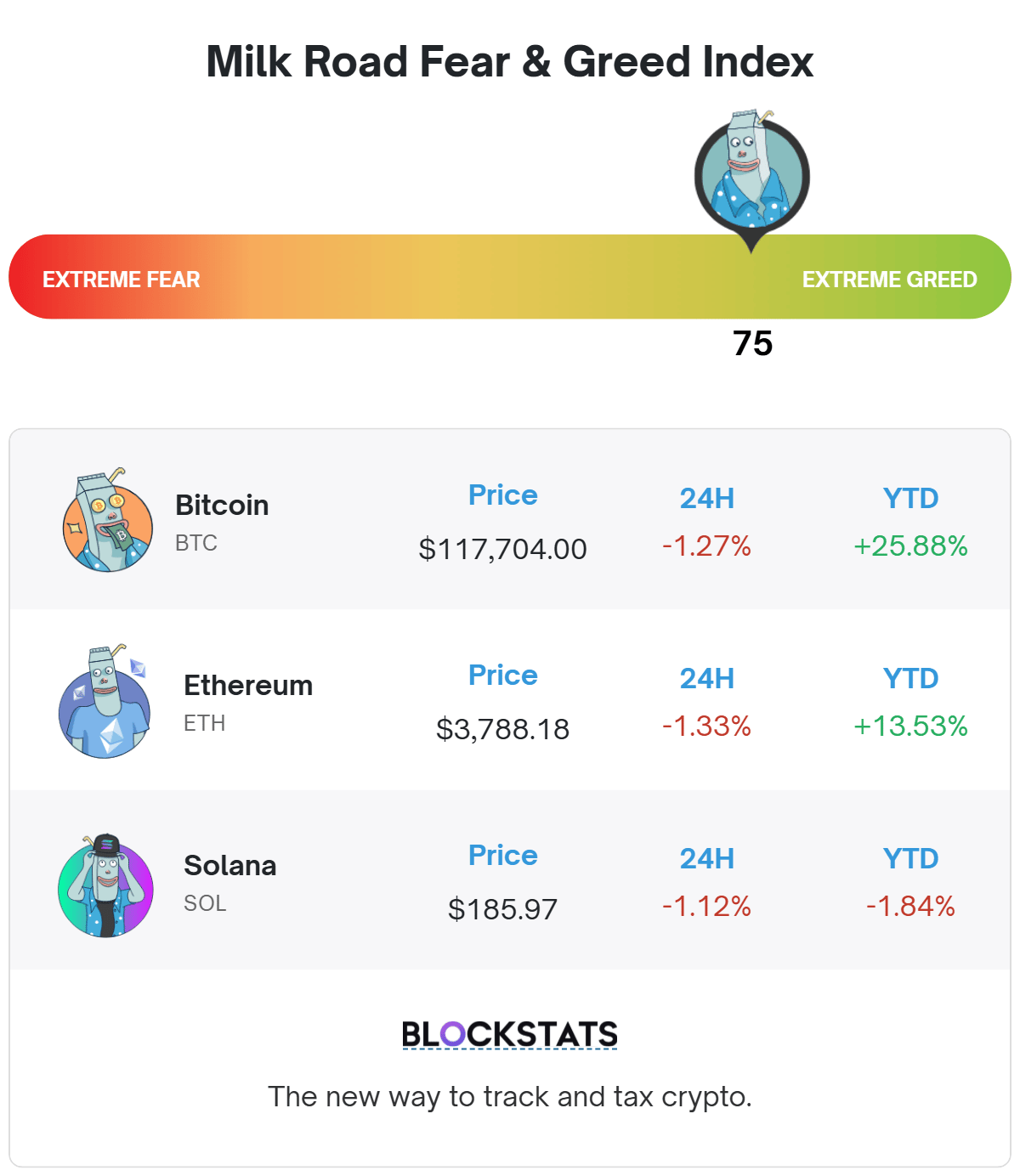

Yep, the market’s potassium levels are spiking – all signs point to a case of early-onset-banana zone.

(Aka: alt season, aka: a time in which 75% of the top 50 tokens outperform $BTC over 90 days.)

This time last week, we mentioned that the progression towards an alt season was speeding up…and that it might be your last chance to allocate.

We hope you took that insight onboard, because after alts took a mid-week breather, it looks like they might be ready to continue accelerating. Here’s the setup 👇

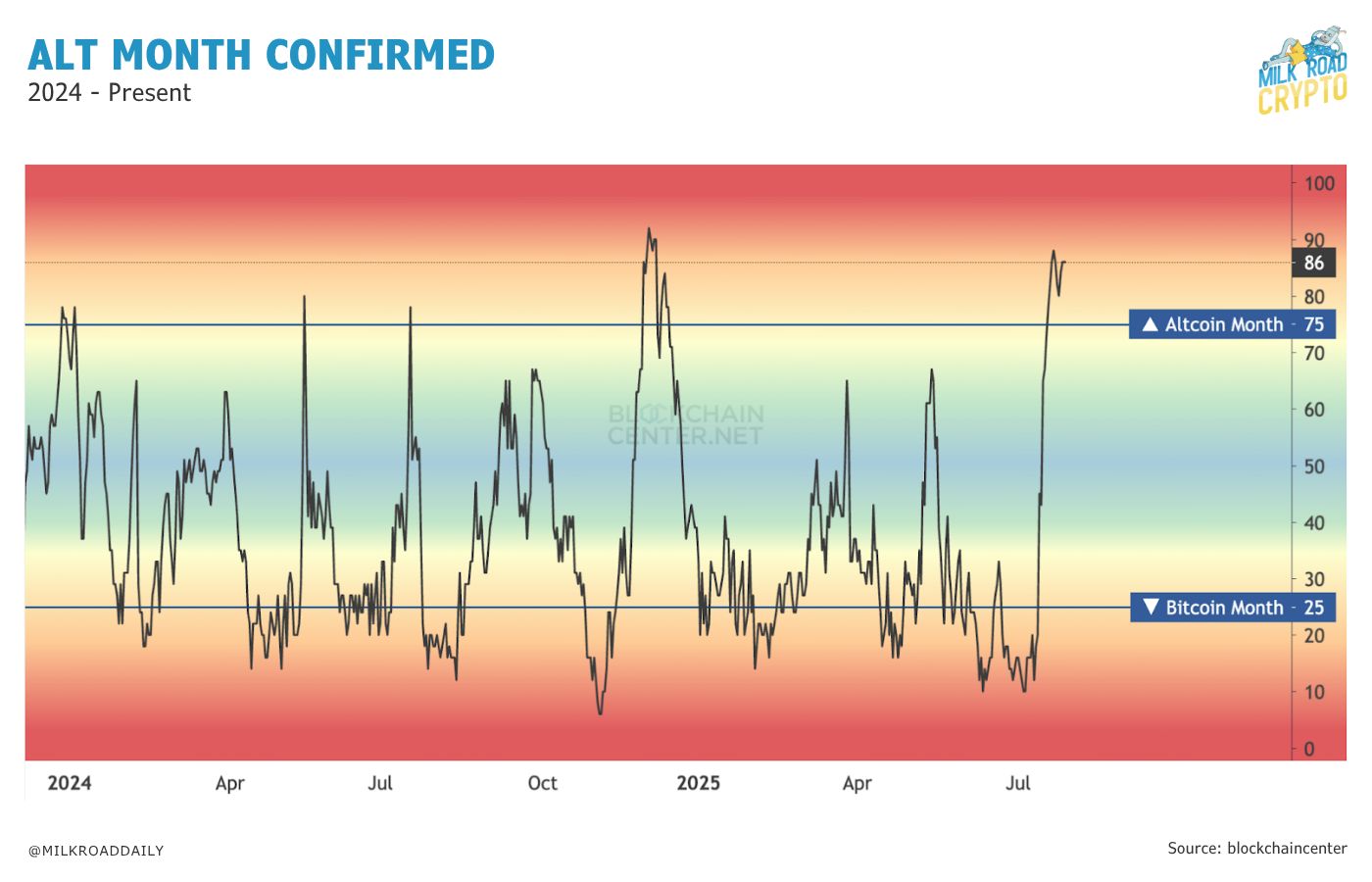

1/ July is now officially an altcoin month 📆

Altcoin season tracks alt performance over the trailing 90 days, altcoin month is tracked over (you guessed it) the trailing 30 days.

And for the last 10 days – we’ve held firmly above the alt month threshold.

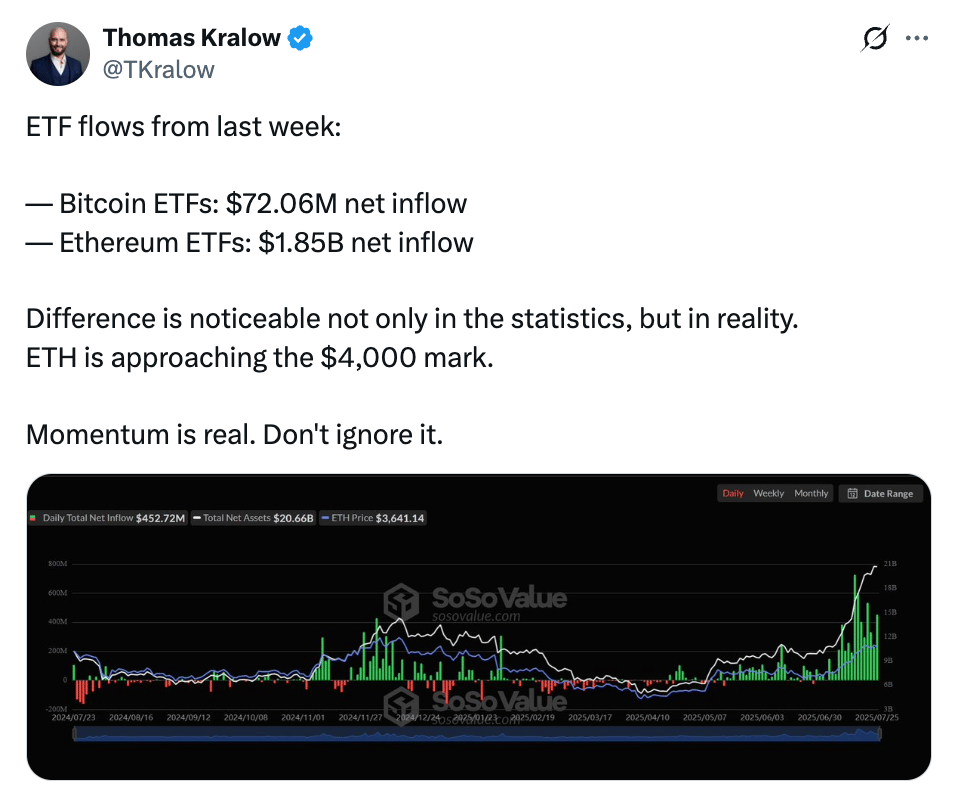

2/ $ETH ETF flows flipped those of $BTC last week 🔁

Think of Ethereum as the canary in the coal mine – if it starts to outperform, the rest of the alt sector often follows.

And last week, we saw $ETH ETFs massively flip the $BTC ETFs by weekly flows of investor dollars.

This suggests the big-dogs’ interest is shifting from Bitcoin to Ethereum (king of the alts).

And this recent shift in institutional focus is also reflected in each asset’s performance over the last month…

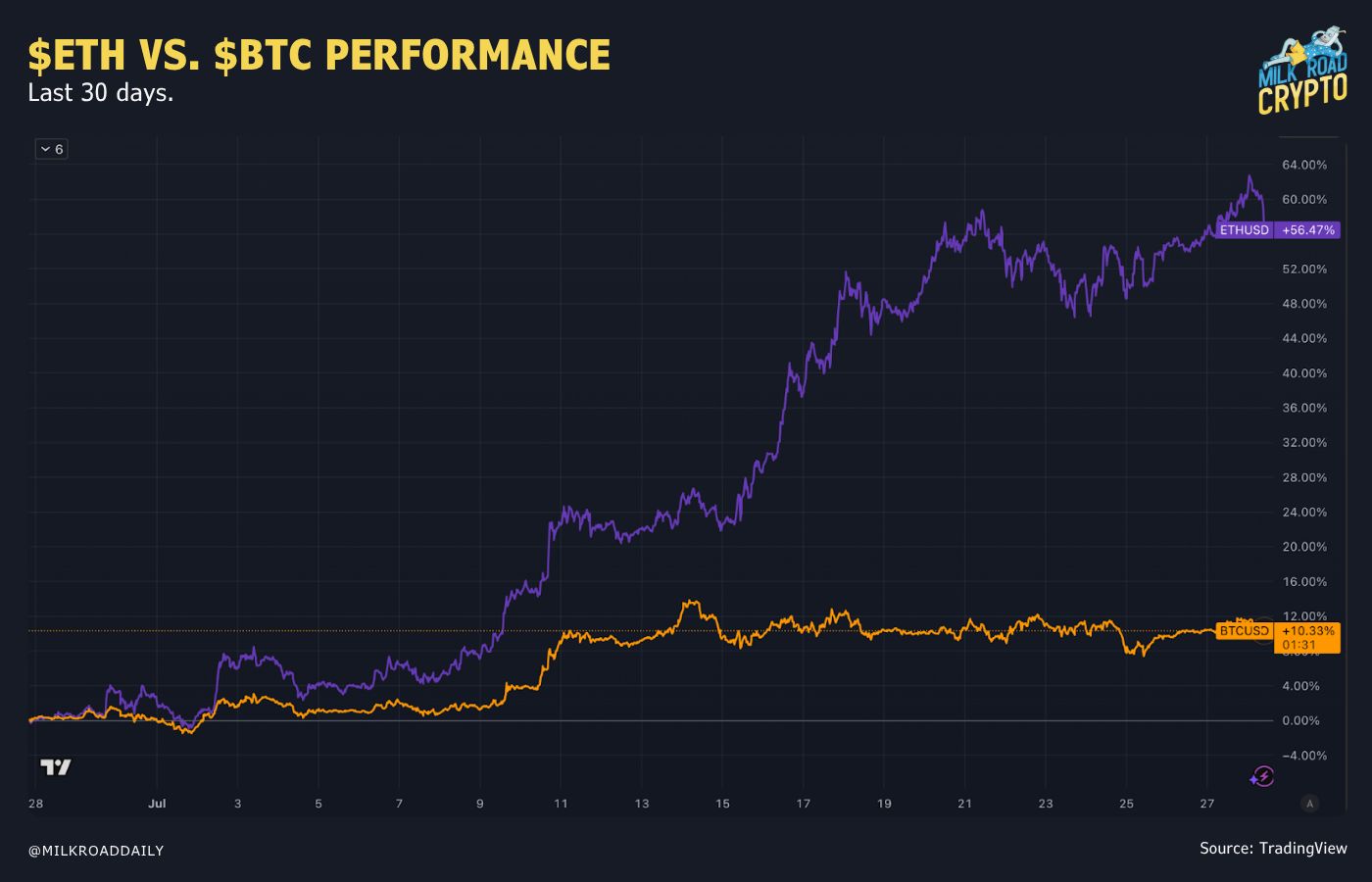

3/ $ETH outperformed $BTC (comfortably) this month 🏃♂️➡️

Over the last 30 days, Ethereum has outperformed Bitcoin by roughly 5.5x.

Imagine going back to April and telling this to your past self – they would’ve slapped you, called you a liar, then broken down crying once they saw the chart below.

(Don’t be embarrassed. It’d been a ROUGH few years for $ETH holders up until that point – an emotional release would be totally warranted.)

Neat! So what do we need in order to keep this party going? (‘Cause alt season already had a false start in late 2024/early 2025.)

Simple: we need a continued stream of market catalysts.

(E.g. Macro tailwinds growing stronger, crypto companies reporting positive earnings, governments continuing to embrace crypto, etc.)

Doesn’t need to be hyper-specific. Just anything that hints “crypto’s in a good spot”.

‘Cause when investor spirits are high (like they are in crypto right now), the market’s sensitivity to catalysts tends to widen/intensify.

Good news: we have multiple potential catalysts on the cards this week.

Keep scrolling to the next article and we’ll break them all down. 👇

I’ve only been to Vegas once. I was 17, couldn’t gamble, and I’ve held a grudge ever since.

Never made it back to a real casino…

Until I found YEET - crypto’s new hottest casino with $300m volume in 3 months!

Here’s how it works:

Sign up on YEET using the MILKROAD code

Deposit crypto across multiple chains like Bitcoin, Ethereum and Solana

Play games from top providers – including YEET’s own custom crypto-themed games

Sign-up and play by August 31st. YEET is giving out 10 x $1k prizes randomly to Milk Road users

*Disclaimer: Hey Roadies! A reality check from the Milk Man: I know my dairy, not your dollars. This partner content isn't financial advice.

WHAT TO LOOK OUT FOR THIS WEEK 📆

Alright:

Shovels – check ✅

Hessian sacks – check ✅

General sense of enthusiasm – check ✅

Let’s go digging for some potential market catalysts.

1/ Macro 🌎

This week we have a patented DOOZY of a macro schedule!

CB Consumer Confidence data – Tue – A vibe check with consumers (happy consumers typically lead to a growing economy)

June JOLTs Job Opening data – Tue – Are companies hiring? (An expanding economy requires more workers)

Q2 2025 GDP data – Wed – Is the economy growing or contracting? (Let’s hope for the former)

Fed Meeting and Interest Rate Decision – Wed – Will we get a rate cut (probably not, but the press conference will give us insight into the Fed’s potential plans to cut in Sep)

June PCE Inflation data – Thu – How much have the prices of consumer goods/services gone up or down? (Probably up…but by how much? Hopefully it’s low)

July Jobs Report – Fri – How’s unemployment looking? (Weirdly enough, we wouldn’t mind seeing this rise slightly, so the Fed has a better excuse to cut rates in Sep)

ISM manufacturing PMI – Fri – Are purchasing managers in the manufacturing sector increasing/decreasing their spends? (Increases forecast a growing economy)

Positive news from any/all of these events could add further momentum to the market – but if you want specifics, we’ll be looking closely at:

PMI on Friday (it’s at 49 – if it breaks 50, it’s likely game on for alts), the post-Fed Meeting press conference (to gauge their outlook), and PCE results (the Fed’s preferred metric for inflation).

Oh, and we’ll be beaming real-time insights to your ear-balls throughout the week on the newly launched Milk Road Macro Podcast (don’t miss it – subscribe and turn on notifications, here!)

2/ Government 🏛️

More potential catalysts? Sure. Why not…

The US and EU just inked a trade deal (15% tariffs on the EU, 0% on the US)

US/China tariffs just got paused for another 90 days (neither wants that smoke)

More trade deals could be inked this week as the August 1st deadline approaches

And sure, 15% tariffs being slapped on Europe + a yet-to-be-settled trade beef with China doesn’t scream “bullish” at first – but remember: markets love certainty above all else.

Confirmed trade deals and a growing pattern of tariff avoidance between the US and China give the market more of a roadmap to plan around.

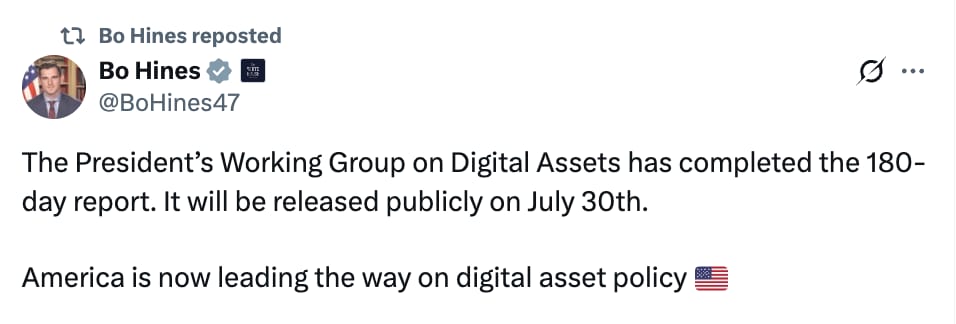

Oh, and this is probably nothing (right?):

The White House is set to release its crypto report on Wednesday (the one tasked with researching a US-based Bitcoin/crypto reserve).

If we get a headline that read something like “US launches $BTC/crypto reserve” all bets are off (and I’ll be buying one of those new Dyson stick vacuums – y’know, rich-guy sh*t).

3/ Earnings 💰

Seriously? That’s not enough for you. Ok. Fine.

Many titans of the crypto, payments, and tech industry are reporting earnings this week – we’re talking:

4/ Podcasts 🎙️

As mentioned at the top of this article, we just launched a brand new show for anyone who wants to understand the macro forces shaping the market.

The Milk Road Macro podcast will drop twice a week, hosted by former BlackRock VP John Gillen, who led macro and digital asset research, shaping the firm’s thinking around crypto and the future of finance.

We’re kicking things off with a monster week:

Tuesday, we’ll be joined by the former head of macro for George Soros, Pablo Duran Steinman (23 years in the game at Deutsche Bank, Goldman, and more...).

Then right after Powell’s press conference on Wednesday, Tony Greer joins to break down what it all means for the market.

Make sure you’re following along on YouTube so you don’t miss the action.

And all of that on top of our regularly scheduled programming over at The Milk Road Show…

Mon: Slava – Founder of IndieGoGo & Nillion (a privacy focused crypto network)

Wed: Jake Brukhman – Founder & CEO of CoinFund

Thu: Douglas Boneparth – CNBC Advisor Council / President at Bone Fide Wealth

All up, across macro, government, and earnings – we count 21 potential market-moving events this week.

Ok, catalysts: listed ✅. Schedule: set ✅. Fingers: tired ✅

Milk Man out.

For just $239, get lifetime access to Babbel: the language learning app that helps you master new languages fast with fun, interactive lessons.*

"Awww, that's cute" — Bitcoin. Galaxy Digital recently offloaded 80,000 BTC to exchanges (~$9B)...yet Bitcoin's price hardly budged. — DL News

Love $BNB? Love vaping? Boy do we have the stock for you…$VAPE is looking to establish the world's largest publicly traded $BNB treasury company.

The two degen tokens that won July! But will they continue to win in August? Read today’s edition of Milk Road Degen to find out.

Crypto cashback, baaaby! The Gemini Credit Card gives you 4% back on gas, 3% on dining, 2% on groceries and 1% on everything else.**

*this is sponsored content.

**this is partner content.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEMES 🤣

ROADIE REVIEW OF THE DAY 🥛

VITALIK PIC OF THE DAY